Wall Street Nvidia’s Earnings High and Inflation Data Awaited

Last week, Wall Street witnessed record highs fueled by Nvidia’s stellar earnings report, with the S&P 500 and Dow Jones reaching new peaks. However, the upcoming release of inflation data is poised to test this rally. Here’s a look at what’s in store for investors on Wall Street this week.

Record Highs and Earnings Spotlight: Nvidia’s blowout earnings report propelled stocks to record highs, with the S&P 500 and Dow Jones ending the week up approximately 1%. The Nasdaq Composite also saw gains, adding about 0.6%. Notably, both the S&P and Dow closed Friday at all-time highs, reflecting the market’s optimism.

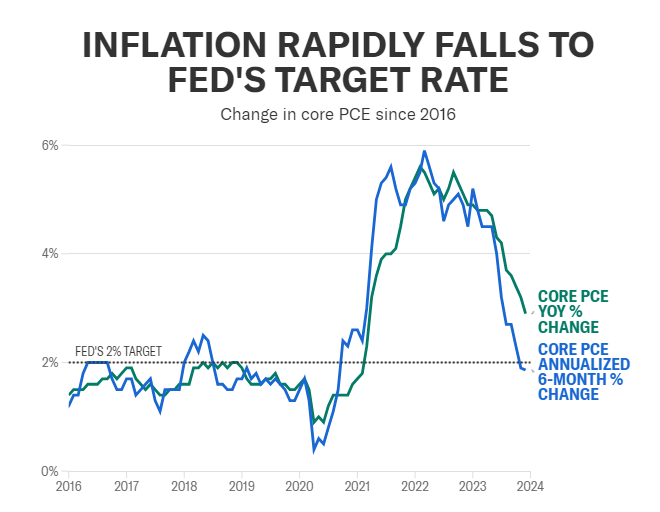

Inflation Data Looms: The largest challenge facing markets in the week ahead is the release of the latest Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, on Thursday. This data will provide insights into inflation trends, which have been a focal point for investors amid concerns about rising prices.

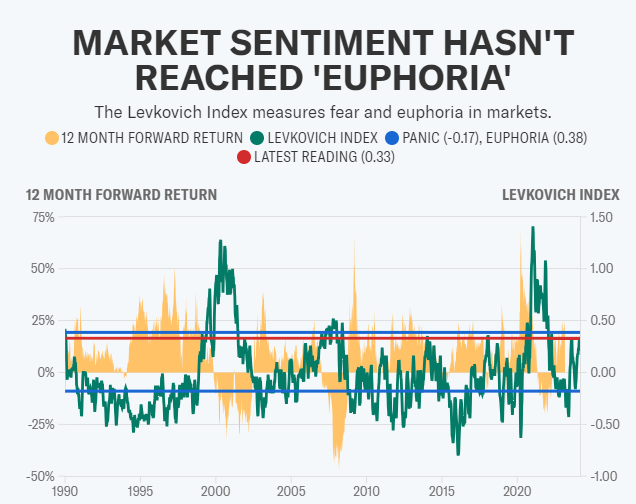

Inflation Concerns and Market Sentiment: Economists expect the annual “core” PCE, excluding food and energy, to have reached 2.4% in January, signaling potential inflationary pressures. A monthly increase of 0.4% would underscore growing fears that inflation may be more persistent than initially anticipated. However, market sentiment remains cautiously optimistic, with the current sentiment indicator suggesting that markets have not yet entered a euphoric phase.

Retail Sector Earnings: As fourth-quarter earnings season winds down, attention will turn to the retail sector, with companies like Macy’s, Best Buy, and TJX set to report. These earnings reports will offer insights into consumer spending trends and the health of the retail industry amid inflation concerns.

Looking Ahead: While Wall Street continues to ride the momentum from Nvidia’s earnings, investors are bracing for the impact of inflation data and earnings reports from key retail players. The coming week will provide valuable insights into the state of the economy and the resilience of the market in the face of inflationary pressures. As investors navigate these uncertainties, a cautious yet optimistic approach may be warranted.

Weekly Calendar Wall Street

Monday

Economic data: Dallas Fed Manufacturing Activity, February (-27.4 previously); New home sales, January (684,000 annualized rate expected, 664,000 previously); New home sales, month-over-month, January (+3% expected, +8% previously)

Earnings: Domino’s Pizza (DPZ), Freshpet (FRPT), Hims & Hers (HIMS), iRobot (IRBT), Workday (WDAY), Zoom (ZM)

Tuesday

Economic data: Conference Board Consumer Confidence, February (114.8 expected, 114.8 previously); S&P CoreLogic Case-Shiller, 20-City Composite home price index, month-over-month, December (+0.15% previously); S&P CoreLogic Case-Shiller 20-City Composite home price index, year-over-year, December (+5.4% previously)

Earnings: AutoZone (AZO), Beyond Meat (BYND), Cava (CAVA), Cracker Barrel (CBRL), Devon Energy (DVN), First Solar (FSLR), Lowe’s (LOW), Macy’s (M), Norwegian Cruise Line (NCLH)

Wednesday

Economic data: MBA Mortgage Applications, week ending Feb. 23 (-10.6% prior); Wholesale inventories month-over-month, January (+0.4% previously); Fourth quarter GDP, second estimate (+3.3% annualized rate expected, +3.3% previously); Fourth quarter personal consumption, second estimate (+2.7% annualized expected; +2.8% previously)

Earnings: Advance Auto Parts (AAP), AMC (AMC), Baidu (BIDU), C3.ai (AI), Icahn Enterprises (IEP), TJX Companies (TJX), Marathon Digital Holdings (MARA), Novavax (NVAX), Okta (OKTA), Paramount Global (PARA), Salesforce (CRM), Snowflake (SNOW), Weight Watchers (WW)

Thursday

Economic data: Initial jobless claims, week ended Feb. 24 (201,000 previously); Personal income, month-over-month, January (+0.5% expected, +0.3% previously); Personal spending, month-over-month, January (+0.2% expected, +0.7% previously); PCE inflation, month-over-month, January (+0.3% expected, +0.2% previously); PCE inflation, year-over-year, January (+2.4% expected, +2.6% previously); “Core” PCE, month-over-month, January (+0.4% expected, +0.2% previously); “Core” PCE, year-over-year, January (+2.8% expected; +2.9% previously)

Earnings: Anheuser Busch (BUD), Bath & Body Works (BBWI), Best Buy (BBY), Birkenstock (BIRK), Celsius (CELH), Dell (DELL), Fisker (FSR), Hewlett Packard Enterprises (HPE), Six Flags (SIX), SoundHound (SOUN), Zscaler (ZS)

Friday

Economic news: S&P Global US Manufacturing PMI, February final (51.5 previously); ISM manufacturing, February (49.2 expected, 49.1 previously); ISM prices paid, February (52.9 previously); University of Michigan consumer sentiment, February final (79.6 expected, 79.6 prior)

Earnings: FuboTV (FUBO), Plug Power (PLUG)

As Wall Street prepares for another eventful week, all eyes will be on inflation data and retail earnings reports. While the market remains buoyant following Nvidia’s earnings high, investors will closely monitor economic indicators for signs of inflationary pressures and their potential impact on market sentiment. With volatility likely to persist, prudent risk management and strategic decision-making will be key for investors navigating the dynamic landscape of Wall Street.

Shayne Heffernan