#crypto #bitcoin

$BTCUSD

“The relationship between Bitcoin and the stock market is crumbling”–Paul Ebeling

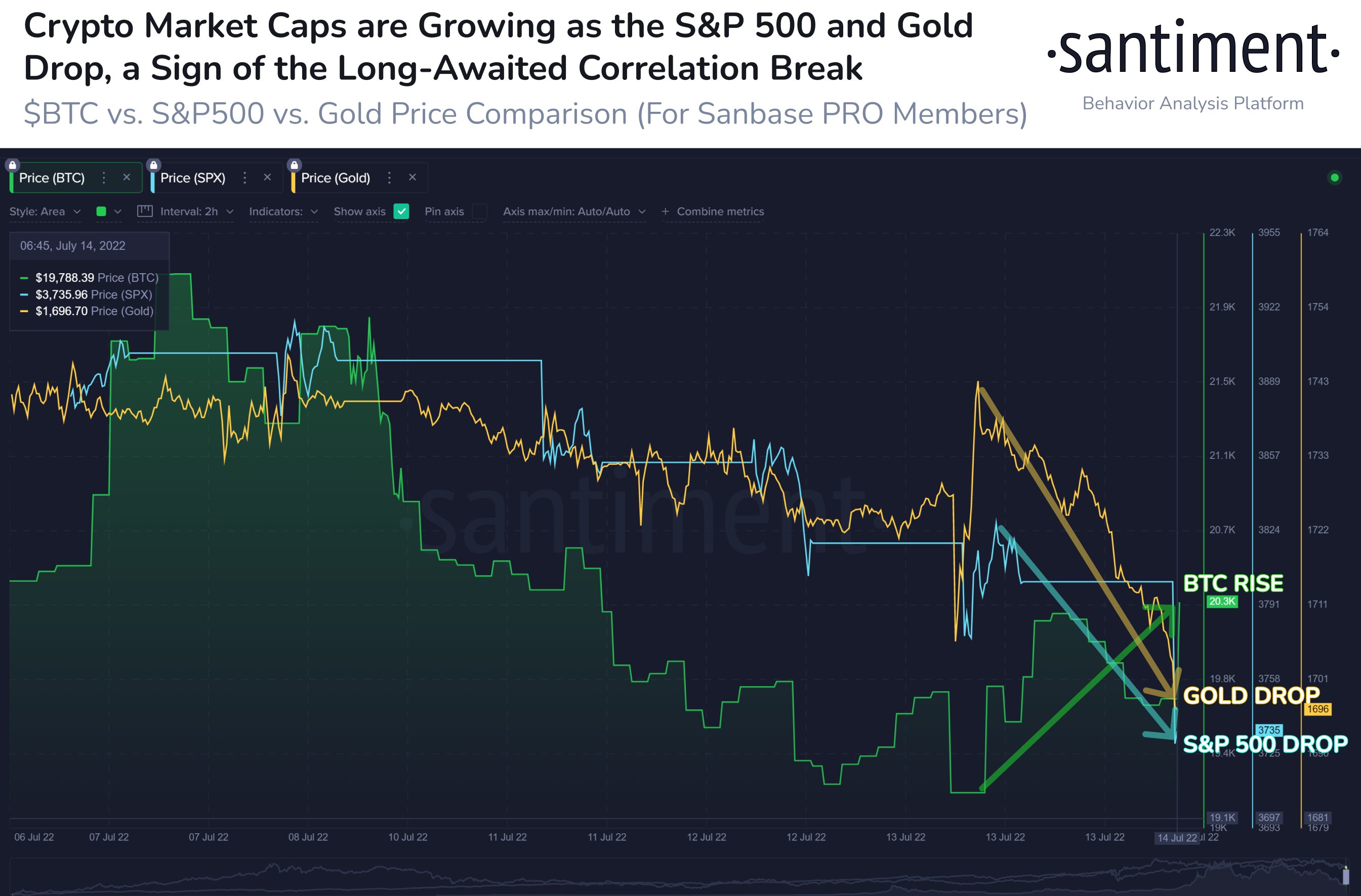

Santiment notes Bitcoin and altcoins tend to surge when they have very little correlation with equities and that, following Wednesday’s release of the most recent Consumer Price Index (CPI) data, crypto has been recovering while the S&P 500 and gold have dropped.about:blank

“If they stay uncorrelated, it’s a good sign of a potential breakout.”

Bitcoin is trading for $20,637 at time of writing. The top-ranked crypto asset by market cap is up more than 4.6% in the past 24 hours.

