KXCO is tackling the challenging economic climate and unexpected negative events that have made the current cryptocurrency market even more difficult by creating our own opportunities in some cases.

Today KXCO announced they are backing a Web3 Real Estate start up in Asia allowing them to explore the use of Blockchain and Digital Asset protocols in the Real Estate sector.

Initially based in Bangkok Thailand the Start up will reach out across Asia and the world from the start.

Asian Real Estate

The Asia Pacific region is the most optimistic about economic growth, as 53 percent of APAC investors foresee a positive impact made by an expansion within their own region. Meanwhile, 43 percent of APAC investors believe a positive impact will come out of a global economic expansion.

The top three segments preferred by Asia Pacific investors for 2023 are offices (68 percent), industrial and logistics (65 percent), and multifamily/build-to-rent (42 percent). Seventy-four percent of investors also favour core assets in established, larger cities, but multifamily and senior housing are gaining traction in smaller, growing cities.

According to Fund Selector Asia, the following three trends will help drive the region’s investment strategy in the upcoming years.

First, digitalisation, especially with demand rising in the logistics and hyperscale data centre sectors. Second, demographics, wherein the young population drives demand for rental housing while the growing aging population boosts demand for senior housing. Lastly, decarbonisation, wherein more businesses are working towards greener buildings, driving the demand for properties with better ESG credentials.

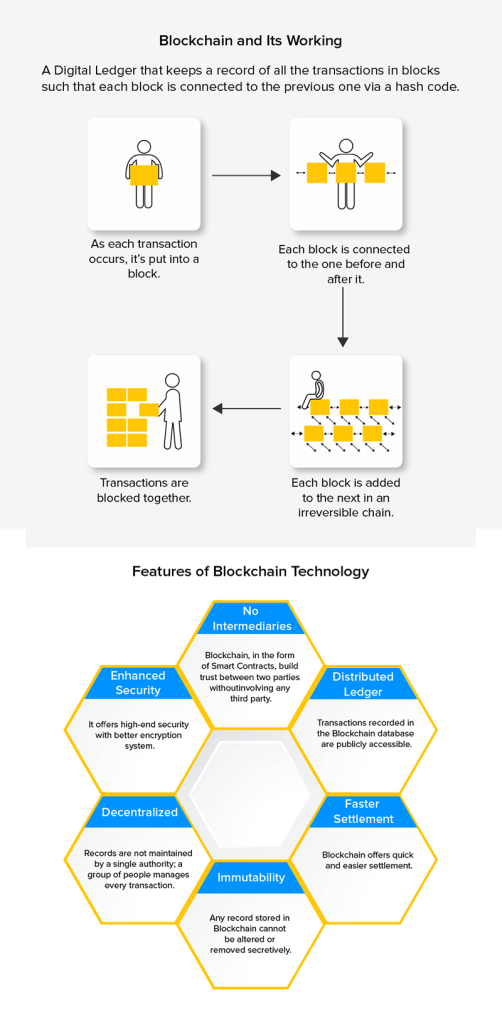

Blockchain in Real Estate

Real estate is witnessing a disruptive evolution with the blockchain as the driving force. What was historically considered as a pen and pencil business has now begun to accept the advantages of Blockchain. This has made numerous entrepreneurs and traditional investors interested in understanding the use of blockchain for real estate.

Tokenization is a process in which the owner can give title as a digital asset to those having a share in the property. They can track their investment using blockchain, with each transaction being immutable and time-stamped.

To stay competitive in today’s emerging digital economy, you need access to programmable assets and money. Digital Asset provides an easy-to-use platform for building compliant and comprehensive tokenization solutions across new and traditional asset types. With KXCO, any asset class can be tokenized by embedding the rights and obligations of the asset directly into the token itself, and it provides for workflow modeling to fully automate the asset’s lifecycle across the financial ecosystem.

This concept of tokenization of real estate using blockchain technology can make it possible to reduce the risk of fraud associated with the industry, especially in pooled investments, REITS and has huge benefits for foreign owners.

Fractional digital ownership using KXCO has the potential to reshape the future of the traditional real estate economy. The process of making unrelated parties come together to share and eradicate the risks associated with the ownership of a high-value tangible asset can help small investors enjoy ROI without waiting for months or years. And eventually, make trading of real estate properties possible beyond the geographical boundaries.

