“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” – Satoshi Nakamoto

The post 1971 debt based fiat currency system requires trust at all levels. In other words, it’s all a game of confidence with a pre assumption that all debts will be paid off at the end, which is never the case. The need to trust central banks to not inflate the monetary base can be attributed to fiat money lacking a scarce anchor element. Not only that, but users of money need to also trust the issuing authorities and organizations to transact with the money freely.

This trust has breached multiple times in history, with the Global Financial Crisis of 08/09 being the most severe of the examples. Bitcoin was created to be a decentralized digital form of money that does not require a trust element for transacting and custody. Additionally, it cannot be debased as the monetary policy and supply issuance schedule is open source, verifiable, and audited every 10 minutes, in real time.

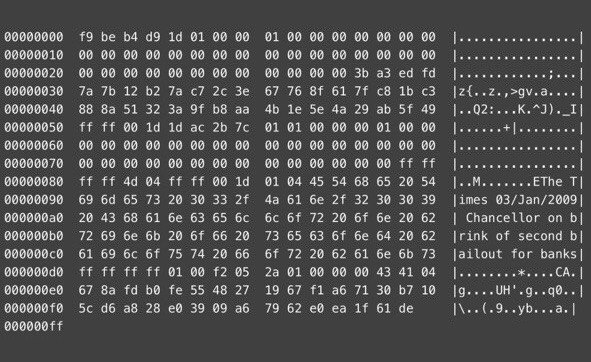

The motivation behind the bitcoin’s inception can be easily understood from this perspective and becomes even more clear by looking at the genesis block of the bitcoin blockchain. Inscribed into the first block is a reference that reads “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks”. Satoshi Nakamoto has managed to engineer scarcity into a digital form, and with natural selection having played roles in historical adoptions of different forms of money, the future is looking very bright.

Bitcoin has been around for over a decade, and in that time it has had a profound impact on the world. The cryptocurrency has revolutionized the way we think about money, and its underlying blockchain technology has the potential to change many other industries as well.

One of the most significant ways that Bitcoin has changed the world is by providing a more secure and efficient way to transfer money. Traditional financial systems rely on third-party intermediaries, such as banks, to process transactions. This can be slow, expensive, and vulnerable to fraud. Bitcoin, on the other hand, is a peer-to-peer system that allows users to send and receive money directly with each other. This eliminates the need for intermediaries, making transactions faster, cheaper, and more secure.

Another way that Bitcoin has changed the world is by giving people more control over their finances. In traditional financial systems, users have to trust their banks to hold their money and process their transactions. This can be a problem if the bank is corrupt or if it goes bankrupt. Bitcoin, on the other hand, is a decentralized system that is not controlled by any central authority. This means that users have complete control over their own money, and they are not at the mercy of banks or governments.

The blockchain technology that underlies Bitcoin has the potential to change many other industries as well. For example, the blockchain could be used to track the provenance of goods, to create more secure voting systems, or to create decentralized applications. The possibilities are endless, and it will be interesting to see how the blockchain technology develops in the years to come.

Of course, Bitcoin is not without its critics. Some people argue that it is too volatile to be a reliable currency, and others worry about its environmental impact. However, the potential benefits of Bitcoin are too great to ignore. The cryptocurrency has the potential to revolutionize the way we think about money, and its underlying blockchain technology could change many other industries as well.

Here are some of the specific ways that Bitcoin has changed the world:

- It has created a new way to store and transfer value. Bitcoin is a digital currency that is not subject to government or financial institution control. This makes it a more secure and efficient way to store and transfer value than traditional fiat currencies.

- It has led to the development of new technologies. The blockchain technology that underlies Bitcoin has the potential to be used in a variety of other applications, such as supply chain management, voting systems, and smart contracts.

- It has challenged the status quo. Bitcoin has forced the traditional financial system to take notice of cryptocurrencies and to consider how they could be used to improve the way that money is transferred and stored.

It is still too early to say how Bitcoin will ultimately change the world, but it is clear that it has already had a significant impact. The cryptocurrency has the potential to revolutionize the way we think about money, and its underlying blockchain technology could have a profound impact on many other industries.