#memes #dogecoin #bitcoin #NFT #blockchain #cryptocurrencies #stocks

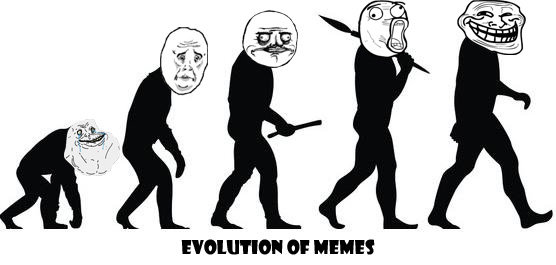

The oldest memes were short videos, and by the 90’s, we saw the introduction of graphics.

Then, as time passed, the format and context of the memes kept changing, but the original idea of what a meme was still coming through.

Memes found their way into the crypto space in Y 2013, just as the market was gaining traction. The 1st memecoin was Dogecoin, a satirical take on Bitcoin and other cryptocurrencies.

Today, Dogecoin is the 6th largest cryptocurrency in the world, with a market cap of $38,777,455,120. The meteoric rise of Dogecoin showed the crypto community that there was a market for memecoins and meme memetic asset market.

Memes today have become an integral part of the crypto space and can be monetized to give their creators the value they truly deserve.

Another critical addition to the world of memes is the memetic asset market, which has gained significant popularity lately.

Memetic asset markets make it possible for memes to be linked to an NFT, giving the meme’s creator the ability to monetize and sell the meme to 3rd parties.

Memetic asset markets enable the monetization of memes, turning them into NFTs. This ties memes to an NFT, allowing their monetization.

Memetic asset markets build the meme community and increase the popularity of memes in the crypto space and on the blockchain.

Memes are creating real-world value, and recent NFT sales have left no doubt that there is a serious market for meme NFTs, and that the memes connected to NFTs are increasing in value exponentially.

The numbers prove that memes have the ability to create serious real-world value and that there is a significant demand for meme NFTs.

Meme’rs and creators can register on meme.com, becoming a part of the meme ecosystem and the “Majestic Establishment of Memetic Exploration.”

Meme.com rewards users for discovering the next big meme or trend. Users can add value to the meme community and facilitate the growth of new memes.

Memes in the stock market: A meme stock is any stock that has seen really huge trading volume from retail investors who’ve targeted it on social media.

In other words, this stock has “gone viral” on social media and has seen its price skyrocket as a result. Examples: GME, AMC and BB; for a stock to be “meme-worthy,” it needs to be devastatingly beaten down, funny enough to be viral, or have enough short interest to justify a squeeze. Stay tuned…

Have a positive weekend, Keep the Faith!