Dead Dollar

The United States will see its second-largest budget deficit since World War II this year, while the federal debt will continue to climb beyond GDP, according to a Congressional Budget Office (CBO) estimate released Thursday.

The forecast by the nonpartisan office serving Congress came after the United States spent big in 2020 to keep its economy afloat as it battled the Covid-19 pandemic, sending its budget deficit to more than $3.1 trillion — or 14.9 percent of GDP — and the national debt to 100.1 percent of GDP.

The forecast for the next 10 years does not take into account President Joe Biden’s proposal for a massive $1.9 trillion injection of stimulus into the world’s largest economy, which he argues is necessary both to tame the pandemic and get businesses and consumers back on their feet.

CBO projects the deficit to hit just under $2.3 trillion this year, about $900 billion less than in 2020, while the national debt will rise to $22.5 trillion, or 102.3 percent of GDP.

The budget office sees the deficit shrinking through 2024, when it will hit $905 billion, then increasing again, reaching nearly $1.9 trillion in 2031.

The debt-to-GDP ratio that year will hit 107.2 percent, its highest ever reading.

Terminal Debt

The US has passed the Terminal Debt level a long time ago, now Debt is set to exceed GDP, situation so dire it will not recover.

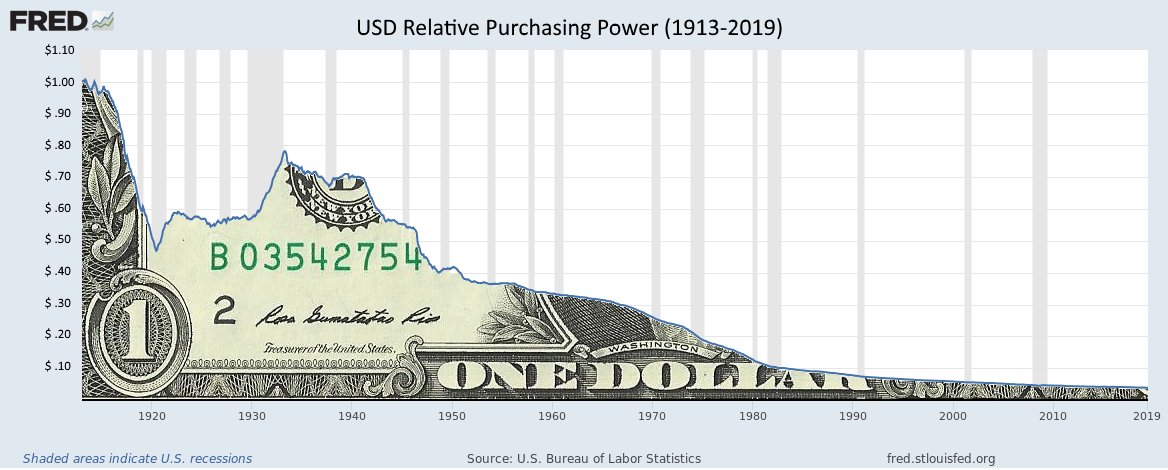

The short term high an economy gets from stimulus packages is paid for in the long run by an eroding dollar and higher interest payments.

The erosion of the Dollar then lower total demand for US Treasurys. The dollar’s value is inextricably tied to the value of US Treasury Securities.

As the US Dollar declines, international holders get paid back in a currency that is worth less, and domestic holders get paid back in a currency with reduced buying power. That further decreases demand. Many of the foreign holders would become more likely to invest in their own countries or in competing Sovereign Debt. At that point, the U.S. would face much higher interest payments.

With Bitcoin that is Impossible

No one can simply print a Bitcoin it has to be mined or purchased.

There are only 21 million bitcoins that can be mined in total. Once bitcoin miners have unlocked all the bitcoins, the planet’s supply will essentially be tapped out. Currently, around 18.5 million bitcoin have been mined; this leaves less than three million that have yet to be introduced into circulation.

Each Bitcoin is equal to 100 million Satoshis, making a Satoshi the smallest unit of Bitcoin currently recorded on the blockchain. Think of the Satoshi as the “cents” part of Bitcoin.

With the weakening dollar cycle continuing to play out and the US facing severe consequences of both Covid and decades of mismanagement it is not a reach to see 1 Satoshi become equal to or even greater than 1c, at that point 1 BTC becomes $1m USD or greater.