M31 Capital Management, LLC, a global investment firm focused on cryptoassets and blockchain technology, is pleased to announce the launch of the M31 Capital Web3 Opportunity Fund to support token projects building the future of the internet. Investors can read more on the M31 Capital website.

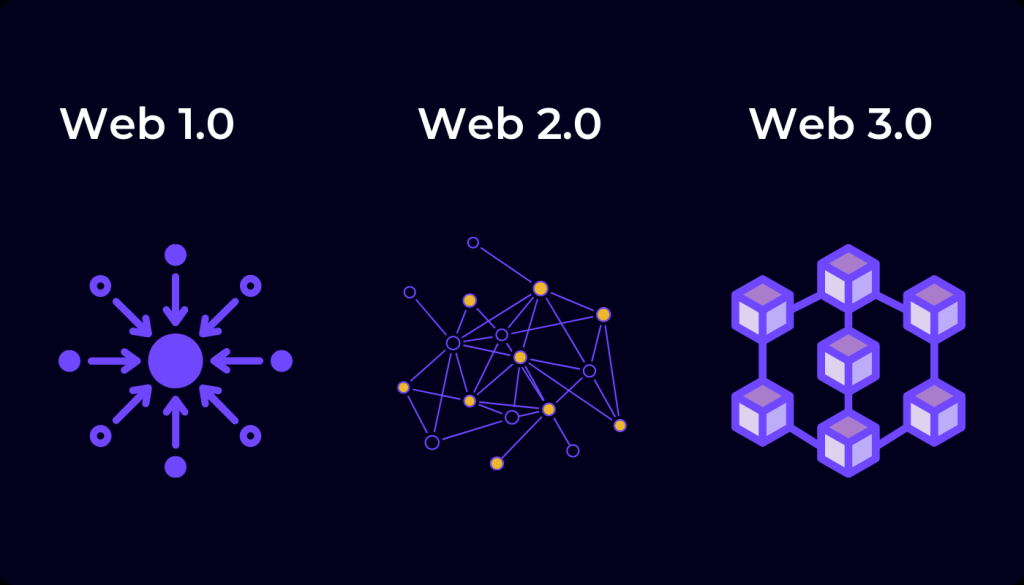

“Decentralized, blockchain-based protocols create an internet that is more open, fair, and user-friendly.” stated Nathan Montone, Founder of M31 Capital. “Web3 tech empowers individuals over institutions and gives rise to a brand new economic model online: the Ownership Economy. It represents a major step forward for the global internet and M31 Capital’s new fund will help drive it forward.”

The firm, led by Nathan Montone, early Bitcoin investor since 2011, and Michael Swensson, previously COO at Bridgewater Associates, has emerged as one of the industry’s leading institutional-grade investment firms. Posting returns of over 2,400% in just the last two years, the fund has also incorporated traditional risk management practices of Swensson’s Wall St. past to help it avoid all of the recent, high profile collapses in the space.

The M31 Capital Web3 Opportunity Fund is the firm’s newest offering in a growing product suite that includes a Bitcoin fund, a DeFi fund, and a venture capital (VC) fund. The new Web3 fund is an actively managed, evergreen fund investing in liquid tokens and select private equity opportunities supporting individual sovereignty. The initial focus is on projects rearchitecting core internet infrastructure and applications as decentralized, permissionless, and user owned networks. Additionally, M31 Capital has pioneered the concept of a “liquid venture fund”, offering liquidity after just a 12-month lockup, unlike traditional VC funds where capital is often locked for 10 years.

Montone shared, “We are incredibly excited about the timing of this fund and the Web3 sector in particular. This is the first cycle in 10 years where price has trended down while fundamentals and revenue growth are hitting all time highs nearly every day. Adoption is rising, huge technological progress is being made, valuations are extremely low, and institutions are continuing to pour tens of billions of dollars into the sector.”

M31 Capital provides projects in its portfolio with technical and nontechnical resources including mining, staking, tokenomic structuring, and advisory to get them off the ground and ensure their long term success. One of the company’s early Web3 investments was Helium (HNT) where it not only was one of the first investors, but also ran many of the first hotspots around the world.

For the new fund, M31 Capital has lined up $50 million in commitments from top investors excited about the opportunity. The firm will raise another $50 million before capping the fund at $100 million. M31 Capital sees the new fund as part of their long-running goal of supporting the disruptive DeFi and Web3 sectors.

U.S. and non-U.S. investors can invest in the Web3 Opportunity Fund today by visiting the M31 Capital website. The firm also provides clients with the ability to invest through both Traditional and Roth IRAs as well.

About M31 Capital:

M31 Capital is a global investment firm focused exclusively on crypto assets and blockchain technology. The firm deploys capital around the world through several institutional-grade investment funds offering different strategies and risk profiles. Our globally decentralized team generates alpha on behalf of sophisticated investors of all sizes by directly participating in the networks we back.