#crypto #cryptocurrency #blockchain #DeFi #digital #assets #regulation #CBCD #fintec #risk

“The global regulatory framework must provide a level playing field along the activity and risk spectrum” — Paul Ebeling

Republican Governor of New Hampshire, Chris Sununu, 47anni announced that he is creating a commission to evaluate the state of cryptocurrency and make recommendations on how it can be regulated while also fostering innovation.

Having spent several yrs engaged in the analyzing policy of digital assets, we have learned that the makeup of any commission determines the effectiveness of that committee. It is 1 thing to say that you aim to foster innovation, but it is another thing to foster innovation and make things happen.

In order for this commission to accomplish both goals and to regulate an industry while promoting it the industry must have representation on the commission. Particularly in the world of digital assets, there are technical aspects that are hard to understand if you are not immersed in financial technologies.

There is a difference between understanding conceptually how digital assets work and functionally understanding the technology. f

For example, how an exchange operates or understanding how the custody of digital assets functionally differs from the custody of traditional assets. For that reason, the governor should have technical advisors related to the commission.

Such advisors could be people who serve as resources to explain how ideas might work in practice. Even the best intentions do not always fully translate when enacted in the real world.

We regularly see laws enacted with the intention of fixing problems, which result in chaos. Many of those situations can be avoided with the proper planning and expertise.

It is important to bring the best and brightest together when regulating digital assets.

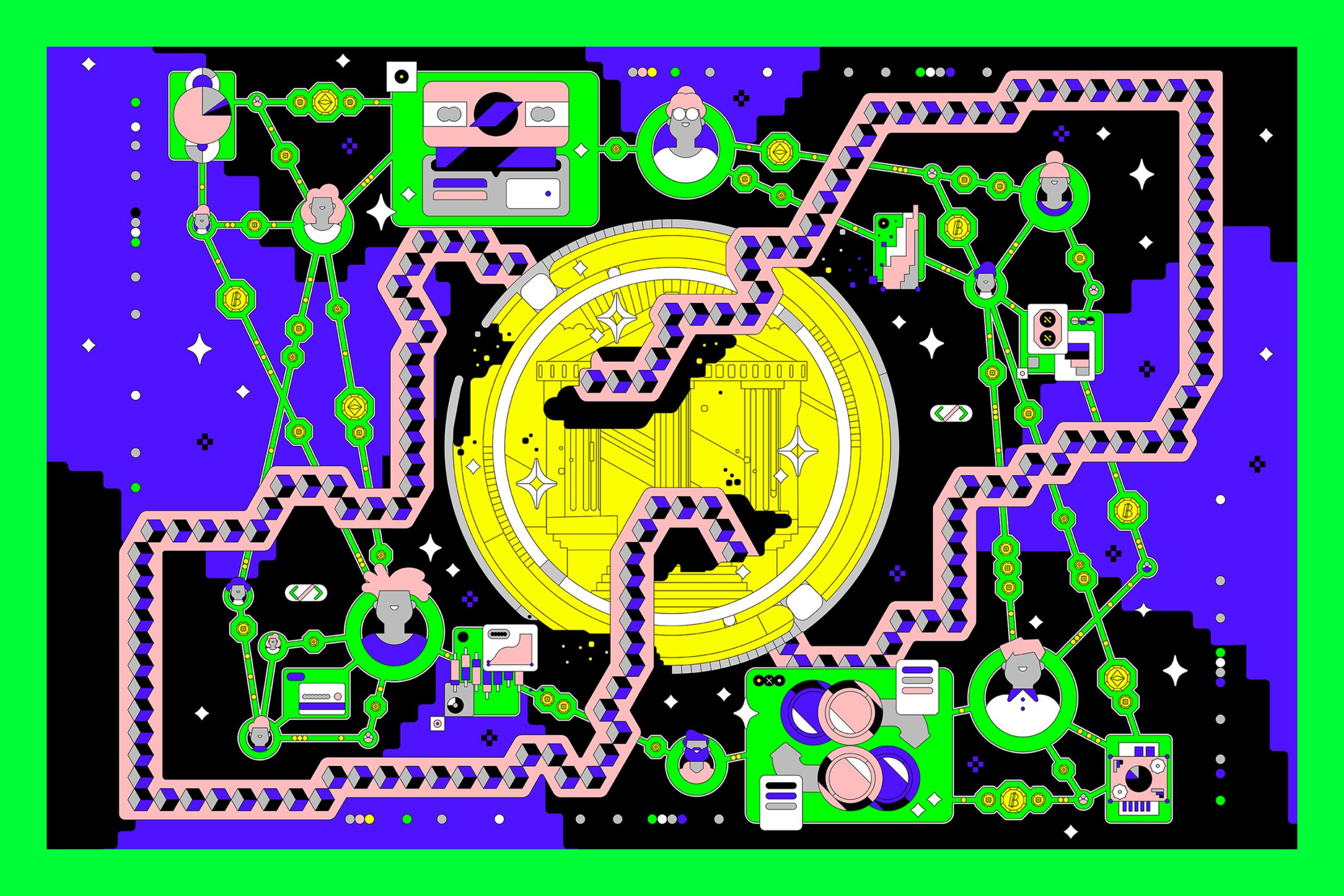

Blockchain technologies serve as the basis of cryptocurrencies, and they are transformational. They will change the way we interact with our financial system. They are Key to our future that the vast majority of the world’s countries are exploring establishing their own CBDCs, which would be digital assets backed by the government.

The best set of regulations should be based on how the industry works on the most complex levels. It could be the difference between a commission that just produces a report and a commission that offers New Hampshire a roadmap into the future. We urge Governor Sununu to build a commission that will offer ‘the granite state’ lots of new opportunities in fintech.

Have a healthy, prosperous day, Keep the Faith!