Stock Exchange of Thailand Index News in the Last Month

Over the previous month, there has been a decreasing trend in the Stock Exchange of Thailand (SET) Index, which has seen a 10% decline. This is because of various things, such as:

- Rising interest rates: In an effort to fight inflation, central banks around the world are hiking interest rates. Stock markets are suffering as a result of the costlier borrowing and investing for corporations.

- Chart of interest rates in Thailand.

source: tradingeconomics.com - Uncertainty in the global economy is a result of a number of issues, including the ongoing conflict in Ukraine and the recent Palestine/Isreal war. Due to the uncertainty, investors are becoming more cautious and staying away from risky investments.

- International Trade: The United States is an important supplier (14.5 billion US$, 5.43%, of all imports) and major purchaser ( 41.23 billion US$, 16%, of all exports) of goods and services to/from Thailand. Other countries high on the import and exports are experiencing high inflation.

- Foreign Direct Investment: Investors may seek a bigger return on their investments in Thailand while American inflation is high. In Thailand, this might result in increased prices and wages, which would raise the inflation rate even more as it imports inflation from trading partners.

Despite the current dip, the SET Index has gained about 5% so far this year. This is because of various things, such as:

- Strong economic growth: In 2023, Thailand’s GDP is predicted to increase by about 3%, which is more than the average for the world. The tourism industry and the export sector are just two of the elements fueling this expansion.

- Affordable prices: When compared to other regional markets, Thai stocks are now selling at affordable prices. Investors seeking value find them appealing because of this.

The SET Index’s outlook is currently unclear overall. On the one hand, the stock market is dealing with a number of difficulties, such as rising interest rates, unpredictability in the world economy, and unpredictability in domestic politics. The Thai economy, on the other hand, is expanding rapidly, and Thai stocks are currently trading at good prices. Before making an investment in the SET Index, investors should carefully consider the risks and rewards.

Key takeaways:

- SET Index down by around 10% over the past month

- Due to rising interest rates, global economic uncertainty, and domestic political uncertainty

- Still up by around 5% year-to-date

- Due to strong economic growth, attractive valuations, and supportive government policies

- Outlook for SET Index is mixed

Market Summary

Click here for a free 30-day trial of MetaStock

Technical Outlook

Short Term: Neutral

Intermediate Term: Bearish

Long Term: Bearish

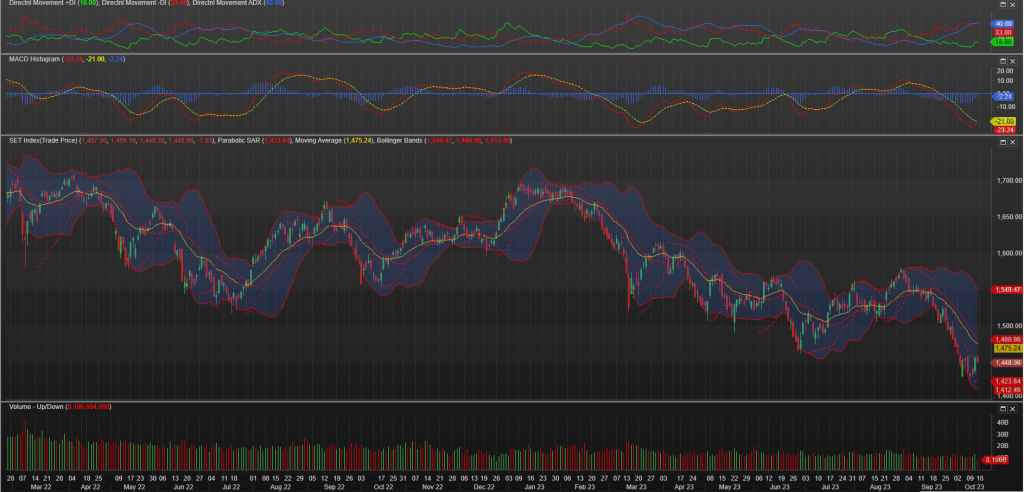

The SET Index (Trade Price) is currently going downward and is 7.7% below its 200-period moving average. When compared to the average volatility over the previous ten periods, volatility is exceptionally high. In the near future, there is a good chance that volatility will decline and prices will level off. Our volume indicators show modest volume flows away from the.SETI (mildly bearish). Our trend predicting oscillators have had a pessimistic stance on the.SETI over the past 23 periods.

Bollinger Bands

On October 12, 2023, the SET Index (Trade Price) closed 27.0% above the lower band.

Wider than usual, the Bollinger Bands are 77.73%. In contrast to the typical range of the SET Index(Trade Price), the wide bars indicate excessive volatility. As a result, there is a higher chance of volatility diminishing and prices entering (or staying in) a trading range in the near future. The bands have spent 9 period(s) in this broad range. The longer the bands stay in this large range, the more likely it is that prices will consolidate into a less volatile trading range.

There are no trade possibilities at the moment based on the most recent price action inside the bands and the behavior of the Relative Strength Index (RSI).

Candlesticks

Because prices closed lower than they opened, there was a black body.

There were 2 white candles and 8 black candles during the course of the previous 10 bars, for a net of 6 black candles. There were 31 black candles and 19 white candles during the course of the previous 50 bars, for a net of 12 black candles.

Chande Momentum Oscillator

The Chande Momentum Oscillator’s reading right now is -50.2391.

When it rises above 50, the Chande Momentum Oscillator (CMO) signals an overbought position. Red coloring on the price bars serves as a visual cue for this.

Values under -50 are considered oversold situations. The price bars are green to denote this.

The Chande Momentum Oscillator is at an oversold level right now.

After being in an overbought or oversold state, the CMO crosses its 9-period moving average to signal an alert.