Thailand SET Outlook from KXCO.io

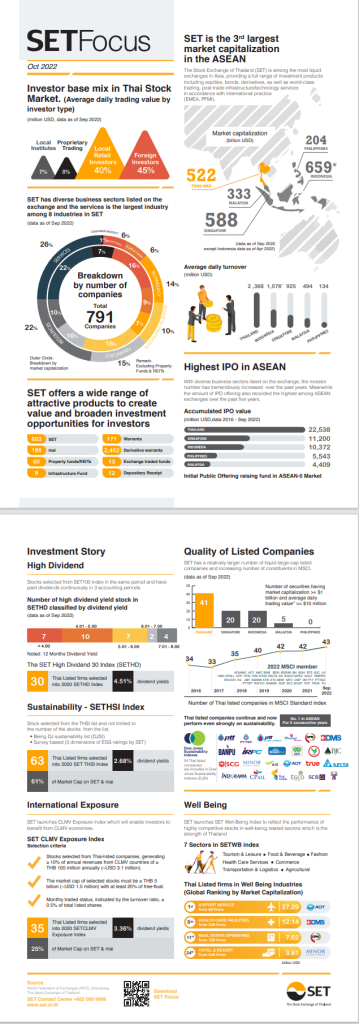

The outlook for Asia in general and especially Thailand is fairly positive.

For the week, the S&P 500 rose 5.9%, the Dow added 4.15% and the Nasdaq jumped 8.1%. It was the S&P 500’s biggest weekly gain since June and the Nasdaq’s largest weekly gain since March.

Worries about an economic downturn have hammered Wall Street this year. The S&P 500 remains down about 16% year to date, on course for its biggest annual decline since 2008.

U.S.-listed shares of Chinese companies rose, with Alibaba Group Holding Ltd gaining 1.4% after China eased some of its strict COVID-19 rules.

- China shortens quarantine by 2 days for close contacts, visitors

- China ends ‘circuit breaker’ penalty for airlines

- Will stop tracing ‘secondary contacts’ of COVID cases

- Shares, yuan rally on reformed curbs

- Guangzhou’s downtown Haizhu district extends lockdown

The move will certainly lift the mood in Thailand further and we are expecting to see a strong day Monday.

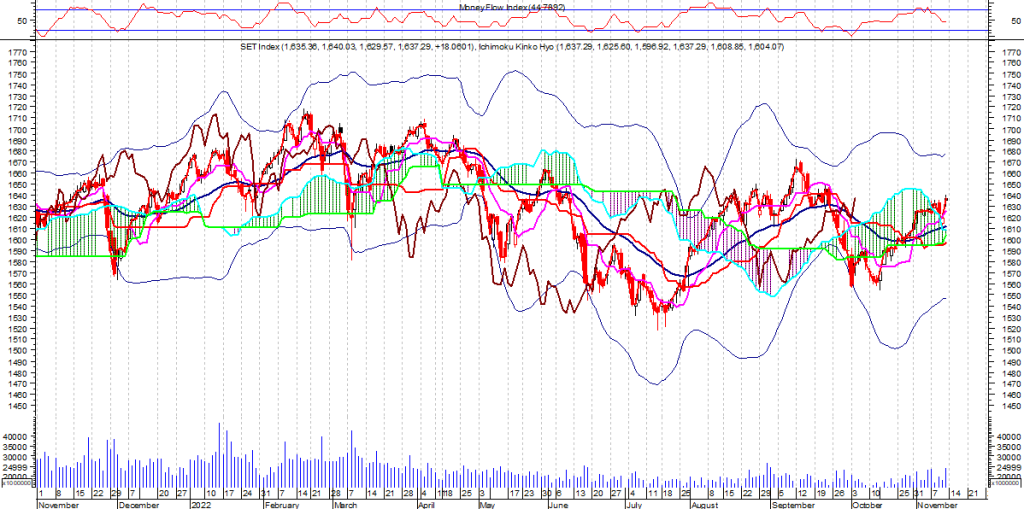

Technicals

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 5 white candles and 5 black candles. During the past 50 bars, there have been 21 white candles and 29 black candles for a net of 8 black candles.

A rising window occurred (where the top of the previous shadow is below the bottom of the current shadow). This usually implies a continuation of a bullish trend. There have been 4 rising windows in the last 50 candles–this makes the current rising window even more bullish.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

SET Index gapped up Friday (bullish) on normal volume. Possibility of a Runaway Gap which usually signifies a continuation of the trend. Four types of price gaps exist – Common, Breakaway, Runaway, and Exhaustion. Gaps acts as support/resistance.

SET Index is currently 0.5% above its 200-period moving average and is in an upward trend. Volatility is extremely low when compared to the average volatility over the last 10 periods.

There is a good possibility that there will be an increase in volatility along with sharp price fluctuations in the near future.

Our volume indicators reflect volume flowing into and out of .SETI at a relatively equal pace (neutral).

Our trend forecasting oscillators are currently bullish on .SETI and have had this outlook for the last 8 periods.

The security price has set a new 14-period high while our momentum oscillator has not. This is a bearish divergence.

Crossovers

Currently the MACD is bullish since it is trading above its signal line. The MACD crossed above its signal line 16 period(s) ago. Since the MACD crossed its moving average, SET Index’s price has increased 3.06% , and has ranged from a high of 1,640.030 to a low of 1,579.780.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 52.8770. This is not an overbought or oversold reading. The last signal was a sell 4 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 63.16. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 25 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 105.This is an overbought reading. However, a signal isn’t generated until the indicator crosses below 100. The last signal was a sell 2 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 16 period(s) ago.