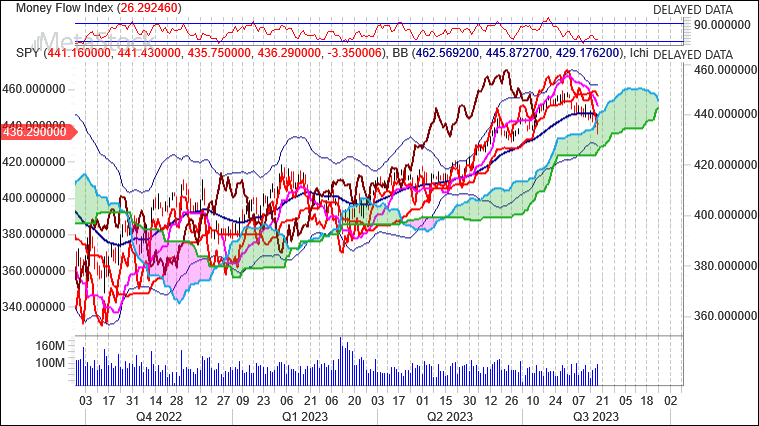

Long term the $SPY is set to recover but over the next few days we could see an entry opportunity between $400 and $420, that would put it in strong buy territory.

The endless drivel rolling out of The Fed and the White House is undermining confidence in the US Economy.

The Fed has been raising interest rates in an effort to combat inflation, but it has also been signaling that it is willing to pause or even reverse course if the economy weakens. This has led to uncertainty about the future course of monetary policy, which is not helping to calm investors’ nerves.

The White House has also been sending mixed messages. On the one hand, President Biden has said that he is confident in the economy and that he does not believe a recession is imminent. On the other hand, his administration has taken steps that could weaken the economy, such as raising tariffs on Chinese goods.

This lack of clarity from the Fed and the White House is making it difficult for businesses and investors to make plans for the future. It is also contributing to the stock market volatility that we have seen in recent months.

The Fed and the White House need to do a better job of communicating their plans to the public. They need to be clear about their goals and how they plan to achieve them. If they can do that, they will help to restore confidence in the economy and prevent a recession.

Here are some specific things that the Fed and the White House can do to improve communication:

- The Fed should hold regular press conferences to explain its decisions and to answer questions from the media.

- The White House should create a clear economic plan and communicate it to the public.

- The Fed and the White House should work together to ensure that their messages are consistent.

By taking these steps, the Fed and the White House can help to restore confidence in the economy and prevent a recession.

Candlesticks

A big black candle occurred. This is bearish, as prices closed significantly lower than they opened. If the candle appears when prices are “high,” it may be the first sign of a top. If it occurs when prices are confronting an overhead resistance area (e.g., a moving average, trendline, or price resistance level), the long black candle adds credibility to the resistance. Similarly, if the candle appears as prices break below a support area, the long black candle confirms the failure of the support area.

During the past 10 bars, there have been 4 white candles and 6 black candles for a net of 2 black candles. During the past 50 bars, there have been 31 white candles and 19 black candles for a net of 12 white candles.

Three black candles occurred in the last three days. Although these candles were not big enough to create three black crows, the steady downward pattern is bearish.

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 3.6547. This is an oversold reading. However, a signal is not generated until the Oscillator crosses above 20 The last signal was a buy 3 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 34.86. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 12 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is -181.This is an oversold reading. However, a signal isn’t generated until the indicator crosses above -100. The last signal was a buy 3 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a sell 15 period(s) ago.

Technical Outlook

Short Term: Oversold

Intermediate Term: Bearish

Long Term: Bullish

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

SPDR S&P 500 is currently 6.0% above its 200-period moving average and is in an downward trend. Volatility is relatively normal as compared to the average volatility over the last 10 periods.

Our volume indicators reflect moderate flows of volume out of SPY (mildly bearish).

Our trend forecasting oscillators are currently bearish on SPY and have had this outlook for the last 7 periods.

Shayne Heffernan