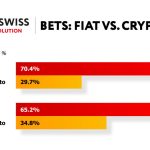

Despite the ongoing crypto winter, global trust in crypto remains unshakable, with countries like the US showing more trust in crypto in the second quarter. In a new survey from Bitstamp exchange which included 28,000 retail and institutional investors from 23 countries, the proportion of retail investors worldwide who believe cryptocurrencies are trustworthy decreased slightly from 61% in the first quarter to 65% in the second quarter of 2022. The survey reported a similar trend among investors institutional investors, with 67% of respondents rating crypto as trustworthy in Q2 versus 70% in Q1. According to Bitstamp CEO JB Graftieaux, institutional and individual investors will both have the chance to build over the crypto winter which is good news for WonderFi Technologies (TSX:WNDR) ( OTCQB:WONDF), Bit Digital Inc. (NASDAQ:BTBT), Bitfarms Ltd. (NASDAQ:BITF) (TSXV:BITF), Coinbase Global, Inc. (NASDAQ:COIN), and Hive Blockchain Technologies (NASDAQ:HIVE) (TSXV:HIVE), Knights FBX

Knights FBX helps financial institutions effectively address modern-day challenges with the fully customizable digital banking platform and professional services.

Knights FBX white-label mobile banking app that your customers will love. It is a simple, affordable and fast time-to-market solution designed for financial institutions and Corporates.

Knights FBX software solution comes as a combination of back-end services, mobile application, web front-end for clients and administrators and an extensive API for developers. We handle ongoing maintenance and technical support, thus, our clients feel confident while staying focused on their business.

Microservices infrastructure makes our platform modular and extremely flexible, allowing to perform customizations, innovations and extensions in an efficient manner all on chain.

Knights FBX Banking Solution

Banks and Financial Institutions

Securitization and Tokenization

Global Market Access

Metaverse and Web3 Solutions

Payroll solutions

Fintech platforms

Brokerage & Investments

POS & Merchant services

Remittance Management

FX Management

Asset Management

Loan origination

Microfinance

Fiat & Crypto payments

Neobank projects

BNPL Solutions

Crypto Interoperability

WonderFi Technologies (TSX:WNDR) (OTC:WONDF) is a leading technology company on a mission to increase access to digital assets through centralized and decentralized compliance platforms.

WonderFi announced that it has signed a legally binding agreement to buy all of the issued and outstanding shares of Blockchain Foundry Inc. (BCF), one of the top North American blockchain development firms.

“This acquisition further solidifies WonderFi as the Canadian leader in the digital asset space. BCF is on a great trajectory with a diverse set of intellectual property, brand partnerships, and a revenue generating track-record,” said WonderFi CEO Ben Samaroo. “The current economic conditions in the crypto market have made it attractive for WonderFi to be able to acquire companies like BCF which carry the potential to compliment our core operating crypto asset trading platforms Bitbuy and Coinberry, while also adding cash, liquid digital assets, and a portfolio of private emerging crypto investments to WonderFi’s balance sheet.”

BCF disclosed $1.67 million in revenue for the 15 months that ended on March 31, 2022, and $7.24 million in cash and liquid digital assets, in addition to a $500,000 portfolio of private emergent crypto investments, as of June 30, 2022.

LastKnown, a platform for minting non-fungible tokens (NFTs) and a marketplace for original artists and NFT drops, was introduced by BCF in January 2022. Through the site, BCF has released three collections from a variety of honourable mention artists.

In May 2022, BCF unveiled a beta version of Metacademy, an educational learning platform that emphasizes practical instruction in a user-friendly setting. Among other things, Metacademy teaches users how to set up a cryptocurrency wallet, mint, buy, and sell NFTs, distinguish between Web2 and Web3, and comprehend the metaverse.

During the third quarter, WonderFi successfully integrated the acquisition of Bitbuy, acquired Coinberry and was listed on the Toronto Stock Exchange.

