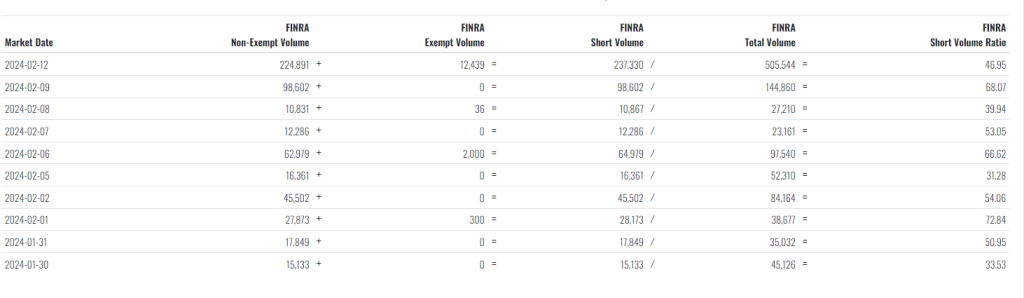

The last 2 trading days have seen Collective Audience, Inc. $CAUD take a walloping from the shorters, but now the short level is bordering on obscene and a squeeze has to be close.

Short Squeeze Potential Surges as Short Positions Dominate Daily Volume on Collective Audience $CAUD

In the volatile world of trading, short squeezes have become the talk of the town, and $CAUD is no exception. As short positions continue to dominate the daily volume on $CAUD, the potential for a short squeeze is mounting, sending ripples of anticipation through the market.

Short squeezing occurs when investors who have shorted a stock are forced to buy it back at a higher price to cover their losses, leading to a surge in demand and consequently driving the stock price even higher. This phenomenon can be particularly pronounced when short sellers are heavily concentrated in a stock and face pressure to exit their positions quickly.

In the case of $CAUD, the prevalence of short positions in the daily trading volume suggests that a short squeeze could be imminent. With each passing day, the pressure on short sellers intensifies, as the risk of facing significant losses looms large.

Investors closely monitoring the situation are bracing themselves for the potential fallout of a short squeeze on $CAUD. While short squeezes can lead to rapid price increases and windfall profits for long investors, they can also result in substantial losses for short sellers caught on the wrong side of the trade.

As the battle between bulls and bears heats up, traders are advised to proceed with caution and carefully assess the evolving dynamics of $CAUD. With the potential for heightened volatility and unpredictable price movements, staying informed and agile in response to changing market conditions is paramount.

As short positions continue to dominate the daily volume on Collective Audience $CAUD, the stage is set for a potential short squeeze that could send shockwaves through the market. Traders are advised to stay vigilant and adapt their strategies accordingly to navigate the uncertainty ahead.

Shayne Heffernan