PayPal Holdings, Inc. (NASDAQ: PYPL) today announced the launch of PayPal Zettle in the U.S., a digital point-of-sale solution that enables small businesses to seamlessly sell across in-person and online channels. The launch comes at a time when there has been a historic shift in consumer behavior towards digital and omnichannel commerce, and businesses need to adapt to meet their customers wherever they are.

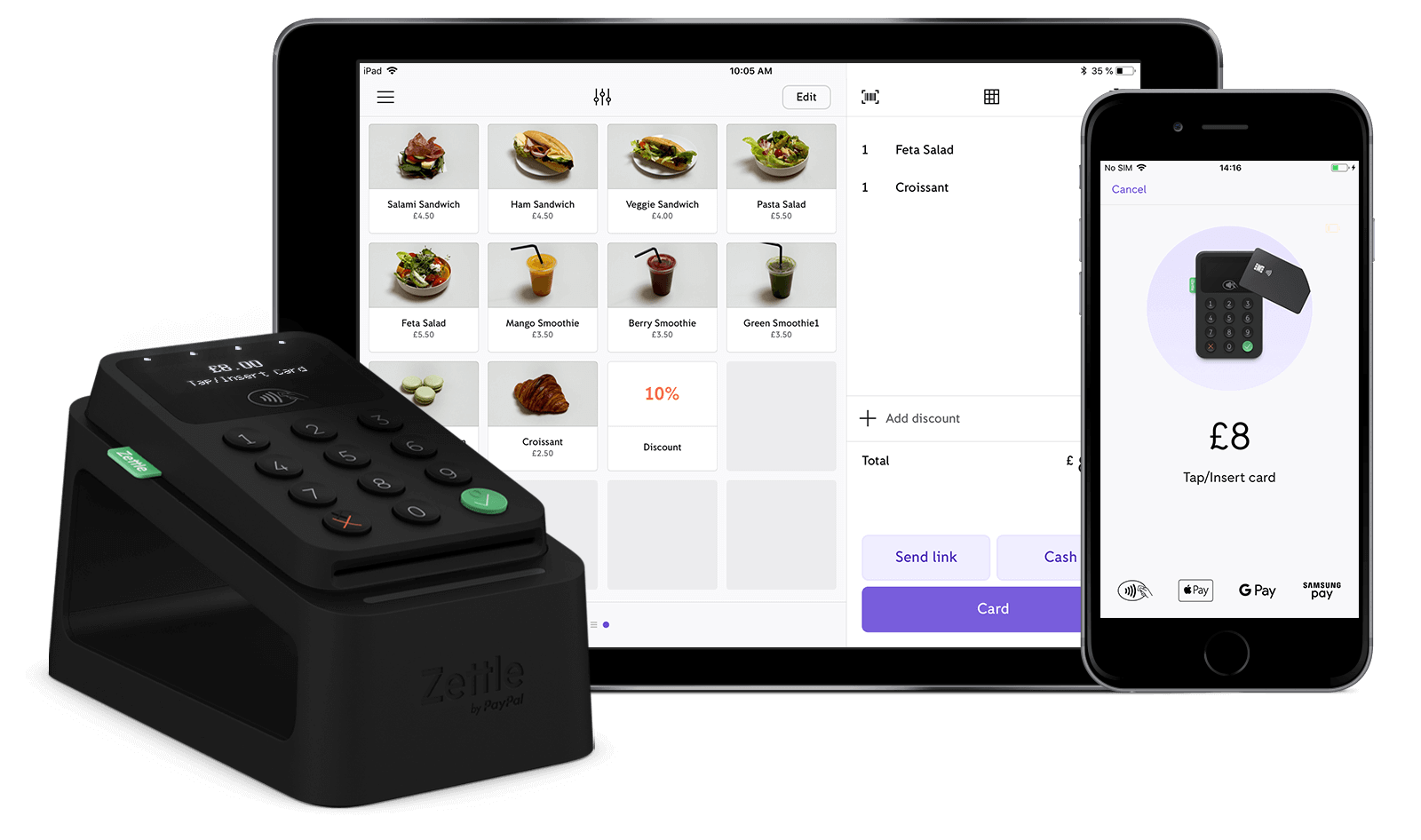

With PayPal Zettle, small businesses will get an integrated solution that enables them to accept a range of payments in-person with the Zettle card reader, helps them start selling online, and also helps them manage sales, inventory, reporting and payments across channels, all in one place. PayPal Zettle will also enable businesses to leverage PayPal’s suite of payment and commerce solutions – from invoicing to PayPal’s Business Debit Mastercard.

Partnering with PayPal for both in-person and online commerce, small businesses can offer their customers increased payment options, including credit and debit cards, PayPal and Venmo QR Codes, popular digital wallets and access to PayPal’s business lending solutions. All in-person and online sales can be easily viewed and managed through a business’s PayPal business account, and businesses will have access to their funds typically within one day.

PayPal Zettle also offers interoperability through PayPal’s vast partner network, so businesses can easily link their PayPal Zettle accounts with their preferred ecommerce, accounting and point-of-sale partners. PayPal Zettle is already integrated with a range of partners including BigCommerce, Lightspeed, QuickBooks Online and SalesVu, and will be integrating with additional partners in the coming weeks and months.

“Consumers want seamless and integrated digital experiences no matter where they shop. As a result, small businesses need access to omnichannel payment and commerce tools to help them effectively compete and meet their customers wherever they are – in-person, online and in-between,” said Jim Magats, SVP, Omni Payments, PayPal. “We believe in the power of small businesses, and we willleverage PayPal Zettle to better serve in-person businesses and enable them to go digital seamlessly.”

Small businesses like Speakcheesy, The Bullpen and Windybush Hay Farms are already seeing success using PayPal Zettle in the U.S.

“We recently switched to PayPal Zettle for our point-of-sale solution and we’re so glad we did,” said Mitch Guttenberg, co-owner, The Bullpen. “Being able to easily leverage multiple PayPal products, view and track all of our transactions in one centralized hub, and have all of our payments settle in one place has been a big win for us. Best of all, our customers and employees love PayPal Zettle because it’s so fast and easy to use.”

“As merchants adapt their businesses to start selling across more channels, the complexity of managing operations becomes a primary point of friction,” said Mark Rosales, Vice President, Business Development and Payments, BigCommerce. “PayPal Zettle’s complete point-of-sale integration with BigCommerce empowers our merchants to operate in a truly omnichannel ecosystem, connecting their digital operations with their offline business in a simplified way, saving time and most importantly, giving our merchants greater control over their business.”

PayPal Zettle is available to small businesses across the U.S. beginning today at a very competitive price. Businesses can purchase their first PayPal Zettle card reader for $29, with additional readers available for $79. The PayPal Zettle transaction rate in the U.S. for card processing is 2.29% + $0.09 cents* at launch, and PayPal and Venmo QR Code transactions will be 1.9% + $0.10 cents* via PayPal Zettle. Businesses can learn more and sign-up here.

About PayPal

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering more than 375 million consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information, visit paypal.com.