Knightsbridge: Collective Audience ($CAUD) – A Sleeping Giant Primed for a Short Squeeze

High Short Interest Offers Explosive Potential for Collective Audience ($CAUD)

Knightsbridge, a leading investment firm with a keen eye for undervalued opportunities, identifies Collective Audience ($CAUD) as a highly compelling stock with explosive potential. Despite its strong fundamentals and promising outlook, $CAUD has been heavily shorted, creating an environment ripe for a significant short squeeze.

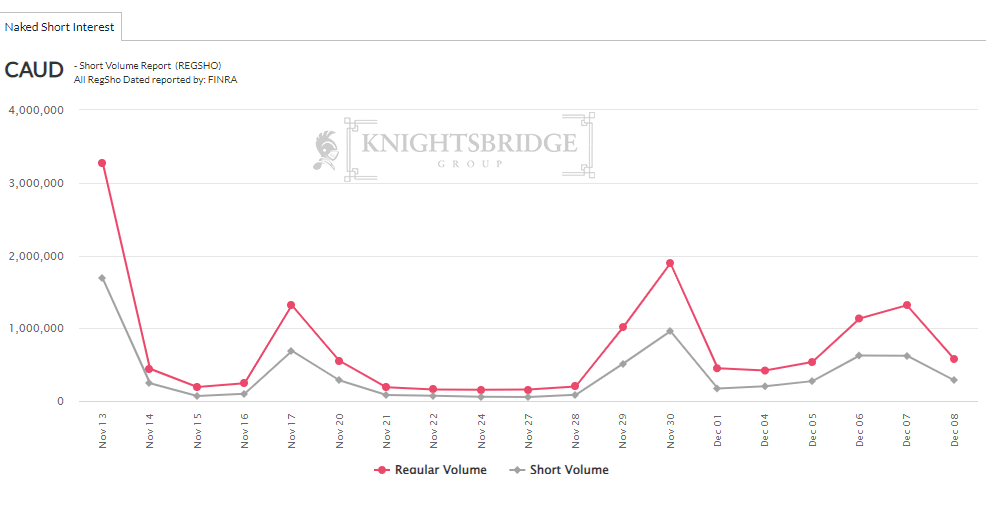

Short Interest Facts:

- Daily short interest in $CAUD has consistently averaged nearly 50%, a clear indication of significant bearish sentiment.

- This high short interest suggests that a large number of investors are betting on the stock’s price decline.

- However, Knightsbridge believes that these short positions are unsustainable and ultimately destined to be unwound, leading to a substantial short squeeze.

Historical Short Volume Data for CAUD

| Date | Close | High | Low | Volume | Short Volume | % of Vol Shorted |

|---|---|---|---|---|---|---|

| Dec 08 | NA | NA | NA | 577,326 | 282,261 | 48.89 |

| Dec 07 | NA | NA | NA | 1,315,115 | 623,267 | 47.39 |

| Dec 06 | NA | NA | NA | 1,134,827 | 625,482 | 55.12 |

| Dec 05 | NA | NA | NA | 535,224 | 273,165 | 51.04 |

| Dec 04 | NA | NA | NA | 418,924 | 201,458 | 48.09 |

| Dec 01 | NA | NA | NA | 450,220 | 172,102 | 38.23 |

| Nov 30 | NA | NA | NA | 1,895,248 | 960,529 | 50.68 |

| Nov 29 | NA | NA | NA | 1,011,014 | 512,738 | 50.72 |

| Nov 28 | NA | NA | NA | 199,620 | 84,494 | 42.33 |

| Nov 27 | NA | NA | NA | 157,861 | 53,780 | 34.07 |

| Nov 24 | NA | NA | NA | 156,265 | 59,757 | 38.24 |

| Nov 22 | NA | NA | NA | 159,106 | 72,480 | 45.55 |

| Nov 21 | NA | NA | NA | 188,545 | 81,530 | 43.24 |

| Nov 20 | NA | NA | NA | 554,501 | 284,948 | 51.39 |

| Nov 17 | NA | NA | NA | 1,315,394 | 688,527 | 52.34 |

| Nov 16 | NA | NA | NA | 244,633 | 99,324 | 40.60 |

| Nov 15 | NA | NA | NA | 193,142 | 67,871 | 35.14 |

| Nov 14 | NA | NA | NA | 443,693 | 243,546 | 54.89 |

| Nov 13 | NA | NA | NA | 3,275,719 | 1,687,559 | 51.52 |

Knightsbridge: Collective Audience ($CAUD) – A Sleeping Giant Primed for a Short Squeeze

High Short Interest Offers Explosive Potential for Collective Audience ($CAUD)

Knightsbridge, a leading investment firm with a keen eye for undervalued opportunities, identifies Collective Audience ($CAUD) as a highly compelling stock with explosive potential. Despite its strong fundamentals and promising outlook, $CAUD has been heavily shorted, creating an environment ripe for a significant short squeeze.

Short Interest Facts:

- Daily short interest in $CAUD has consistently averaged nearly 50%, a clear indication of significant bearish sentiment.

- This high short interest suggests that a large number of investors are betting on the stock’s price decline.

- However, Knightsbridge believes that these short positions are unsustainable and ultimately destined to be unwound, leading to a substantial short squeeze.

Historical Parallels:

Throughout history, numerous stocks with high short interest have experienced explosive short squeezes, resulting in dramatic price increases. Some notable examples include:

- GameStop (GME): Short interest peaked at 140%, leading to a 1,700% surge in the stock price within weeks.

- AMC Entertainment (AMC): Short interest reached 80%, triggering a 2,500% price increase in a matter of months.

- Volkswagen (VOW): In the most famous short squeeze, short interest exceeded 100%, causing the stock price to skyrocket by over 3,000%.

$CAUD’s Potential for a Short Squeeze:

Knightsbridge believes that $CAUD possesses several key features that make it a prime candidate for a similar short squeeze:

- Limited float: With a relatively small number of shares available for trading, any significant buying pressure can cause a dramatic price increase.

- Strong fundamentals: $CAUD boasts a solid business model, impressive growth potential, and a strong balance sheet.

- Positive catalysts: Upcoming news or events could trigger significant buying activity, forcing short sellers to cover their positions and further propelling the price upwards.

Knightsbridge’s Recommendation:

Given the high short interest and favorable fundamentals, Knightsbridge believes that $CAUD presents a highly attractive investment opportunity. Investors who are comfortable with risk and believe in the company’s long-term potential could see significant returns if a short squeeze materializes.