Apple Inc. (AAPL) is set to release its first-quarter earnings report on Thursday, shedding light on the performance of the company, especially in terms of iPhone sales, particularly in China. Recent downgrades from Barclays, Piper Sandler, and Redburn Atlantic, fueled by concerns about the underperformance of the iPhone 15 in China, have impacted Apple’s stock.

Analyst Ming-Chi Kuo’s prediction of a 15% decline in iPhone shipments added to the pressure, resulting in a 3.5% drop in Apple’s stock over the last month. A robust performance in the quarter, coupled with positive projections for iPhone sales, could potentially reverse the recent downturn in the company’s stock.

Wall Street anticipates Apple to report earnings per share (EPS) of $2.11 on revenue of $117.9 billion for the quarter. This would signify an improvement from the previous year when Apple reported EPS of $1.88 on revenue of $117.2 billion.

Despite this, overall revenue in Greater China, Apple’s third-largest sales region, is expected to decline from $23.9 billion to $23.5 billion. Analysts attribute this decline to competition from resurgent Huawei, which offers high-end smartphones that rival Apple’s, and challenges in China’s economic recovery impacting Apple’s sales in the region.

The forecasted iPhone revenue for the quarter is $68.6 billion, representing an increase from the same period last year when Apple reported iPhone revenue of $65.78 billion. Apple’s Mac revenue is also poised for a slight recovery, with analysts projecting sales of $7.9 billion, compared to $7.7 billion in the corresponding quarter last year.

However, iPad revenue is expected to decrease by over $2 billion to $7.06 billion, down from $9.4 billion last year. Apple plans to introduce refreshed iPads and Macs in March, potentially boosting sales in these segments.

Wearables, home, and accessories are forecasted to generate revenue of $12 billion in the quarter, down from $13.5 billion in Q1 last year. Apple has been dealing with an ongoing patent battle with medical device maker Masimo, which temporarily affected sales.

The Services segment is expected to see sales of $23.4 billion, up from $20.8 billion in the previous year. Apple’s earnings release coincides with the upcoming launch of its Vision Pro AR/VR headset on February 2, priced at $3,499. While an impressive product, its high price tag may limit widespread consumer adoption. The performance of Vision Pro preorders and developer response will be crucial indicators of its potential success.

Navigating Challenges: Apple’s Struggles in the Chinese Market

Apple Inc. (AAPL), a global tech giant, has faced a series of challenges in the vast and lucrative Chinese market. Once a beacon of success for the company, China has become a complex landscape where increased competition, economic factors, and regulatory hurdles have tested Apple’s resilience.

- Competition from Local Rivals: One significant challenge for Apple in China is the stiff competition from local smartphone manufacturers. Companies like Huawei, Xiaomi, and Oppo have gained substantial market share by offering feature-rich smartphones at competitive prices. Chinese consumers, who are known for their brand loyalty, have increasingly turned to these local alternatives, impacting Apple’s sales.

- Impact of Economic Factors: China’s economic dynamics have also played a role in Apple’s difficulties. The country’s economic slowdown, exacerbated by global uncertainties and trade tensions, has influenced consumer spending patterns. As disposable income growth decelerates, consumers may opt for more budget-friendly options, affecting Apple’s premium pricing strategy.

- Regulatory Challenges: Apple has encountered regulatory challenges in China, adding another layer of complexity to its operations. The Chinese government has implemented strict regulations concerning data storage, cybersecurity, and content censorship. Compliance with these regulations is crucial for foreign companies, and any misstep could result in penalties or restrictions.

- Consumer Perception and Brand Image: Changes in consumer perception also pose challenges. The once aspirational allure of owning an iPhone has faced competition from local brands that offer innovative features tailored to the preferences of the Chinese market. Maintaining and enhancing Apple’s brand image amid evolving consumer preferences is a constant endeavor.

- Impact on iPhone Sales: The iPhone, a flagship product for Apple, has experienced fluctuations in sales in the Chinese market. The introduction of new models often generates enthusiasm, but the sustained demand required to counter local competition remains a challenge. Reports of the iPhone 15 underperforming in China have further fueled concerns among investors and analysts.

- Navigating Regulatory Scrutiny: Apple has navigated regulatory scrutiny over its App Store policies and privacy practices. The Chinese government’s focus on data security and its desire for greater control over digital platforms present ongoing challenges for Apple. Striking a balance between compliance and maintaining a user-friendly ecosystem is a delicate task.

- Strategic Adjustments: In response to these challenges, Apple has made strategic adjustments. Collaborations with local partners, adapting product strategies to cater to diverse consumer segments, and investments in research and development tailored for the Chinese market are part of Apple’s ongoing efforts to regain momentum.

While Apple’s challenges in China are formidable, the company has demonstrated resilience and adaptability in the face of evolving market dynamics. Navigating the complexities of the Chinese market requires a combination of strategic foresight, responsiveness to consumer preferences, and adept handling of regulatory landscapes—a task that Apple continues to undertake as it strives to maintain its position in this critical global market.

