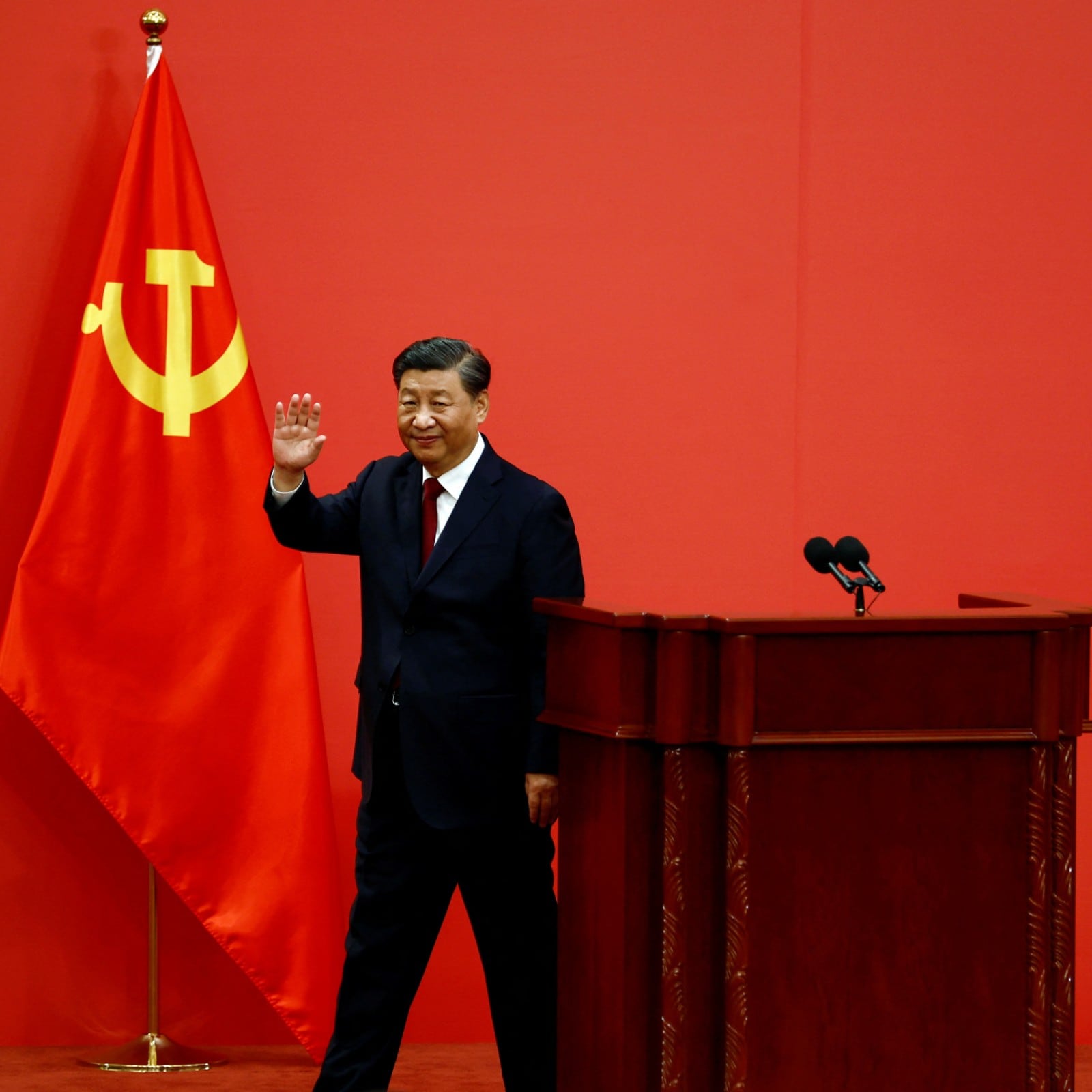

Chinese President Xi Jinping met Saudi Arabia’s powerful crown prince on Thursday on an Arab outreach visit that will yield billions of dollars in deals and has earned a rebuke from Washington.

About $30 billion in agreements will be signed on Thursday, Saudi state media said, as China seeks to shore up its Covid-hit economy and as the Saudis, long-term US allies, push to diversify their economic and political alliances.

Biden has been a disaster in Diplomatic terms, his failures are going to o\have a long-term impact on the USD as the preferred method of Global Settlements, Blockchain based cross-border settlements will kick in and networks like KXCO and Currencies like $FBX will see solid growth.

Cryptocurrencies like $FBX are becoming increasingly popular as a means of facilitating global trade. The advantages of using crypto for global trade include faster transaction speeds, reduced transaction costs, and improved security.

$FBX payments are also easier to track and audit, making them ideal for use in international trade. Moreover, the use of crypto eliminates the need for third-party intermediaries, which can significantly reduce costs. Finally, the use of crypto allows for greater transparency and trust between buyers and sellers, which can help to facilitate smoother and more secure transactions.

