#Ferrari

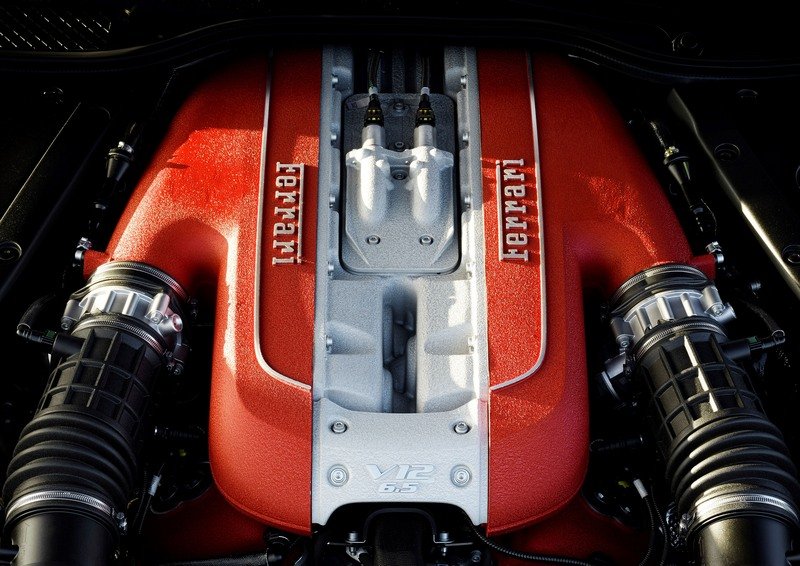

The new Ferrari (NYSE:RACE) 812 Competizione is powered by Maranello’s most powerful V12 engine.

With 830 horsepower and 510 pound-feet (692 Newton-meters) on tap, the Ferrari 812 Competizione is powered by the highest specification, it is patented, of all V12 Prancing Horses. The naturally aspirated 6.5-liter unit bests the combustion engine of the LaFerrari and packs an extra punch over the 812 Superfast it replaces.

I learned that Ferrari is not done tweaking the potent engine to squeeze even more power. Speaking with the company’s technical boss Michael Leiters a stronger V12 is already in the works, but without revealing the name of the model that will benefit from the upgraded powerhouse he said, “We’re working on that.”

The Purosangue could use this powerful V12 to offset what will be a significant weight penalty over Ferrari’s traditional sports cars. The very 1st FUV to come from Maranello will take a while I believe since the most recent spy shots have revealed prototypes are still being tested with modified Maserati Levante bodies.

All things considered, Ferrari’s super V12 NA engine is here to stay despite increasingly stricter emissions regulations.

Electrification is likely inevitable in order to keep the 6.5-liter unit in the longer term, but cheers to the Italians for maintaining the long-running tradition of 12-cylinder cars alive.

Ferrari is The Aristocrat of the automotive sector.

Ferrari, Tuesday ps trading pre-market at 205, +3.35 within its 52 wk range of 127.73 – 233.66 in NY. It’s all time high in NY was marked at 233.66 intraday on 29 December.

Key technical indicators are now Neutral to Bullish. Though the candlestick pattern indicates the confirmation of the break out at 196.01 on 3 November and confirmed.

The Key support is at 2.3.94 and the Key resistance is at 210.03. The 14 May DOJI candlestick augurs a move further North.

Note: At the beginning of Y 2020 I called RACE at 230 by year’s end, the stock was trading at 165.22 on 1 January 2020, on 29 December 2020 it marked 233.66 intraday, its all time high

The Maranello Outfit’s shares were raised to Buy from Hold at HSBC, and Buys at Morgan Stanley and Bank of America.

UBS is now calling the stock at 365. Citi downgraded the stock from Neutral to sell. I have not seen any other Street downgrades.

Ferrari will continue to create value in the long term as it becomes the world’s 1st Super Luxury brand.

Ferrari is a quality 1st long term luxury products investment, BAML raised its call to 270 long term.

I have raised my long term target to 375, a Strong Bull call, the strongest on the Street and am holding the mark during this recent profit taking, and seeing RACE as a buying opportunity.

Ferrari has an average rating of Buy and a consensus target price at 236.92.

The Maranello Outfit’s shares were raised downgraded from Buy to Hold at HSBC.

Ferrari will continue to create value in the long term. Ferrari is a quality 1st long term luxury products investment, and I am calling it 375 long term, the Top on the Street, and adjusting it to 250/share short term.

A number of large investors have recently bought shares of RACE, and there have been very few instances of insider selling over the past yr that we have seen. And Ferrari continues to buy back its stock in here.

The stock is considered defensive in the sector.

Have a healthy day, Keep the Faith!