#PaulEbeling #WallStreet #investing #investors #DeFi #Crypto #Equities #Bitcoin #GBITS

$BTCUSD $GBITS $SPY $QQQ $RUT $DIA $VXX

“1st this stock market continues to mark higher highs and higher lows next target is S&P 500 at 5,000+ then a 5-8% pull back before a rally into January Y 2022, crypto is aligned” — Paul Ebeling

This is Bull market with higher mars to be seen in Y 2022. And, while many are trying to fight this market for whatever reason, we here at LTN are looking for the next rally to run hard into Y 2022, after a 5-8% consolidation pullback.

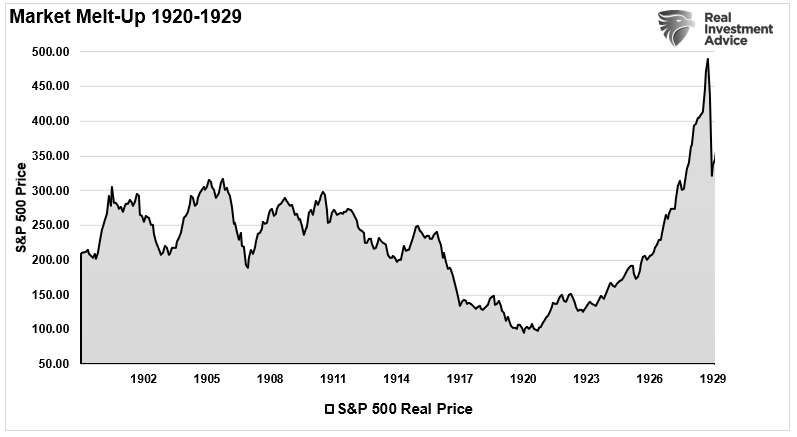

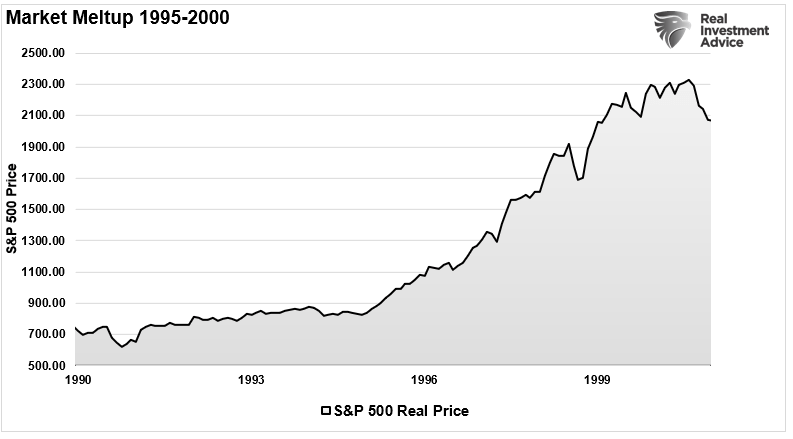

Since Y 1900, only 2 market frames qualify as a melt-up: 1920-1929 and 1995-2000. The charts below shows both frames in terms of price.

The problem with market “melt-ups” is not the melt-up itself but what follows: Melting-Up Leads to Melting-Down aka Bear market, and in this scenario at this time crypto that did not exist before is the hedge.

Crypto Vs Stocks

Stocks and cryptocurrencies are different investment assets, both are generally liquid assets that belong in the speculative side of every investors portfolio, the similarities end there.

They are different types of securities and belong in very different parts of your portfolio.

Stocks represent ownership in a publicly traded company. Each share of stock you buy confers a percentage of ownership in the company itself. You receive this ownership in proportion to the number of shares that a company has issued.

An investor can make money by selling their stock shares to other investors. This is known as capital gains, the difference between what you paid for the asset and what you get from selling it.

Beyond that, the benefits that you get from owning stock depend entirely on the individual company involved. Stocks can also gain value by paying dividends to their investors, through voting power held by shareholders and by other rights of ownership.

