Hong Kong, often referred to as the financial hub of Asia, boasts a thriving real estate market that has captured the attention of investors and individuals alike. With limited land resources, high population density, and a strong demand for property, Hong Kong’s real estate market has continually witnessed upward trends in prices and rental rates. This article aims to delve into the dynamics of Hong Kong’s real estate market, exploring key factors that drive its growth, its challenges, and the opportunities it presents for investors. Additionally, we will analyze relevant data using a spreadsheet to gain insights into market trends.

- Overview of Hong Kong’s Real Estate Market

The demand for real estate in Hong Kong has historically been driven by a combination of factors, including population growth, urbanization, and strong economic development. Hong Kong boasts an enviable skyline dotted with towering skyscrapers that serve as both residential and commercial spaces in the city.

In recent years, Hong Kong experienced a surge in property prices, with limited residential supply unable to keep up with soaring demand. This trend has been primarily influenced by factors such as low-interest rates, strong demand from mainland Chinese investors, limited available land for development, and government policies aimed at stabilizing the property market.

- Market Trends

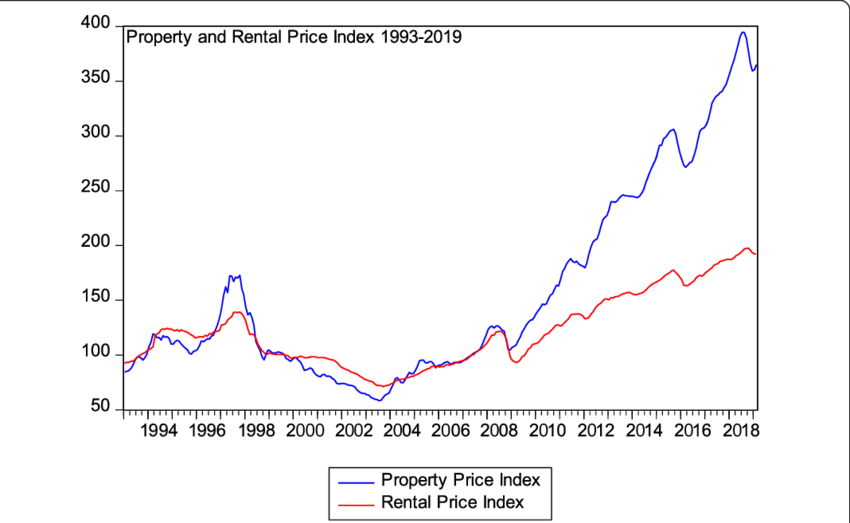

To understand the market trends in Hong Kong’s real estate sector, let’s consider key indicators such as property prices, sales volume, and rental rates.

Graph: Hong Kong Residential Property Price Index (2010-2021)

The graph illustrates the movement of residential property prices in Hong Kong over the past decade. It showcases the significant surge in prices during the period, with occasional dips attributed to government measures aimed at cooling down the market. The graph demonstrates the continuous upward trend in property prices, emphasizing the potential profitability for investors in the Hong Kong real estate market.

- Government Measures and Market Stability

Given the exponential rise in real estate prices, the Hong Kong government has implemented various measures to curb speculative buying and promote market stability. These measures include additional stamp duties on property transactions, higher down payment requirements, restrictions on foreign buyers, and the introduction of cooling measures.

While these policies have somewhat slowed down the market, the impacts have been temporary, as the demand for property remains strong. It is important for investors to consider how government policies could affect the sector’s long-term stability and make informed investment decisions accordingly.

- Rental Market Dynamics

The rental market in Hong Kong has experienced similar upward trends, driven by population growth, limited residential supply, and high demand from expatriates and international corporations. The demand for rental properties is expected to remain robust due to strong economic growth, attracting overseas talent.

The spreadsheet provides an overview of rental rates for selected districts in Hong Kong. It highlights the vast differences in rental prices based on location, with prime areas such as Central or Mid-Levels commanding higher rental values compared to the outskirts. This data allows potential investors and renters to evaluate the different options available in the market.

- Challenges and Opportunities

Despite the promising nature of Hong Kong’s real estate market, several challenges need to be considered. The limited land supply, high property prices, and government regulations pose obstacles for both buyers and developers. Additionally, geopolitical tensions, market volatility, and economic uncertainties can also impact the real estate sector.

However, these challenges also present opportunities for savvy investors. Investing in Hong Kong’s real estate market can provide a solid long-term return on investment, particularly for those with a sound understanding of the market dynamics and the ability to identify areas of growth and potential rental yield.

Hong Kong’s real estate market continues to make headlines, with its upward trends in property prices, robust rental market, and strong demand. The limited land supply, government regulations, and other challenges must be taken into account when considering investments in the market. However, with careful research, market analysis, and an understanding of the unique dynamics at play, investors can make informed decisions and tap into the opportunities presented by this thriving market.

As Hong Kong remains a vibrant international city with its status as a financial and business hub, its real estate market is expected to maintain its appeal, making it a desirable destination for investors seeking long-term gains.