HODLERS are waiting for LUNC to stabize back at $0.00032 this October, but is it possible? With a 15% increase in the past 24 hours, LUNC reached $0.000296, before dropping back down to $0.000279.

The collapse of the algorithmic stablecoin Terra and its ecosystem in May 2022 created a massive crisis in the crypto space. Many unvestors lost hope in Crypto and those who didn’t, turned a profit. Recent price drops were also caused by a Red Notice being plced on Do Kwon. Where he responded by saying that he was not in fact hiding from anyone, just has not run into anyone lately. Reports also suspect that Do Kwon will return to South Korea as the Foreign Ministry plans to scrap Do Kwon’s international passport.

In a 24-hour space, Terra Classic (LUNC) made a 61% reclaim of its value. Also, its trading volume spiked by 250% to hit $2.29 billion over the past 24 hours.

Also, Terra (LUNA) recorded a positive trend, climbing by 30% as its average trading surged to $2.68. The trading volume is at $730 million, showing a rise of about 204%.

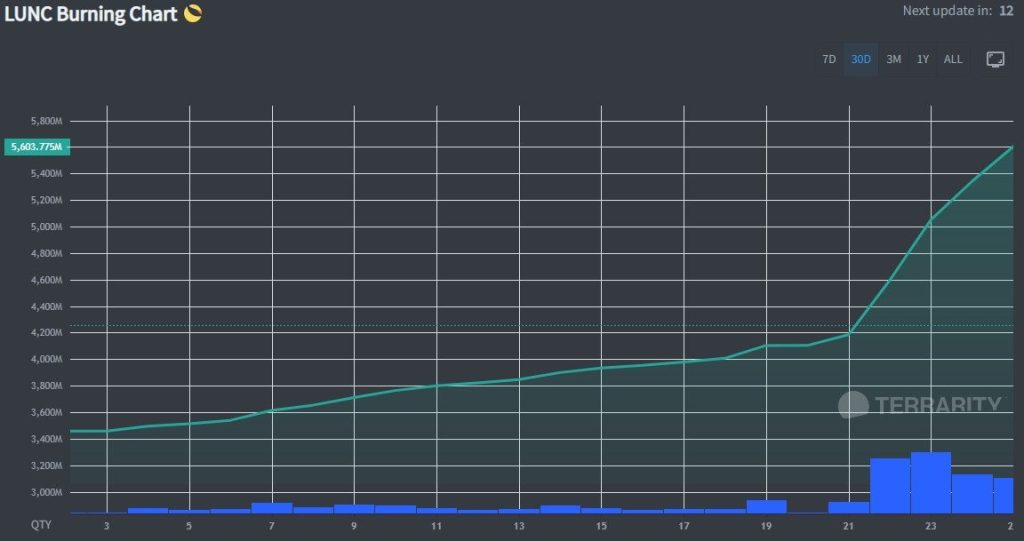

LUNC burning is going well and charts are looking linear. According to Terrarity, it is said that in 5 years, 8.436% of the total LUNC supply will be burnt. This is a total of 582,197,733,676 tokens compared to the 0.062% that has been burnt today.