The fall of the Roman Empire is a historical event that has captivated the imaginations of scholars and enthusiasts for centuries. While the causes of its decline are complex and multifaceted, there are intriguing parallels between the factors contributing to the empire’s fall and challenges facing the global economy today. In this article, we will explore some of these connections and consider what lessons can be drawn from history to navigate contemporary economic challenges.

Economic Overextension

One of the critical factors leading to the fall of the Roman Empire was its economic overextension. The empire expanded rapidly, conquering vast territories and acquiring wealth from tribute and taxation. However, this growth was unsustainable, as the costs of maintaining such a vast empire began to exceed its economic capacity. In the modern world, globalization has led to similar challenges. Many nations have become interconnected through trade, but this has also exposed them to economic vulnerabilities. The 2008 global financial crisis demonstrated how economic overextension in the form of unsustainable debt and speculative bubbles can have severe consequences.

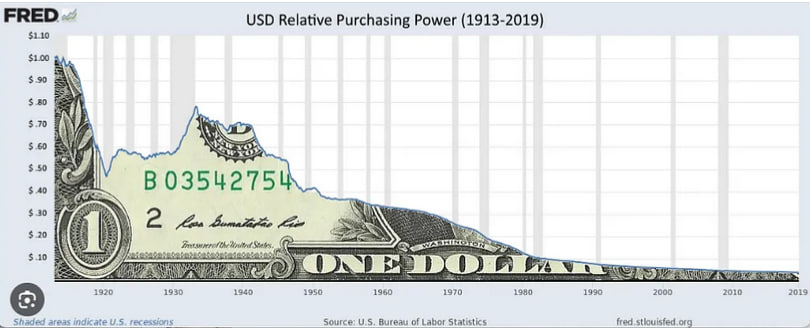

Devaluation of Currency

The Roman Empire faced a crisis of currency devaluation as emperors continuously debased the denarius, the Roman silver coin, by reducing its silver content. This rampant inflation eroded the value of money and led to economic instability. Today, we see parallels in the devaluation of currencies as governments resort to quantitative easing and using interest rates as a tool to stimulate their economies. While these measures can be necessary during times of crisis, they also carry the risk of inflation and devaluation, which can undermine economic stability.

Decline in Productivity

Another factor in the Roman Empire’s fall was a decline in agricultural productivity. This was due in part to soil depletion and the overuse of slave labor. In the modern era, we face challenges related to declining productivity, albeit for different reasons. Factors such as an aging workforce, technological disruption, and income inequality can all contribute to sluggish productivity growth. Addressing these issues is crucial for sustained economic prosperity.

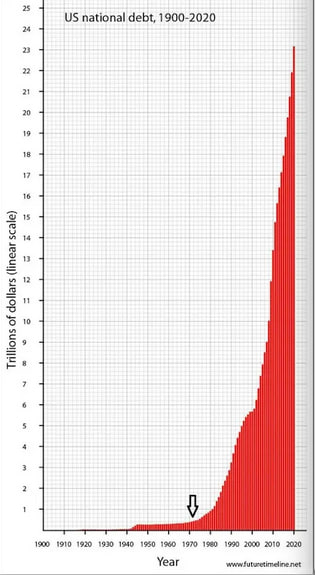

National Debt

During the end of the Roman Empire, the national debt, as we understand it in modern terms, was not a significant factor contributing to the empire’s decline. However, in today’s world of fiat, the U.S. national debt of $33 trillion, and soon to be 50 trillion, has become a factor to take into consideration that leads us to understand the severity of this global predicament we are faced with. Taking a realistic approach, we can assume that paying back the debt is virtually impossible and a default is imminent.

Political Instability

The Roman Empire experienced political instability with frequent changes in leadership, power struggles, and corruption. This turmoil hindered effective governance and contributed to economic decline. In today’s global economy, political instability remains a concern. Trade tensions, geopolitical conflicts, and the rise of populist movements can disrupt international cooperation and economic growth. Stable governance is essential for maintaining economic stability and fostering trust among nations.

Conclusion

While the fall of the Roman Empire occurred over a millennium ago, its lessons remain relevant in understanding the challenges facing the U.S. and global economy today. Economic overextension, currency devaluation, declining productivity, and political instability, together with a mountain of unsustainable debt are all issues that demand attention and careful consideration. By learning from history, we can make informed decisions to ensure a more stable and prosperous economic future for all. How? We are in the beggining of a new cycle of a commodities bull-run and therefore rational investors will be allocating a substantial portion of their portfolios to commodities. Bitcoin is the superior commodity, and due to its fundamental design with near perfect decentralization and fixed supply, we believe that it will lead the commodities bullrun and therefore should hold a place in every investor’s portfolio while navigating the dynamics of the money printing clown world we find ourselves in today.