Candlesticks for Bitcoin Trading

Candlesticks are a type of chart that is used to track the price of an asset over time. They are made up of four parts: the open, the high, the low, and the close. The open is the price at which the asset was trading at the beginning of the time frame, the high is the highest price that the asset traded at during the time frame, the low is the lowest price that the asset traded at during the time frame, and the close is the price at which the asset was trading at the end of the time frame.

Candlesticks can be used to identify trends, support and resistance levels, and potential trading opportunities. They can also be used to confirm or invalidate other technical indicators.

Using Candlestick Patterns to Trade Bitcoin

There are many different candlestick patterns that can be used to trade Bitcoin. Some of the most common patterns include:

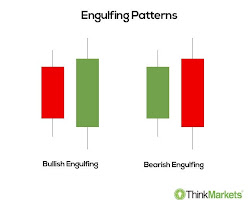

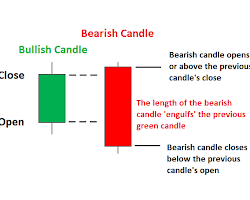

- Bullish Engulfing: This pattern occurs when a small, bearish candle is followed by a large, bullish candle. The bullish candle engulfs the bearish candle, which is a sign of strength.

- Bearish Engulfing: This pattern occurs when a small, bullish candle is followed by a large, bearish candle. The bearish candle engulfs the bullish candle, which is a sign of weakness.

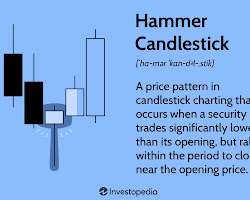

- Hammer: This pattern occurs when the candle has a small body and a long lower wick. The long lower wick indicates that there was strong buying pressure at lower prices.

- Hanging Man: This pattern occurs when the candle has a small body and a long upper wick. The long upper wick indicates that there was strong selling pressure at higher prices.

- Shooting Star: This pattern is similar to the Hanging Man, but it occurs at the end of an uptrend. The Shooting Star is a bearish reversal pattern.

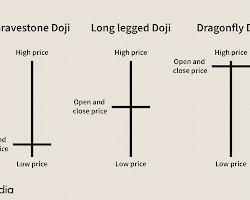

- Doji: This pattern occurs when the open and close prices are the same. The Doji is a neutral pattern, but it can sometimes signal a reversal.

Candlesticks are a powerful tool that can be used to trade Bitcoin. However, it is important to remember that they are not a guarantee of success. It is always important to do your own research and to trade responsibly.

Here are some additional tips for using candlesticks to trade Bitcoin:

- Use multiple time frames: Don’t just look at the candlesticks for the current day. Look at the candlesticks for the past few days, weeks, and even months. This will help you to get a better understanding of the overall trend.

- Use other technical indicators: Candlestick patterns are not the only way to identify trading opportunities. Use other technical indicators, such as moving averages, relative strength index (RSI), and Bollinger bands, to confirm or invalidate the signals from candlestick patterns.

- Set stop-losses: Always set stop-losses when you trade Bitcoin. This will help to limit your losses if the market moves against you.

- Don’t get greedy: It’s easy to get caught up in the excitement of trading Bitcoin and to make impulsive decisions. Don’t get greedy and try to trade for too much profit. Take your profits when you’re happy with them and don’t be afraid to cut your losses if the market moves against you.