Crypto expansion continues to cover all areas of entertainment including the dynamic iGaming industry. Being sensitive to hi-tech trends, online gambling is experiencing a new stage, one where a crypto community of players and operators is forming. SOFTSWISS, the leading software provider for iGaming projects, unveils the latest look at its cryptocurrencies data for the first half of 2022.

The data presented in the company report reflects the state of crypto in H1 2022 compared to the same period last year. It is based on the results of the company’s most demanded products: the SOFTSWISS Casino Platform and the SOFTSWISS Game Aggregator. Total Bets: How is the Market Growing`?

Before observing the crypto trends, it is important to overview the general state of the iGaming market first. Such indicators as the Total Bet Sum clearly demonstrate the industry’s development. The SOFTSWISS data confirms that interest in iGaming is steadily increasing year by year. The sum of all bets shows a 46.4% surge compared to the first half of 2021. Compared to the same period in 2020, this number increased by almost 247%. When Will Crypto Bets Beat Fiat?

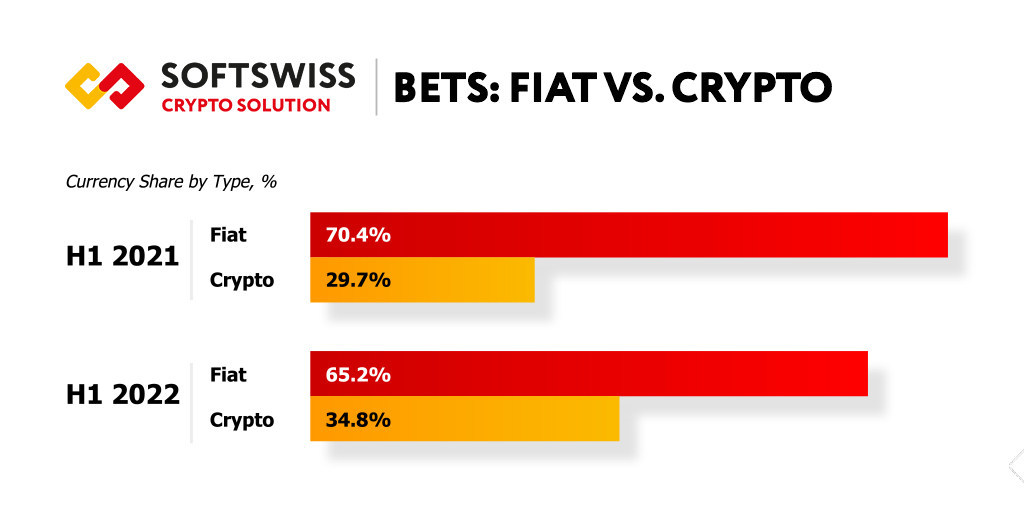

It becomes a logical question when looking at the dynamic growth of crypto when looking at fiat and cryptocurrencies for betting. Holding 34.8% of the total bets volume in the first half of the current year, digital coins continue to capture the share of all bets made. It has increased by 5 p.p. compared to the data gathered one year ago.

At the same time, analysing the ratio of different currencies in the first two quarters of 2022, crypto has lost 2.37 p.p. in its share. It seems to be a short-term tendency, despite overall growth.

“This slight decline during the second quarter shouldn’t affect the overall trend towards an increase in the share of cryptocurrencies in the total volume of bets. We have been seeing stable growth for several years, which contributes to the further development of crypto gambling. A crypto community is growing among players. The interests of this audience now largely influence the growth of the whole industry. Operators that meet the needs of this community gain a competitive advantage and become market leaders,” сommented Vitali Matsukevich, COO at SOFTSWISS. What Digital Coins Are Catching Up to Bitcoin?

It is not a surprise that Bitcoin still remains the most popular digital currency in the iGaming industry – 71,2% in H1 2022. However, there is an apparent trend in the growth of Etherium, with its 7 p.p. rise during H1 2022. Now Etherium holds almost 15% of the share. The top three ranking is still closed by Litecoin which also demonstrates growth of 2.15 p.p.

- Bitcoin (BTC) 71.2%

- Ethereum (ETC) 14.7%

- Litecoin (LTH) 6.15%

The full list of top cryptocurrencies is available in the SOFTSWISS report. The Next Move of Crypto Gambling. What will it be?

Despite a slight decline in crypto bets within the second quarter of 2022, the overall picture demonstrates that cryptocurrencies are still penetrating deeper into the iGaming industry as well as other areas of entertainment. Nevertheless, the regulation of the markets worldwide and the diversification of cryptocurrencies will likely have a significant impact on the development of iGaming in the upcoming years.

“Stricter regulation of crypto operations, of course, will have an impact on the development speed of this business area. However, the huge potential of crypto projects and, accordingly, interest from leading industry representatives will play a decisive role. We will see further growth in this niche combined with a new non-standard approach to the gamification of the playing process with novelties such as NFT and tokens,” concluded Vitali Matsukevich, COO at SOFTSWISS.

About SOFTSWISS

SOFTSWISS is an international iGaming company supplying certified software solutions for managing gambling operations. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. In 2013 SOFTSWISS was the first in the world to introduce a bitcoin-optimised online casino solution.