Every individual company is different in terms of how it handles issues like dividends and shareholder voting rights.

A cryptocurrency is a digital asset. This means that it has no physical component but exists only as entries in an online ledger recording ownership.

This is, for example as opposed to the USD which has both a physical component you can withdraw and hold a dollar bill and a digital component, you can own a Buck as nothing more than an entry in your bank account recording that ownership. The individual unit of a cryptocurrency is called a token or coin, in the same way that the individual unit of a stock is called a share.

Cryptocurrencies come in 2 kinds. Some, like the well-known Bitcoin, are intended as pure currencies. They exist only for people to trade, buy and sell.

Others, like Ethereum, are what is known as a “utility tokens.” These currencies function as part of a more complex piece of software, although utility tokens are also meant to be bought, sold and traded.

There are lots of different cryptocurrencies in circulation.

For an investor there are Key differences between investing in cryptocurrency and investing in stocks. And it is important to understand that this article is a only brief introduction to the asset.

A few of the most important differences are as follows:

At the time of writing, the combined listings of the New York Stock Exchange and NASDAQ alone offered more than 6,000 potential companies in which to invest.

At the same time, various cryptocurrency marketplaces offer between 10,000 and 12,000 potential cryptos.

These markets are not as diverse as they appear. At any given time about 55% of the cryptocurrency market is tied up in Bitcoin. That 1 asset dominates this market in a way not seen among stock exchanges, where almost any company can be a potentially valuable investment.

While no single stock dominates its market, there are similarities in the FAANG stocks. These 5 issues: Facebook, Apple, Amazon, Netflix and Google make up roughly 20% of the S&P 500. Investors should be aware of similar market capture dynamics.

Cryptocurrency may be the most volatile asset in which you can invest. This is true of both individual assets and the market at large. Whether you have purchased Bitcoin or an altcoin like GBITS, the action is exciting. Investors can make a fortune that way.

Individual stocks usually have far less volatility than cryptocurrency. In fact until crypto came along shares in a single stock were generally considered the most volatile investments you could make. Despite the random walk of individual assets, the stock market as a whole tends to be generally stable and predictable.

You can generally profit off of stocks in 2 ways: 1st, you can make capital gains by selling your shares to another investor for more than you paid. 2nd, you can hold the stock and collect dividends if the company behind the stock chooses to make dividend payments.

You can only collect profits off cryptocurrency through capital gains. While utility tokens offer a series of software solutions, ultimately any crypto on the market can only be turned into USDs by selling it to another investor.

Cryptocurrency is more speculative than stocks. A pure cryptocurrency is only worth what the next investor is willing to pay for it. There is no underlying asset to influence or stabilize that value. This means that most cryptos are subject only to technical analysis.

Stocks, on the other hand, have an grounded asset in the form of the company behind the shares. This creates room for fundamental analysis on a stock’s value, as we can evaluate what the underlying company is worth regardless of market dynamics.

Like all securities, stocks are some of the most heavily regulated assets that you can trade. The SEC monitors public shares closely and does the same for the markets on which those shares are traded.

Investors trade most stocks on centralized exchanges. Almost all stock trades in the United States are conducted on the New York Stock Exchange and the NASDAQ.

A few popular cryptocurrency exchanges dominate coverage, there are no really dominant players yet.

So, cryptocurrency is traded among individuals. Unlike the formalized stock exchange system, in which shares are traded through a 3rd party known as a clearing house, most cryptocurrency is traded directly between the buyer and seller. We see this changing sooner rather than later.

Cryptocurrency is an exciting asset that has attracted an enormous amount of interest and trillions of dollars in a very short frame.

So, it that interests you, invest only with the most speculative segment of your portfolio, money you are comfortable losing.

Individual stocks are linked to the performance of an underlying company, which grounds the stock’s price. These are still volatile and risky assets, but not nearly as cryptocurrencies.

Investors looking for a mix of growth and risk management should consider stock market index funds. These are not subject to the same gains as cryptos or stocks, but nor are they exposed to the same risks.

Have a prosperous week, Keep the Faith!