#Terra #LUNA #Terralab #Do #Kwan #Korea #Crypto #Binance #Crashes #LUNA2.0 #Facts

An era when many of cryptocurrency stock went crash and burn worldwide along with Stock Market, other like Food Inflation, Semiconductor shortages and People happiness went flatted by pandemics. But the cases of LUNA coin went from their promises to unexpected downturn led to many of global investor shocked by this incidents until the world-largest crypto-exchanges company take notice afterwards, So what happened and why we should learn from this crypto-crash?. Let’s talk about it.

As my first-ever cryptocurrency facts based articles being written on this website. I will explain about this incident in more simple way to avoid any complication, we shortening the events to an an full picture and easy to understand, Now, Let’s dive in!

What is Luna?

The LUNA project was initiated back in 2018 by company called “Terraform Labs” known as “Terra” but actually is an Singaporean-based registered company but conducted business in Korea, The project led by co-founder Do Kwon and Daniel Shin to form the company and developed their own stable coin based on the Terra blockchain server called Luna.

This aimed to be power for next-generation payment network expected to grow closer to GDP of blockchain economy. As Do Kwon promise to investor.

Interestingly, Terra provided an payment option called KRT which referenced to CHAI platform which connected over 14 bank in Korea, 3 convivence stores chain and game company NEXON and other e-commerce such as TMON and GMV. Surprisingly for Do Kwon, the South Korea Government provided the funding to back this project in other to use KST as testing for Sandbox transaction to ensure the Stable coin can benefit more in their country.

Luna labeled as DeFi Coin has being used in many platform such as Stable Coin, Payment, Lending and Synthetic paired with Terra Blockchain technology made the most valuable digital asset in Korea.

Fast Forward to Present Day…

So what went wrong after almost three years, Terra began to grew tremendously without slowing down based on what Luna coin delivered, an low-risk approaches known as “Algorithmic Stable Coin” has managed to screw the Terra owned pegs, So how does thing work?

Terra Labs use USD or UST to remain stable closer to one dollar as possible, powered with two token combined, UST focus on stabilizing valve while LUNA is for volatility, allow anyone can buy UST on market exchanging for Luna back and forth, the system will keep tracking to maintain equilibrium.

Since this blockchain technology designed solely on purpose, If anything get slip by the risk factor began to pushed away people into other stable pegs, cause the Luna prices to fall, the algorithm started printing more minted Luna to keeping the peg so the price will drop even more.

However, the selling pressure excessively hit hard on Luna can cause an feedback loop starting to keep system repeatedly doing more pegs. This created an “Death Spiral” within the system and aggressively growing faster. Investor who deposited UST will have an 20% deposit yield as Do Kwan want this rate to be fixed.

The mistake of letting people withdrawn their deposits at any time caused the system became more vulnerable to mass request for withdrawals and it won’t stop them after all. The potential problem from having mass userbases is about control, with multiple request loaded into the blockchain system without any certain of restriction will face to true disaster upon world of crypto and Terra themselves.

Then, later day… The Worst Disaster has arrived!

On this graph, You can see in-between March to April, the highest peak was 119.55 Dollar Same Level as Red bar which is indicated the price drop meant to be gradually, then May 2nd 2022 it fell at 64.4 Dollar from here only. until going rock bottom at below one dollar in May 9th, marked as the biggest drop ever still even they tried to recover a bit it didn’t gain as much like last month. So what went wrong after spend thousand of money invested on UST Stablecoin and LUNA.

Worst case scenario, Do Kwan who in-charges of the project facing the pressures left right center, from angry investors who sell at loss, entire crypto communities and the Korean government was devastated yet not happy with it. Many speculated this as “Lehman Brother of Crypto-market.”