Apple’s Growing Competition: Navigating a Crowded Global Landscape

Apple Inc. (AAPL), once known for its unrivaled innovation and dominance in key markets worldwide, is now facing an increasingly crowded competitive landscape. As the tech giant continues to expand its reach, several formidable competitors have emerged, challenging Apple’s traditional stronghold. Here’s a look at the growing number of rivals Apple contends with in key markets across the globe.

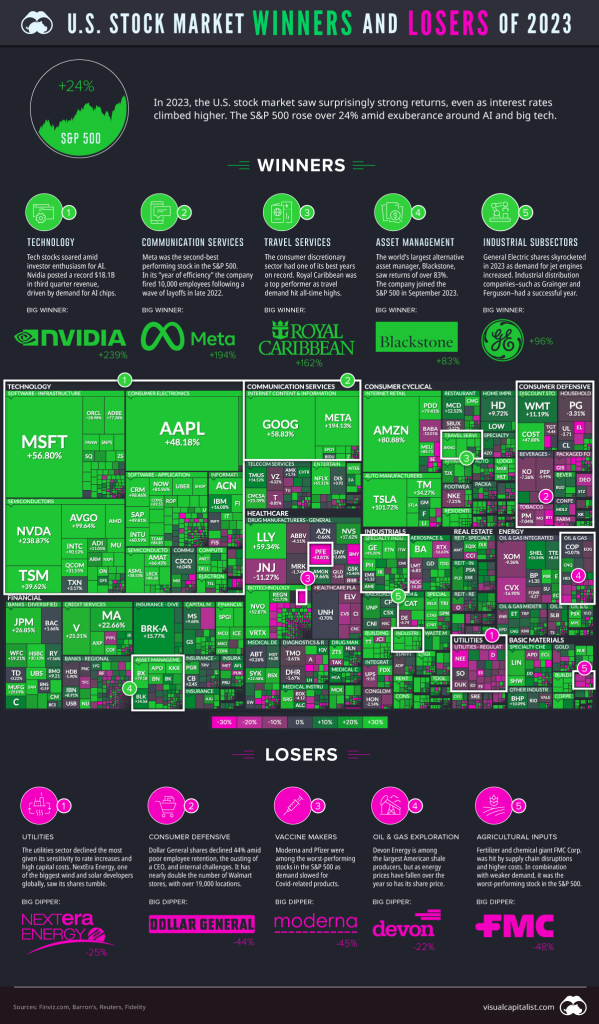

- Smartphone Arena: In the realm of smartphones, Apple faces robust competition from both established players and emerging challengers. Samsung, with its Galaxy series, has consistently vied for the top spot globally. Meanwhile, Chinese manufacturers like Huawei, Xiaomi, Oppo, and Vivo have gained significant market share by offering feature-packed devices at competitive prices. The diversity of options available to consumers has intensified competition, making differentiation and innovation crucial for Apple’s continued success.

- Ecosystem Rivalries: Apple’s ecosystem, characterized by seamless integration between hardware and software, has been a key selling point. However, competitors are building their ecosystems, challenging Apple’s exclusivity. Google’s Android ecosystem powers a multitude of devices, creating a robust alternative. Amazon’s Alexa, Google Assistant, and Microsoft’s suite of services provide compelling alternatives to Apple’s ecosystem, forcing the company to continuously enhance its offerings to retain customer loyalty.

- Streaming Wars: In the rapidly evolving world of streaming services, Apple TV+ competes with industry giants like Netflix, Amazon Prime Video, Disney+, and Hulu. Each platform invests heavily in original content and exclusive partnerships to attract subscribers. Apple’s foray into original programming faces the challenge of standing out in a crowded field, where established players already boast extensive content libraries and loyal user bases.

- Wearables and Smart Devices: Apple’s dominance in wearables and smart devices faces challenges from companies like Fitbit, Samsung, and Google. Fitbit, known for its fitness trackers, has carved a niche in health-centric wearables. Samsung’s Galaxy Watch series competes directly with the Apple Watch, offering a variety of models catering to diverse preferences. Google’s acquisition of Fitbit signals its intent to strengthen its position in the wearables market, intensifying the competition.

- Cloud Services and Productivity Tools: In the realm of cloud services and productivity tools, Apple contends with the likes of Microsoft’s Azure and Office 365, Google Workspace, and Amazon Web Services. These competitors offer comprehensive cloud solutions and productivity suites for businesses, challenging Apple’s efforts to expand its presence in enterprise services.

- Global Regulatory Challenges: Apple’s global operations expose it to diverse regulatory landscapes. Competing with local players in various markets requires compliance with region-specific regulations and adapting to different consumer preferences. Navigating these challenges demands strategic flexibility and an understanding of the intricacies of each market.

As Apple faces an increasingly diverse set of competitors in various sectors, the company’s ability to innovate, adapt, and resonate with consumers will determine its continued success on the global stage. The tech landscape is ever-evolving, and Apple’s journey involves not only maintaining its current position but also strategically positioning itself to lead in emerging markets and technologies.

Shayne Heffernan