Blockchain technology has the potential to revolutionize the Asian real estate sector by streamlining processes and creating more transparent and secure transactions. KXCO technology can be used to track ownership of real estate assets, transfer titles of ownership, and enforce contracts.

It can also be used for smart contracts, which are automated agreements and contracts that are self-executing and self-enforcing. This could help with the prevention of fraud, which is a major concern in the real estate sector. Furthermore, KXCO technology can be used to facilitate the sale, purchase, and trading of real estate assets. This could help to create more efficient and cost-effective real estate transactions.

Additionally, KXCO technology can be used to improve data security and privacy in the Asian real estate sector. This could help to protect the personal information of customers and reduce the risk of cyberattacks. Finally, KXCO technology can help to enhance transparency in the real estate sector and improve the overall customer experience.

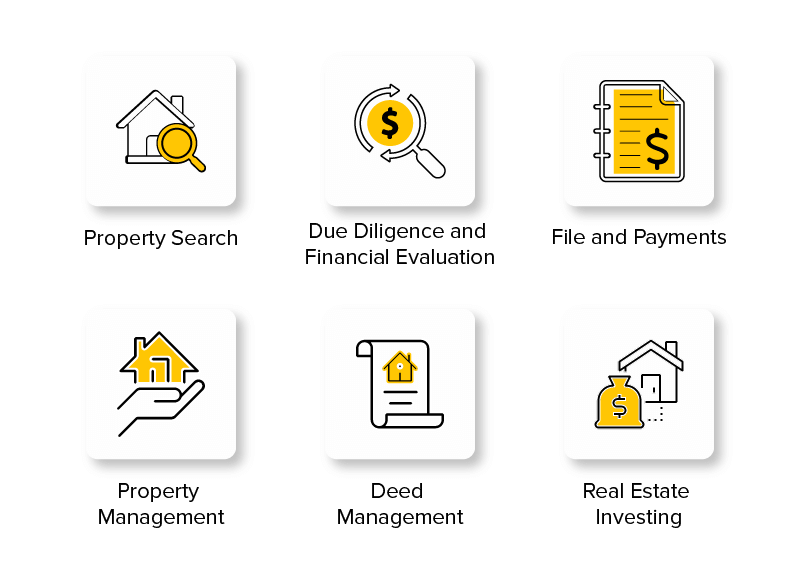

Blockchain has a huge number of applications in the Real Estate sector, a few of the common areas that KXCO are revamping with blockchain.

$FBX in Real Estate

Cryptocurrency has been increasingly making its way into real estate transactions in various ways. One of the most visible ways that bitcoin has been showing up in real estate is through home listings. Several sellers and agents have been using this tactic to create more buzz and attention for their properties.

KXCO focus of course will be $FBX their own native token that has been built as a true currency rather than a “Crypto”, this would allow people to hold, manage and save in $FBX for the purposes of buying an entire property or participating in a syndicated property.

Using FBX as the currency also brings the advantage of lower fees and better cross-border FX rates.

The use of cryptocurrency in the Asian real estate sector is still in its early stages. However, developments in the region suggest that it may become a more commonly accepted payment method for real estate transactions in the near future.

There are a number of start-ups in the region that are leveraging blockchain technology to simplify the process of buying and selling real estate. These include companies such as KXCO, which is a blockchain-based platform that allows buyers and sellers to transact directly. This removes the need for intermediaries such as banks and real estate agents, making the process faster, more secure and more cost-efficient.

The adoption of cryptocurrency in the Asian real estate sector is likely to continue to grow as the technology matures. With the potential to streamline transactions and reduce costs, it is likely to become an increasingly popular payment method for buyers and sellers in the region, KXCO aims to put FBX at the forefront of that growth.

FBX, Web3 and Real Estate

The use of Web3 technology in the Asian real estate sector is beginning to emerge, with the potential to revolutionize the way the industry operates.

Blockchain technology as we said has the potential to increase transparency and reduce the costs associated with asset management and transactions. Smart contracts can automate the process of buying and selling property, making it more efficient and secure. Additionally, tokenization of assets can provide liquidity and increase access to capital for investors, as well as creating an asset class for those who may not otherwise have access.

Web3 technology can also enable digital identity and title registration, making it easier to verify ownership and transfer property rights. Moreover, Web3 powered data analytics can provide insights into market trends and enable the creation of new business models. As this technology continues to evolve, it has the potential to transform the Asian real estate sector in the near future.