China’s economic prowess has been the subject of admiration and concern in recent years. As the world’s second-largest economy, it plays a crucial role in global trade and investment. However, recent developments have raised questions about the country’s economic stability. In this opinion article, we will examine the market volatility in China and its implications, while also delving into the challenges faced by the nation’s trade sector.

Market Volatility and Its Implications:

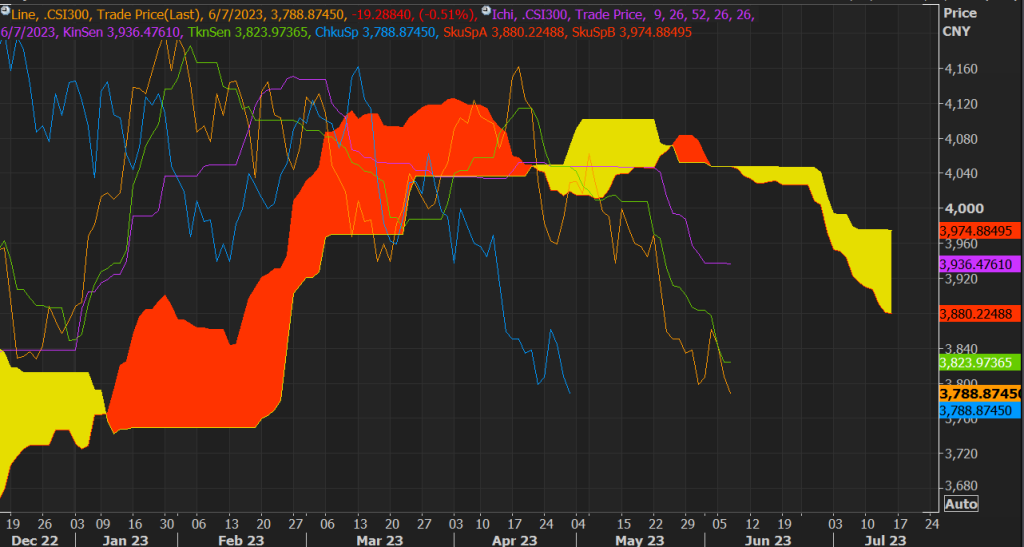

The stock market serves as a barometer for economic health, reflecting investor sentiment and expectations. According to recent data from MetaStock, a leading financial application, China’s stock market has experienced notable volatility in recent weeks. This trend has sparked concerns among investors and analysts alike.

From the information available, we can observe a sharp decline in stock prices in various sectors, including technology and finance. This volatility suggests a degree of uncertainty and unease within the market. Investors are likely questioning the stability of the economic landscape, which could impact their willingness to invest and the overall confidence in China’s financial system.

Furthermore, market volatility can have far-reaching consequences. It can dampen consumer spending, restrict business expansion, and hinder the growth of domestic industries. As such, China’s policymakers face the daunting task of restoring stability and bolstering investor confidence to ensure sustained economic growth.

Challenges in China’s Trade Sector:

Apart from internal market volatility, China’s trade sector has encountered significant challenges. The country’s exports have experienced a considerable tumble in recent months, as reported by Reuters. This decline can be attributed to several factors, including weakening global demand and trade tensions with key partners.

Moreover, China’s imports have slowed down, indicating potential weaknesses in domestic consumption. This poses a substantial challenge for the Chinese government, which has been striving to rebalance its economy toward a more sustainable model driven by domestic consumption.

One prominent example of trade-related hurdles is Indonesia’s delayed China-funded rail project, as highlighted in a Reuters article. This setback showcases the complexities and obstacles faced by China in expanding its economic influence overseas. Such hurdles not only impact bilateral trade relationships but also raise questions about China’s ability to effectively manage large-scale projects and maintain favorable diplomatic ties.

Conclusion:

As China navigates through market volatility and trade woes, the path to economic stability remains uncertain. Restoring investor confidence, addressing domestic consumption challenges, and fostering favorable trade relationships will be critical in determining the country’s future economic trajectory. The global community keenly watches these developments, as China’s economic stability has far-reaching implications.

In conclusion, China must tread carefully and proactively address the challenges it faces to sustain its economic growth. The world waits with bated breath to witness how China’s policymakers tackle these hurdles and shape the future of one of the world’s most influential economies.