#government #regulation #cryptocurrency #digital #asset #knights

“Governments were created in a way that makes them reactive, particularly as to regulatory compliance” — Paul Ebeling

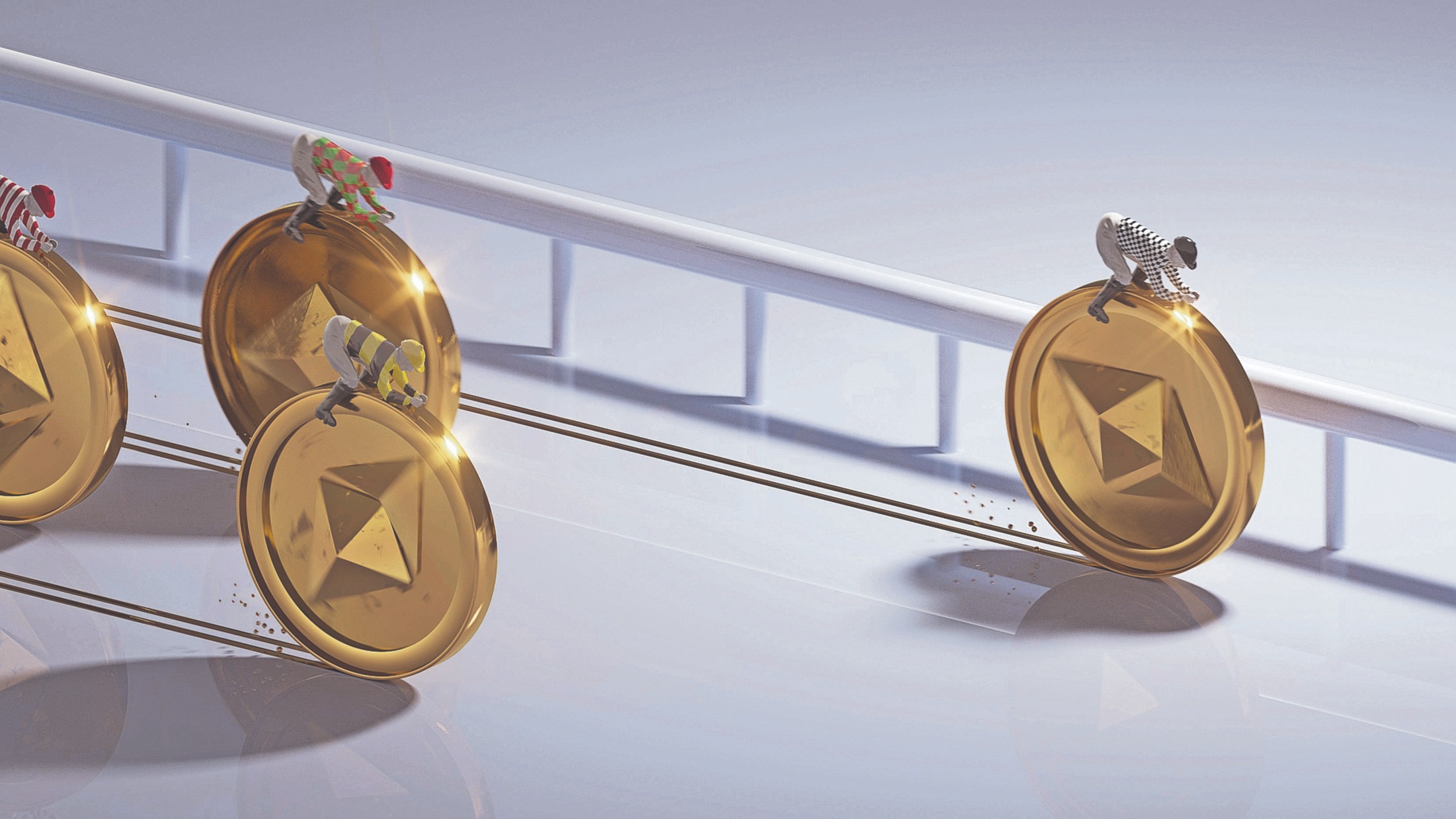

Since the beginning of the digital asset industry there have been those who have taken advantage of a lack of consistency in how exchanges operate. Many view the cryptocurrency sector as a new-age Wild West, leading some countries to simply implement a ban rather than work grasp the fundamentals of technology they do not yet understand.

We have now reached the threshold required for action, just the way our government was designed by the founders.

The Big Q: What does this mean for digital assets?

The Big A: It is a process, as the industry becomes more secure, it enters the mainstream. This is truly the beginning of an international transformation in how we participate in the financial markets.

A new innovation emerges, then a minor outcry. Regulators and politicians wait to see if it is anything more than a fad. Then innovation reaches a Key point, and action is taken. For better or worse, government are slow and deliberative,

Governments around the world have been looking at adopting, regulating cryptocurrencies since the inception of Bitcoin. Ever since, the crypto ecosystem has been a Super ride North.

A November joint statement from the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency shows that the government is turning the corner on digital assets. The concern has moved beyond simply stopping money laundering. Now, they are slated to look at ways to better regulate the custody of digital assets, as well as a more holistic view of the industry.

This financial disrupter is to big to ignore!

Stay tuned…

Editor’s Note: The Knightsbridge DAO is the 1st-of-its-kind, a DAO with a Broker, Exchange, Chain, Consultancy, Service Provider, NFT Hub and an extensive and growing portfolio of Tech, DeFi and real world assets. The Knightsbridge DAO (Decentralized Autonomous Organization) as an organization represented by rules encoded as a transparent computer program, controlled by the organization members, and not influenced by a central government. As the rules are embedded into the code, no managers are needed, thus removing any bureaucracy or hierarchy hurdles. Taking the very best technology from a cross-section of industries to deliver the next step change in decentralization for financial services.

The link for Knights DAO is: https://knights.app/the-knightsbridge-dao/ Refer a friend and earn while you sleep

Our Twitter and Telegram are active and it would be super if you follow, join and share https://twitter.com/knightsdaoxhttps://t.me/knightsDAO

Have a prosperous day, Keep the Faith!