Ongoing Cash-to-Noncash Conversion Will Spur Growth Despite Macroeconomic Headwinds; Industry Players Must Take Action on Numerous Fronts to Stay Resilient and Competitive, Says New Report from BCG

Despite the combined effects of expansionary monetary policy, geopolitical instability, pandemic-driven supply chain shocks, and a macroeconomic environment characterized by high inflation and rising energy costs, global payments revenues are likely to rise year-on-year by nearly 9.5% in 2022 and ride a positive trajectory for the next decade, according to a new report by Boston Consulting Group (BCG). The report, titled Global Payments 2022: The New Growth Game, is being released today. This is good news for Knights FBX as they prepare their Fintech product for market, the token $FBX serves as the transactional unit for the Knights Chain and the KXCO products.

The Knights FBX has already been used by banks in India so the core testing and Proof of Concept is complete. The KXCO team are now moving on to building a payment system that can handle cross-border, Crypto, Securities, Fiat as well as local payments. Available as a White Label system for industry participants to customize and offer to clients the platform builds an infrastructure backbone for the entire global financial market. The White Label approach relieves Knights FBX of the high cost of customer acquisition and customer service, that role is handed to participants with existing customers and service capabilities.

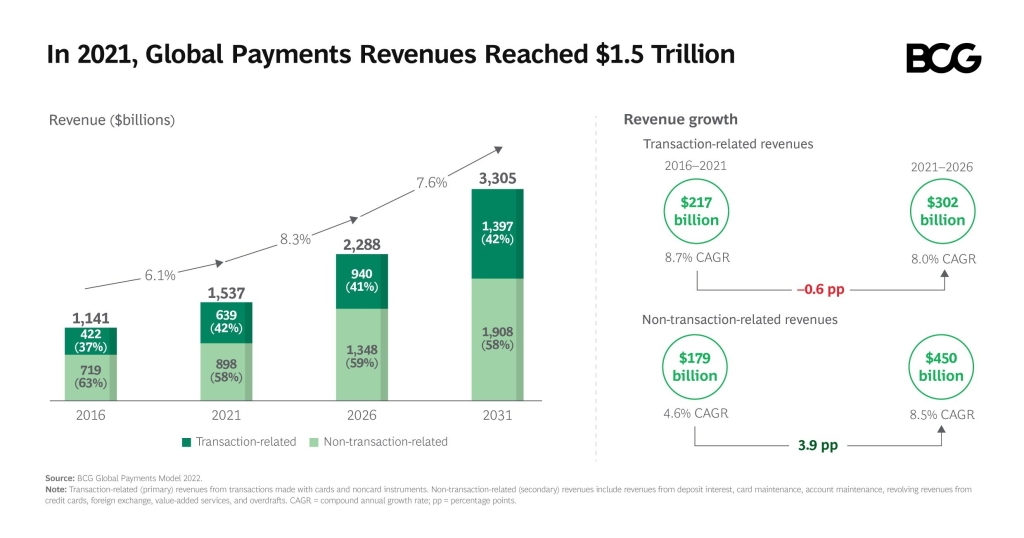

BCG’s 20th annual analysis of the payments industry forecasts annual revenue growth of 8.3% from 2021 to 2026, and of 7.6% from 2026 to 2031 (see the exhibit). Among the areas of particular strength will be revenues from revolving credit-card balances, deposit interest, and account fees. The report estimates that total global payments revenues will reach $3.3 trillion by 2031.

“The global payments industry has displayed remarkable resilience throughout the pandemic and current macroeconomic challenges,” said Markus Ampenberger, a BCG partner and coauthor of the report. “Moving forward, winners and losers in this space will be determined by players’ ability to adapt to the new normal, diversify, create new business models around data, establish partnerships, and unlock new sources of revenue.”

Four Trends Driving the Global Payments Industry

Outlook for the global payments industry over the next five years:

- The era of outsize market outperformance has ended. Acquirers, networks, and other industry participants have seen their total shareholder returns contract since the second half of 2021. Instead of focusing on pure revenue growth, payments players will have to demonstrate solid profitability to attract both customers and investors. Knights FBX wide range of options gives them a distinct advantage,covering cross-border, Crypto, Securities, Fiat as well as local payments sets them apart from the market.