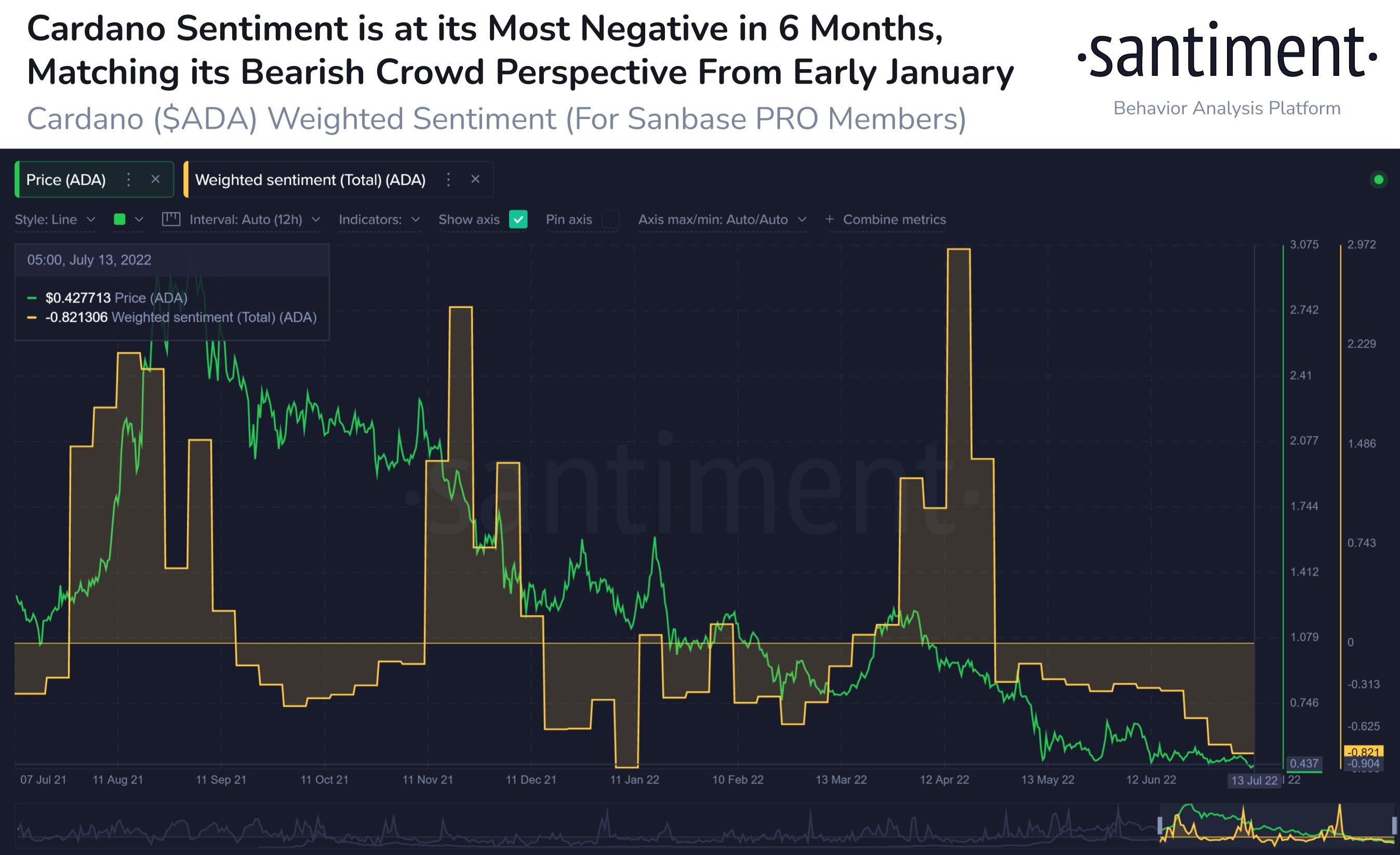

Santiment also notes the price of Cardano (ADA) is down nearly 70% since the beginning of 2022, spurring negative social sentiment toward the Ethereum (ETH) competitor.

This is a potentially positive development for ADA’s price in the short term, according to the analytics firm.

“The last time the crowd was this negative in January, ADA rebounded +24% in 5 days until sentiment turned positive again.”

Cardano is trading for $0.44 at time of writing. The 8th-ranked crypto asset by market cap is up nearly 4% in the past 24 hours.

A tip of my hat to sovereign individuals with satoshis and Bitcoin in cold storage with our firm. Click here

Have a prosperous weekend, Keep the Faith!