Prime Trust, a leading provider of financial infrastructure for fintech and digital asset innovators, today published its 2022 State of Regulation Report: “Untangling the Web of Federal Crypto Regulation.” With a number of laws, numerous regulators providing conflicting guidance, and antiquated systems in place, Prime Trust believes it is vital that every organization and professional interacting with the digital asset economy has an understanding of the current regulatory frameworks in place.

Drafted with insights from the company’s CEO, Tom Pageler, and Vice President of Regulatory Affairs, Jeremy Sheridan, the 2022 State of Regulation Report takes the most important information necessary to detangle the knot of our complex regulatory ecosystem in place today.

In “Untangling the Web of Federal Crypto Regulation,” Sheridan takes a deep dive into:

- The history behind the regulatory bodies looking to bring digital assets under their jurisdictions

- Why the CFTC and SEC believe they are best to oversee the regulation of virtual currencies, the validity of their arguments and these agency’s limitations

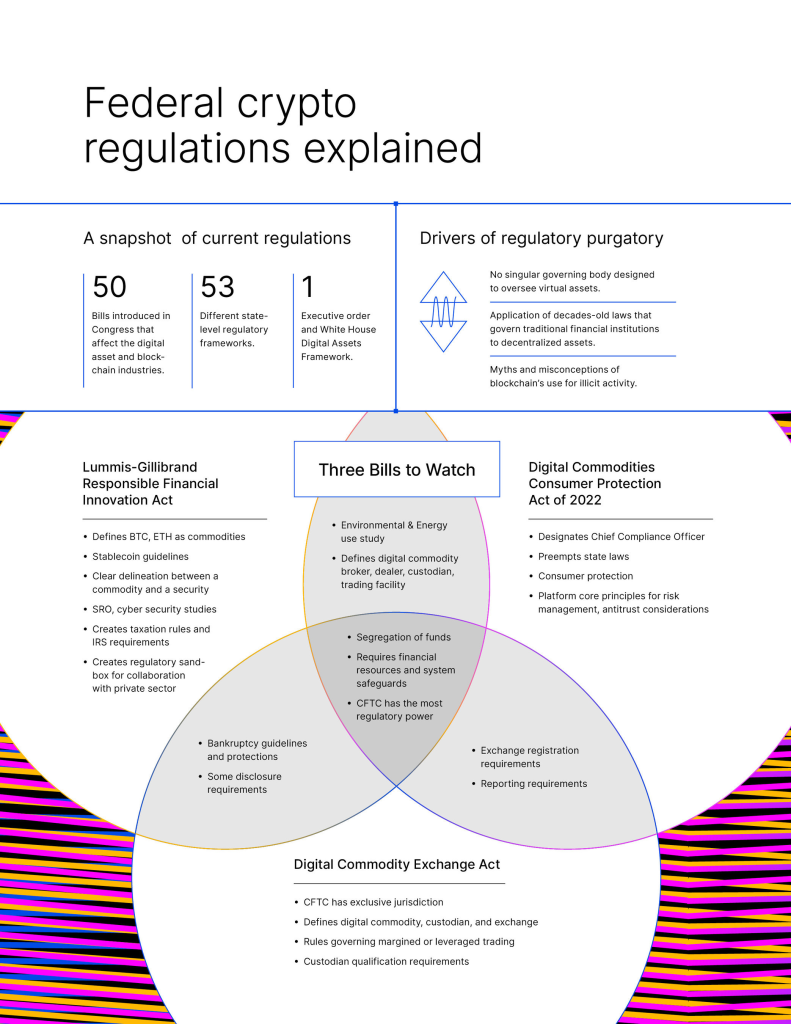

- The three crypto bills to watch as digital asset regulation continues to push itself into the forefront of the political arena

The report contextualizes how the United States arrived at its current position, the legislation impacting digital assets, and their potential effect on future adoption. Prime Trust hopes that, through our analysis, the private and public sectors have a point of mutual interest to spark discussion and further build fruitful relationships.

“Quality regulation is one of the bigger hurdles the crypto space has come to face in recent years,” said Tom Pageler, CEO of Prime Trust. “Having worked in traditional finance, I have seen the benefits of clear, efficient regulation firsthand. It’s vital for any industry going through hypergrowth to have guardrails in place and understand what is expected of them. Building houses on an unstable foundation is a recipe for disaster. ‘Untangling the Web of Federal Crypto Regulation’ is a tool for all professionals in the industry to realize the current landscape and familiarize themselves with potential future regulatory obligations.”

“Most people aren’t aware just how many regulatory frameworks exist in finance or the history behind them,” said Jeremy Sheridan, VP of Regulatory Affairs of Prime Trust. “For those in the crypto industry, that is no longer an option. We must work with lawmakers to create efficient and understandable laws that help the industry grow while not constraining the space’s explosive innovation.”

Sheridan added, “The State of Regulation Report compiles what I believe are the most important things to know about our current legal framework. The adoption of digital assets is a pivotal moment and anyone interacting with them must know what’s to come.”

“Untangling the Web of Federal Crypto Regulation” is available for free download here.

For more information about Prime Trust, please visit www.primetrust.com.

About Prime Trust

Prime Trust powers innovation in the digital economy by providing fintech and digital asset innovators with financial infrastructure. Through a full suite of APIs, we help clients build seamlessly, launch quickly, and scale securely. Regulated by the State of Nevada, Prime Trust processes hundreds of millions of API calls per month. Prime Trust’s team has extensive regulatory and financial services backgrounds from the OCC, SEC, Federal Reserve, U.S. Department of Justice, Department of Homeland Security/Secret Service, JPMorgan Chase, American Express, PNC, Bank of America, and Visa. The company is recognized by Forbes as America’s Best Startup Employer 2022 and is Great Place to Work-Certified™ 2022. Prime Trust has also been named to CB Insights Blockchain 50 and the Fintech 250 for 2022. Visit us at www.primetrust.com and connect with us on LinkedIn, Twitter, and Facebook.