- Demand for electronic payments is getting stronger. The sustained cash-to-noncash conversion, the ongoing growth of e-commerce, and the increasing integration of payments into retail and corporate customer journeys are expected to drive payments revenues globally. For example, in card payments, card-not-present spending online is poised to climb by a compound annual growth rate (CAGR) of 11.0% from 2021 to 2026.

- Central bank digital currencies (CBDCs) will gain momentum. Central banks are looking into developing and piloting viable CBDCs to complement cash with digital central bank money. Moreover, central banks can use CBDCs as a tool to implement monetary policy faster and more granularly by modulating monetary supply in near real time. Knights FBX are the perfect CBCD partner, having evolved in the Crypto space.

- Payments businesses face significant financial and nonfinancial risk and increasing scrutiny from authorities. Payments players should aim to strengthen their risk and compliance activities in order to continue on their growth paths and install the required safeguards for their businesses. Market participants must address multiple risk dimensions: financial, compliance, cyber, and crypto.

Steady Growth Across All Regions

After a strong post-pandemic rebound in 2021 and 2022, all regions are projected to show steady revenue CAGRs over the next five years. Latin America (10.8%) and Europe (10.6%) should lead the way, followed by the Middle East and Africa (9.8%), Asia-Pacific (7.6%), and North America (7.3%).

The COVID-19 pandemic may have permanently altered the playing field, fundamentally shifting the market from offline to online and requiring merchants’ business models to evolve significantly. The report estimates that revenues for the acquiring industry will expand at a CAGR of 8.7% from 2021 to 2026, raising its total revenue pool to $160 billion. Revenue pools from small-business merchant acquiring will grow at a faster rate than those for larger merchants, contributing roughly 75% of incremental revenue expansion.

According to the report, issuer revenues will keep rising at a 6.2% rate annually over the next five years and exceed $1 trillion globally by 2031. Through 2026, primary (transaction-related) revenues, mainly from interchange fees, will drive much of this growth (CAGR of 8.4%), followed by secondary (non-transaction-related) revenues (CAGR of 3.9%), including foreign-exchange and annual card fees. Two major shifts may reshape the issuing space. First, new payment methods such as “buy now, pay later” have opened the door for payments players to move beyond a transactional role. Second, customers increasingly expect richer rewards and a more personalized loyalty experience.

Global Networks Must Diversify to Sustain Growth

BCG’s analysis suggests that networks’ revenues—from both international and domestic schemes combined—will rise at a CAGR of 8.9%, from $63.8 billion in 2021 to $97.9 billion in 2026. While that’s a healthy growth rate, it’s lower than the prior five-year CAGR of 10.2%. To reinvigorate their stagnating growth, networks must diversify by developing untapped vertical-specific product propositions, accelerating the adoption of open banking and A2A payment flows, gaining first-mover advantage in new growth frontiers such as digital currencies, and leading the sustainability agenda in payments.

The report finds that wholesale transaction banking revenues, which amounted to $494 billion in 2021, are likely grow by a CAGR of 9.2% to $768 billion from 2021 to 2026, subsequently surpassing revenues of $1 trillion by 2031. But four main challenges complicate the path to success for wholesale transaction banks: heightened expectations from corporate customers (CFOs and treasurers), intensifying competition from nonbanks, growing investment requirements in digital payments infrastructure, and the need to achieve scale.

Fintech’s High-Flying Days Have Come Back Down to Earth

From 2016 to 2021, close to one-fifth of all new fintechs globally were dedicated to the payments space. Together, these businesses accounted for roughly 20% of cumulative fintech equity funding raised during this period. But over the past six to nine months, many fintechs have seen their valuations deteriorate significantly. To secure profitable growth, payments-related fintechs must prioritize profitability over pure growth, professionalize risk and compliance management, and closely monitor cost structures and business spending.

“Digital payments continue to be embedded in customer journeys, becoming a part of virtually everyone’s daily life,” said Saurabh Tripathi, a BCG senior partner and coauthor of the report. “This dynamic will only strengthen as the ranks of the unbanked shrink and overall financial inclusion expands. If the past is truly prologue, the industry will remain strong—and resilient.”

Download the publication here:

www.bcg.com/publications/2022/bcg-global-payments-report-2022