The Looming Challenge: $10 Trillion in U.S. Government Bonds to Be Issued in 2024

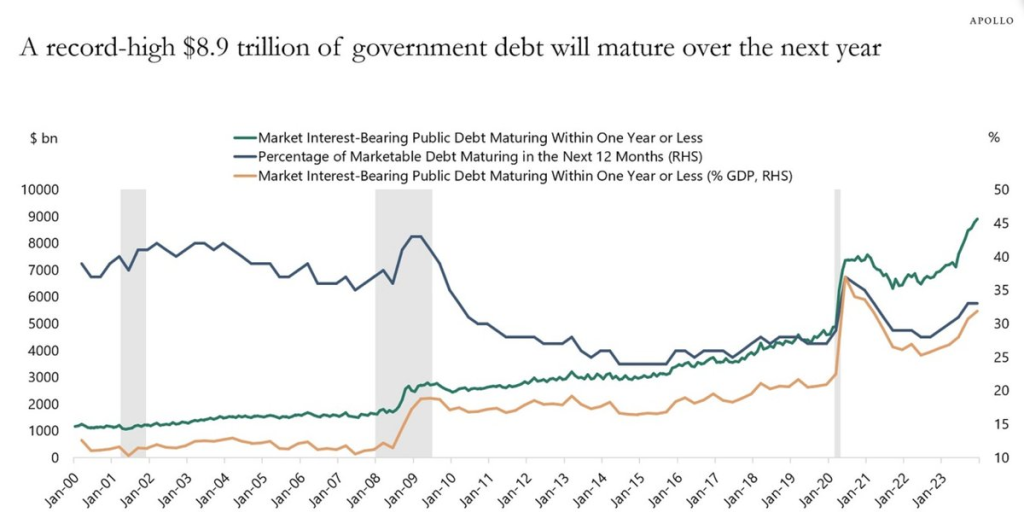

As the United States grapples with a significant financial landscape, a daunting challenge emerges on the horizon. In the coming year, a staggering $8.9 trillion of government debt is set to mature, coinciding with a projected government deficit of $1.4 trillion in 2024. This juxtaposition poses a critical question: Who will step up to purchase over $10 trillion in U.S. government bonds during the course of the year?

The Maturing Debt: With $8.9 trillion worth of government debt maturing, the need for a robust strategy to manage this debt becomes imperative. The maturity of these bonds necessitates a comprehensive approach to refinancing, ensuring the stability of the financial system.

Government Deficit Projection: Adding to the complexity is the projected government deficit of $1.4 trillion for the year 2024. This deficit reflects the shortfall between government revenues and expenditures, highlighting the ongoing financial challenges that the country faces.

The $10 Trillion Question: The crux of the matter lies in finding buyers for the substantial amount of U.S. government bonds set to be issued in 2024. Surpassing the $10 trillion mark, this figure represents not only a considerable financial undertaking but also a test of investor confidence and the ability of financial markets to absorb such a substantial influx.

Implications and Considerations: The issuance of such a colossal amount of government bonds can have far-reaching implications for the financial markets, interest rates, and the overall economic landscape. Investors, both domestic and international, will play a crucial role in determining the success of these bond issuances and, consequently, the economic stability of the nation.

As the United States prepares to navigate the intricacies of its financial obligations, the looming challenge of issuing over $10 trillion in government bonds in 2024 requires careful consideration. How the nation addresses this monumental task will undoubtedly shape the economic trajectory and financial well-being for the years to come.

If no one buys U.S. government debt, it could have severe consequences for the financial markets, the economy, and the government’s ability to meet its financial obligations. Here are some potential outcomes:

- Interest Rates Surge: If there’s a lack of demand for U.S. government debt, the government may need to offer higher interest rates to attract buyers. This could lead to a significant increase in interest rates across the economy, affecting everything from mortgages to business loans.

- Market Turmoil: A lack of buyers for U.S. government debt could create turmoil in financial markets. Bond prices may fall sharply, and investors could shift their funds to other assets, causing volatility in stock markets and other financial instruments.

- Government Spending Constraints: Without buyers for its debt, the U.S. government might face constraints on its ability to borrow and spend. This could force the government to cut spending, potentially impacting essential services and programs.

- Currency Depreciation: If the government resorts to printing more money to cover its expenses, it could lead to inflation and a depreciation of the U.S. dollar. A weaker currency may affect international trade and increase the cost of imported goods.

- Credit Rating Downgrades: A lack of demand for U.S. government debt could lead credit rating agencies to downgrade the government’s creditworthiness. This, in turn, could lead to higher borrowing costs and further erode investor confidence.

- Global Economic Impact: The U.S. government debt is considered a benchmark for safe-haven assets globally. A crisis in U.S. government debt could have spillover effects on other economies and financial systems worldwide.

It’s important to note that a scenario where no one buys U.S. government debt was unlikely given the historical reputation of U.S. Treasuries as a safe and reliable investment, but the rapid growth of US money printing does make the question valid. The U.S. government debt market is one of the largest and most liquid in the world, attracting a diverse range of investors, including foreign governments, institutional investors, and individuals. The U.S. Treasury has a long track record of meeting its debt obligations, which contributes to the continued demand for U.S. government debt. The problem now is that the world has changed; China and Russia will not be buyers, so the total potential demand is falling while the supply is rising at a rapid rate.

Shayne Heffernan