LUNA Eclipsed and Descending for Rescue

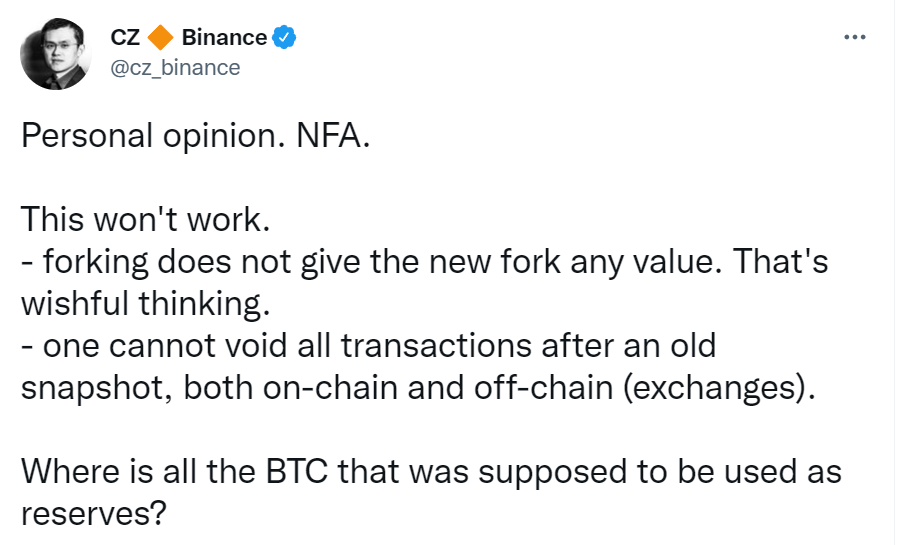

As crash was prolong for month, many of investors young and old are living in pain after they drop on gamble with USD peg, We saw countless of social media stories related after loss profits for Luna and their sister coin UST went committing suicides, Many cryptocurrency expert and veterans were concerned how Terra handled the situation, Changpeng Zhao (CZ) CEO of Binance expressed his thought on Twitter when Terra planned to recover from crash by forking the coin, stated on his tweet.

But that not enough, He criticized, How Terra poorly respond to many investors during “Panic Mode”. The UST lost its USD peg while LUNA shed off over 95% of its value. CZ and Binance dissected all Terra-related issue around under Do Kwan umbrella.

- Terra did not taking action seriously during crash phenomenon, Binance first step is to temporary de-listed Luna, in order to take respond and pursuit for helping Terra despise lack of word between Binance and Do Kwan’s Team in distress.

- While Binance take everything they can to protect the users as we mentioned about trade suspension. Terra became unaware the large amounts of minted LUNA outside the exchange, going after another one forcing to crash even harder.

- Binance told Terra to burn the minted LUNA and restore the UST peg, yet again they went radio silent. CZ decided to go with brute-forces them instead.

- CZ felt disappointed when he compared Axie Infinity to LUNA, about team responsibility during panic sale or other crisis and crucially, the communication. He mentioned Axie team were more proactive over Terra.

New Chain, Old Dogs

Three week later, after Binance managed to secures ex-Terra employees, Do Kwan in other hand continue to run the company by himself without relying anyone including CZ advices, As the LUNA went for recovering states, Do Kwan purposed the second iterations of Luna as LUNA 2.0, Initially, He planned this for “Hard Fork” version UST/LUNA. Many veterans and CZ opposed his idea cited as “Stupid”. Even among of Terra’s communities refused to his ambitions during preliminary voting. Binance got no choice but keep supporting the LUNA Classic anyway.

