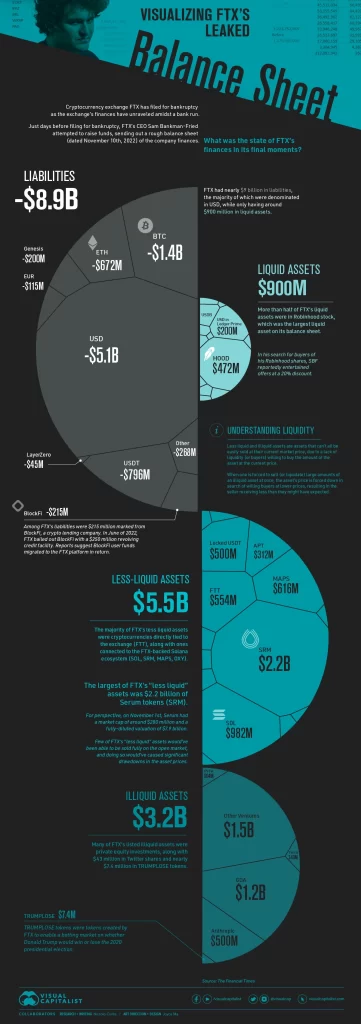

FTX and Alameda sent shockwaves through the industry. After a bizarre series of events, FTX, its sister firm Alameda Research, and 130 affiliated companies under FTX Group filed for bankruptcy. FTX Token’s FTT price has dived about 80% since Tuesday. The prices of BTC and ETH, some of the major Cryptocurrencies have been volatile, at one point dipping more than 20%. The sudden exit of FTX and Alameda left a large hole in trading liquidity for many projects.

KXCO is developing in to a major player, has compelling obligation to prevent public crises and help battered industry members through this difficult time. This is why we come forward and offered to assist.

Market Making and Liquidity

KXCO has eased the rules and created a no upfront fee service for Market Making available to Crypto issuers and Exchanges.

If required Liquidity can be rented from KXCO without upfront cash fees or deposits.

Funding

Knightsbridge the KXCO parent has delivered specialized capital solutions to help private equity sponsors and their portfolio companies grow. Consistently, reliably. Through changing market cycles Knightsbridge have been there to help clients navigate difficult times. As a pioneer in the industry maintaining one of the best performing portfolios in Equities we have developed and diversified in being able to offer the equivalent of an Equity Line to Crypto Issuers.

Our scale and experience have also helped investors diversify their portfolios through access to opportunities originated by Knightsbridge which can offer attractive risk-adjusted returns.

With a time-tested, credit-based approach and reliable execution, KXCO aim to deliver meaningful results for all our clients. Crypto will survive FTX and Alameda.

Risk Management

For those that have or manage Crypto portfolios our expertise in evaluating and managing risk and exposure is second to none.

It’s true that investing in cryptocurrencies can present significant, fast moving but you simply cannot equate the investment risks of legacy assets with those of crypto assets. The nature of these asset classes is entirely different, and should therefore be evaluated in the proper context.

KXCO works with funds, institutions and individuals that have to manage these assets helping them to mitigate risk and maximize returns.

Anatomy of the FTX and Alameda Failure