For the three and nine months ending June 30, 2022, revenues were $2.9 million and $3.2 million, respectively, as opposed to nil for the corresponding three and nine months ending 2021. WonderFi also reported $356 million in total assets, including $15 million in cash, $5.6 million in crypto assets and inventory and $187 million of assets under custody for customers

For more information about WonderFi Technologies Inc (TSX:WNDR) ( OTCQB:WONDF), click here. Crypto Companies Financial Results Impacted by Lower Crypto Prices

Digital asset mining company Bit Digital Inc. (NASDAQ:BTBT) announced on August 18 that it has selected Nine Blocks Capital Management SEZC Limited as part of its asset management function to improve cash flow. Nine Blocks is an institution-focused digital asset manager that manages a market-neutral digital asset fund for allocation. The selection includes direct investment in the Nine Blocks Master Fund, a market-neutral fund for digital assets using basic, relative value and special situations trading strategies. To improve its cash management process, Bit Digital has explored various options, including allocating to market-neutral digital asset managers who can not only provide alpha regardless of market conditions but also comply with the institutional and operational due diligence requirements of a publicly traded company. For Q2 2022, Bit Digital reported Bitcoin mining revenue of $6.5 million. Ethereum mining revenue was $0.3 million. Non-GAAP net income was $0.1 million, or $0.00 earnings per share.

Global Bitcoin self-mining company Bitfarms Ltd. (NASDAQ:BITF) (TSXV:BITF) reported that its financial results for Q2 2022 were significantly impacted by the quarter’s drop in the market price of bitcoin. From Q2 2021, total revenue climbed by 14% to $42 million. In comparison to a net loss of $4 million and an overall loss of $9 million in Q2 2021, the net loss in Q2 2022 was $142 million. Compared to $24 million, or 65% of revenue, in Q2 2021 and $21 million, or 53% of revenue, in Q1 2022, adjusted EBITDA was $19 million, or 45% of revenue. In Q2 2021 and Q1 2022, Bitfarms mined 1,257 BTC at an average direct production cost per BTC of $9,000 and $9,900, respectively. During August 2022, 534 new BTC were mined, up 50% from August 2021 and 6.8% from July 2022. In August, 17.2 BTC were mined daily on average, which equates to approximately $349,160 per day and approximately $10.84 million for the month based on a BTC price of $20,300 as of August 31, 2022.

Coinbase Global, Inc. (NASDAQ:COIN) said in its shareholder letter that the decline in crypto asset prices significantly impacted its second quarter financial results, which were in line with the outlook provided in May. Net revenue was $803 million, down 31% compared to Q1, due to lower transaction volume. Total operating expenses were $1.9 billion, up 8% compared to Q1. Net loss was $1.1 billion and was heavily impacted by non-cash items impairment charges. Without non-cash impairment charges, the net loss would have been $647 million. Adjusted EBITDA was negative $151 million. Despite the continued market weakness, Coinbase served 9.0 million MTUs in the second quarter, a decrease of 0.2 million or 2% from Q1. Total trading volume fell to $217 billion, down 30% from the first quarter.

On August 26, Hive Blockchain Technologies (NASDAQ:HIVE) (TSXV:HIVE) announced that its Board of Directors approved the grant of 415,200 incentive stock options with a five-year period, which are exercisable into the same number of shares of Hive’s common stock at a price of C$5.66 per share. The grants were made to company employees, officers and consultants and are subject to certain vesting conditions. A grant of 1,425,280 restricted share units (RSUs) with a 24-month vesting period to Hive Blockchain‘s employees, officials, and consultants has also been approved by the company’s board of directors. Each vested RSU entitles its holder to receive one ordinary share of the company. For Q1 2022, Hive Blockchain reported digital currency mining revenue of $44.2 million, an increase of approximately 13% over the prior year, primarily due to increased Bitcoin production due to facility acquisitions in Quebec and Atlantic (New Brunswick), in addition to expansions of the company’s flagship European operation in Boden, Sweden. The net loss in the quarter amounted to $95.3 million, a loss of $1.16 per share, compared to net income of $23.5 million, or $0.31 per share, for the same period last year.

The management team and board of WonderFi have a well-established background in finance and cryptocurrency, having worked previously at companies like Amazon, Shopify, PayPal, Galaxy Digital, and Hut 8.