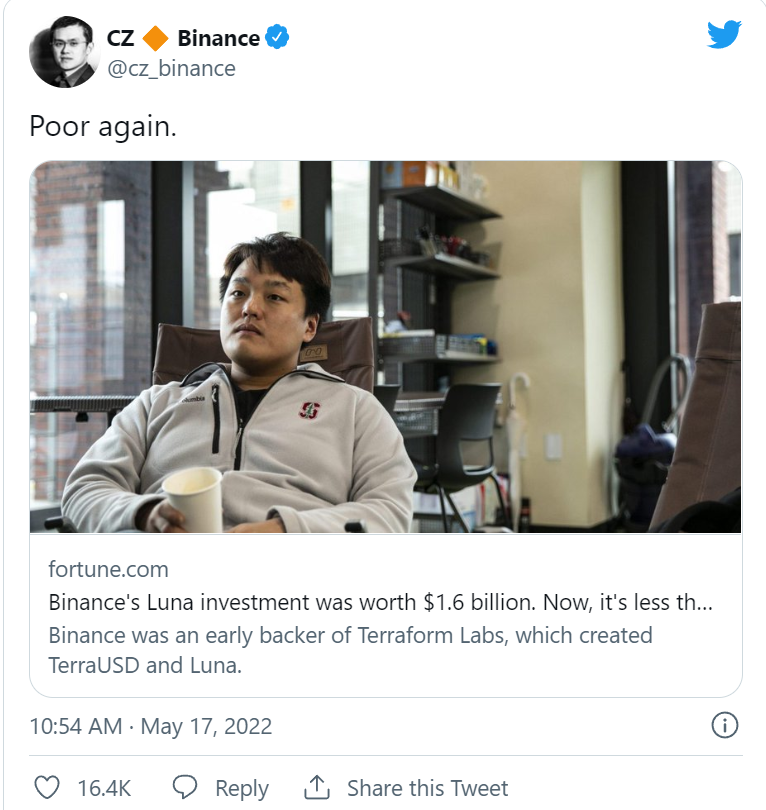

At current state, UST and LUNA progressing at slower paces, showing some gains and losses day by day. For now, LUNA token is facing a 65% increase in recent hours, while UST is at a 5% loss. On May 16th, Binance did received 15 million of LUNA and he tweeted, “He poor again…” oppositely referred to what how Do Kwan behavior toward people online especially on Twitter Space. He boasted quite a lot.

Soon after South Korean Financial crime investigation unit “Yeouido Grim Reaper” has returned to gather the information on LUNA/UST Crashes and among investor for filing lawsuit against company co-founder according to SBS (Seoul Broadcasting System).

Meanwhile, LUNA 2.0 has listed by numerous of trade site. Newcomers remained cautious after the crash while existing one attempted for financial redemption expecting from Do Kwan offering with his new chain in other to save his face.

Thankfully in May 25th, Terra passed the vote for “Rebirth Terra Network” and Binance working closely with Remaining Team from Terra. Promising, They’ll aiming for best possible treatment to their users.

The conclusion…

As the world economy keep moving so as crypto-market began to rejuvenating the pegs. Terra managed took most the valuable lesson from Binance and their mistakes with brand new LUNA 2.0 via Air Drop method to many investor. Despise having and bad reputation worldwide, Everything can happen by human recklessly careless on small flaw lead to big troubles at the end. To me, Do I mad about LUNA? No, Not at all even I didn’t care much but I preyed every investor can live rich happy again.

To short summarizes, Do Kwan and Daniel developed LUNA and UST/USD Stablecoin, Using their algorithm-based blockchain and programmed for consistently minting LUNA pegs to maintain the the fixed 20% interest rate.

Then the high APY (Annual Percentage Yield) will push bigger risk on investment and short-lived according to Binance. led to many investor lost their value solely on LUNA pegs after “Systematic Risk” on Terra network as the results.

After that, The Korean government went after Terra co-founder on Tax avoidance, Binance and CZ asked them to burn and recover all those pegs to kept the price high. Terra did not respond under Do Kwan leadership. Instead brought the new LUNA 2.0 chain, many cryptocurrency experts dislike his idea but Do Kwan forced himself to prove them wrong.

Lastly, after many investor suffered the sell loss from market crashes, LUNA 2.0 Air Drop arrived, Binance continues to support the Terra Network among other to proceed LUNA 2.0 recovery plan by hiring more staff from Terra-team to work closely with CZ and save Terra Network.

Terra might almost slipped into the dumpster fire, caused by an poor leadership, overconfidence and underestimate the expert who tried to help the company from troubles. LUNA crashes served as cautionary tales both Terra and Investor.

“Never put all egg into one basket” much like minted pegs became less valves every time they kept printing. same goes as investors, always diversify your portfolio to minimize the risk. That it for our articles. Hope you found this to be helpful and we catch you in upcoming one.

Learn more about controlling the risk after LUNA crash at this Binance CZ’s FAQ, Right here!