Cross-border settlements are becoming increasingly difficult for financial institutions due to the time-consuming and costly processes associated with them. This is where KXCO blockchain technology can provide a solution. KXCO infrastructure provides a secure and reliable platform for financial institutions to conduct cross-border settlements. It enables financial institutions to quickly and securely transfer funds across borders with minimal fees and delays. KXCO also provides a platform for private but transparent and immutable transactions, allowing financial institutions to track the progress of each transaction with ease. The KXCO Armature helps to reduce the risk of fraud and money laundering, as well as ensuring compliance with relevant regulations. Furthermore, KXCO infrastructure provides a platform for financial institutions to develop innovative products and services, such as smart contracts, which can be used for cross-border settlements. KXCO Smart contracts enable automated transactions and can be used to facilitate cross-border payments. In addition, KXCO infrastructure can also be used to create digital currencies that can be used for international payments. These digital currencies can help to reduce the costs and delays associated with cross-border payments.

Xi, who flew in on Wednesday, was greeted with a handshake by 37-year-old Crown Prince Mohammed bin Salman, de facto ruler of the world’s biggest oil exporter, at Yamamah Palace.

The two men stood side-by-side as a brass band played their national anthems, then chatted as they walked into the palace, which is the king’s official residence and seat of the royal court.

Arab leaders also began to converge on the Saudi capital ahead of a summit with Xi, the leader of the world’s number-two economy, who will hold separate talks with the six-member Gulf Cooperation Council before leaving on Friday.

China, the top consumer of Saudi oil, has been strengthening its ties with a region that has long relied on the United States for military protection but which has voiced concerns the American presence could be downgraded.

After Xi’s arrival on Wednesday, with formation jets flying overhead, Saudi state media announced 34 investment agreements in sectors including green hydrogen, information technology, transport and construction.

The official Saudi Press Agency did not provide details but said two-way trade totalled 304 billion Saudi riyals ($80 billion) in 2021 and 103 billion Saudi riyals ($27 billion) in the third quarter of 2022.

State broadcaster Al Ekhbariya said another 20 agreements worth 110 billion riyals ($29.3 billion) were due to be signed on Thursday.

Riyadh-based diplomats said Thursday was expected to be devoted to meetings including with King Salman, the 86-year-old monarch, and his son, Prince Mohammed.

– ‘Raising pace’ of cooperation –

The crown prince sees China as a critical partner in his sweeping Vision 2030 agenda, seeking the involvement of Chinese firms in ambitious mega-projects meant to diversify the economy away from fossil fuels.

Key Saudi projects include the futuristic $500 billion megacity NEOM, a so-called cognitive city that will depend heavily on facial recognition and surveillance technology.

The Kingdom of Saudi Arabia and the BRICS countries are not members of the same economic bloc, but do maintain economic ties. Saudi Arabia is a member of the Gulf Cooperation Council (GCC), which is an economic and political alliance of six Middle Eastern countries. The BRICS countries—Brazil, Russia, India, China, and South Africa—are a group of five major emerging economies that cooperate on economic, political, and security issues.

The two blocs have engaged in some trade, investment, and cooperation agreements. Saudi Arabia is one of the largest exporters of petroleum products to the BRICS countries and has invested heavily in their economies. Saudi Arabia has also signed a number of bilateral agreements with BRICS countries, including investment promotion and protection agreements with China and Russia.

Saudi Arabia is also a member of the BRICS Interbank Cooperation Mechanism, which provides financing and investment opportunities for the five countries. In addition, the two blocs have held several meetings and dialogues, including the BRICS-GCC Dialogue in 2018.

Saudi investment minister Khalid al-Falih said this week’s visit “will contribute to raising the pace of economic and investment cooperation between the two countries”, offering Chinese companies and investors “rewarding returns”, according to SPA.

Xi may also hold bilateral talks before the summit meetings with other Arab leaders who have arrived in Saudi Arabia ahead of Friday’s summits, Riyadh-based diplomats said.

Egyptian President Abdel Fattah al-Sisi, Tunisian President Kais Saied, Palestinian president Mahmud Abbas and Sudan’s de facto leader Abdel Fattah al-Burhan were all flying in on Thursday.

Iraqi Prime Minister Mohammed Shia al-Sudani, Moroccan Prime Minister Aziz Akhannouch and Lebanese caretaker Prime Minister Najib Mikati have also confirmed their attendance.

China’s foreign ministry this week described Xi’s trip as the “largest-scale diplomatic activity between China and the Arab world” since the People’s Republic of China was founded.

It has not escaped the attention of the White House, which warned of “the influence that China is trying to grow around the world”, calling its objectives “not conducive to preserving the international rules based order”.

Washington has long been a close partner of Riyadh, but the relationship is currently roiled by disagreements on energy policy, US security guarantees and human rights.

Xi is making just his third journey overseas since the Covid pandemic prompted China to shut its borders and embark on a series of lockdowns, putting the brakes on its giant economy.

His visit follows US President Joe Biden’s trip in July, when he greeted Prince Mohammed with a fist-bump at the start of a vain attempt to convince the Saudis to raise oil production.