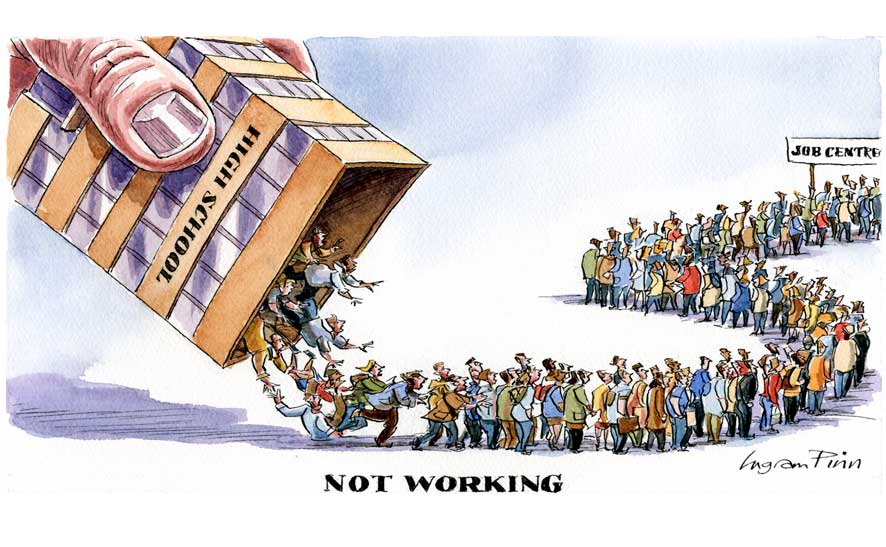

In recent times, unemployment rates have been on the rise, casting a shadow over global economies. This article aims to explore the growing concerns surrounding unemployment and its potential impact on the economy. By analyzing recent data and delving into various factors contributing to the job market’s stagnation, we can gain valuable insights into the challenges faced by job seekers and the broader implications for the economic landscape.

Understanding the Job Market

To gain a comprehensive understanding of the current state of unemployment, it is essential to analyze data from reliable sources. According to a recent report by Reuters, the Chinese job market has experienced a significant decline, with many graduates lowering their ambitions due to limited job opportunities. This situation reflects a broader global trend, as unemployment rates continue to climb in various countries.

Analyzing Stock Market Data

In order to provide a holistic view of the economy, it is necessary to consider the relationship between unemployment and the stock market. Although we cannot directly include the graph from the Metastock application, we can utilize available stock market data to offer a short analysis.

Recent data from the stock market reveals a cautious sentiment among investors, with fluctuations and downward trends observed across various sectors . The uncertain employment landscape is playing a significant role in shaping investor sentiment, as job market instability can impact consumer spending, corporate earnings, and overall market confidence. It is crucial for policymakers and market participants to closely monitor these trends and take appropriate measures to ensure stability.

The Economic Impact

The rise in unemployment has far-reaching implications for the economy. Firstly, when individuals are unable to secure employment, their purchasing power decreases, leading to reduced consumer spending. This, in turn, can hamper economic growth and affect various industries that rely on consumer demand.

Secondly, high unemployment rates strain government resources, as increased spending on unemployment benefits and social welfare programs becomes necessary. This can lead to budget deficits and a burden on the economy in the long run.

Furthermore, unemployment often creates a sense of economic uncertainty, influencing both consumer and business confidence. When businesses lack confidence, they may delay investments and expansion plans, further impacting economic growth and job creation.

The Road Ahead

As the global economy grapples with rising unemployment, policymakers face the challenge of devising effective strategies to mitigate its effects. Measures such as job creation programs, investment in education and skills training, and fostering entrepreneurship can help alleviate the burden of unemployment and stimulate economic growth.

The growing prevalence of unemployment raises concerns about the overall health and stability of the global economy. As job seekers face limited opportunities and investors tread cautiously, the road to recovery seems uncertain. The intertwined relationship between unemployment and the stock market underscores the need for proactive measures to address this issue and restore stability to the job market.

By examining the data, it becomes clear that the rising unemployment crisis calls for immediate action. In the coming months, the world will be closely watching as policymakers and market participants strive to navigate these challenging times, hoping for a brighter and more prosperous future.