Cryptocurrency investments have emerged as a dynamic and disruptive force in the financial landscape, captivating the attention of investors worldwide. As we step into the future, the prospects and challenges of cryptocurrency investments become increasingly significant. In this comprehensive guide, we’ll explore the current state of cryptocurrency markets, analyze the potential for future growth, and delve into the challenges that investors may encounter along the way.

Current State of Cryptocurrency Markets

The cryptocurrency market has undergone substantial evolution since the inception of Bitcoin over a decade ago. Today, it encompasses a myriad of digital assets, each with its unique features and functionalities. Bitcoin, often referred to as digital gold, continues to dominate the market, while other cryptocurrencies like Ethereum, Ripple, and Litecoin carve out their niches. Investors have witnessed both remarkable successes and notable downturns in the crypto space. The market’s volatility remains a double-edged sword, offering significant profit potential alongside inherent risks. Understanding the intricacies of market trends, trading volumes, and investor sentiment is paramount for those seeking to navigate the complexities of cryptocurrency investments.

Understanding the Landscape of Cryptocurrency Investments

At its core, cryptocurrency investments involve a diverse array of digital assets, each possessing unique features and use cases. Bitcoin, the pioneering cryptocurrency, continues to play a pivotal role, while alternative coins like Ethereum, Ripple, and Litecoin bring innovation to the forefront. The market’s volatility, characterized by rapid price fluctuations, presents both opportunities and challenges for investors. Grasping the intricacies of market trends, technological advancements, and regulatory developments is essential for those seeking to thrive in this transformative space. As the cryptocurrency landscape continues to mature, investors must adapt to the nuances of this digital frontier, where opportunities abound, but strategic awareness is paramount for success.

Analyzing the Present Opportunities and Risks

On the one hand, the opportunities are vast, with the potential for substantial returns fueled by the industry’s innovation and adoption. Decentralized Finance (DeFi) platforms, blockchain integration into various sectors, and the emergence of non-fungible tokens (NFTs) represent just a few avenues for growth. However, these opportunities are accompanied by inherent risks, ranging from the market’s notorious volatility to regulatory uncertainties. Investors must carefully assess the potential rewards against the backdrop of these risks, conducting thorough due diligence to make informed decisions. The ever-changing landscape demands a vigilant approach, where staying informed and agile is crucial to capitalize on opportunities while mitigating the associated risks.

Exploring the Potential Upsides of Cryptocurrency Investments

At the forefront is the decentralization revolution, challenging traditional financial intermediaries and fostering financial inclusion. Cryptocurrencies offer a borderless and accessible financial ecosystem, opening avenues for unbanked and underserved populations. Additionally, the potential for exponential returns has drawn both individual and institutional investors into the market. The innovative technologies underpinning cryptocurrencies, such as blockchain, promise enhanced security, transparency, and efficiency in various industries. As mainstream adoption grows, the upsides extend beyond financial gains, encompassing the democratization of finance and the reimagining of traditional business models. While volatility and regulatory challenges persist, exploring the potential upsides of cryptocurrency investments entails recognizing their transformative impact on the global financial landscape and the unprecedented opportunities they present for those willing to navigate this dynamic space.

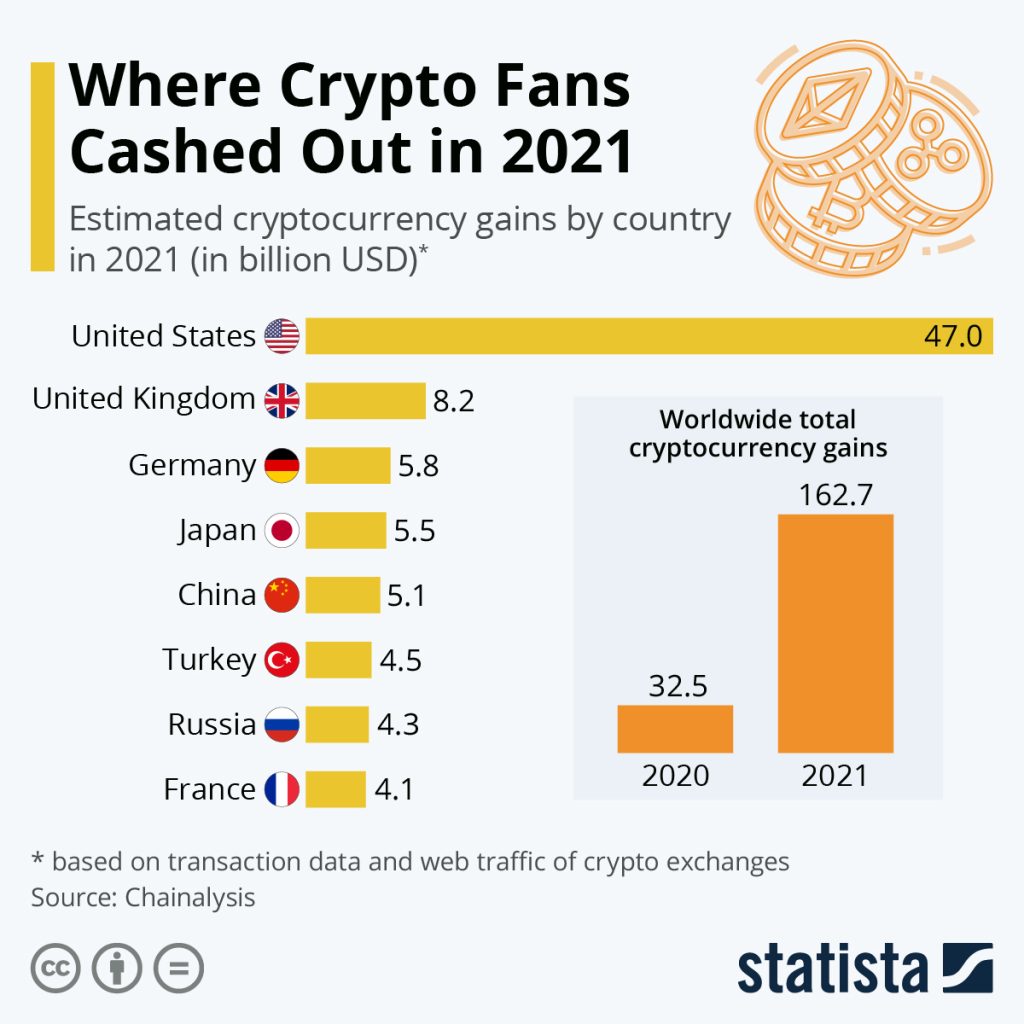

According to Statista many investors who held from the earlier years were able to book their profits.

Addressing the Risks and Hurdles in Cryptocurrency Investment

It is imperative for investors seeking long-term success in this dynamic and evolving landscape. One of the foremost challenges lies in the inherent volatility of cryptocurrency markets. Prices can experience significant fluctuations within short periods, posing both opportunities and risks. Regulatory uncertainties add another layer of complexity, as governments worldwide grapple with establishing frameworks for digital assets. Security concerns, including the vulnerability of exchanges to cyberattacks and the risk of fraud, highlight the need for robust risk management strategies. Additionally, market liquidity, technological challenges, and the potential for market manipulation are factors that demand careful consideration. To navigate these hurdles effectively, investors must prioritize education, conduct thorough due diligence, and implement risk mitigation strategies such as portfolio diversification. Proactive engagement with evolving regulations and staying abreast of technological advancements are crucial components of addressing the risks and hurdles inherent in cryptocurrency investment, fostering a more resilient and informed investment approach.

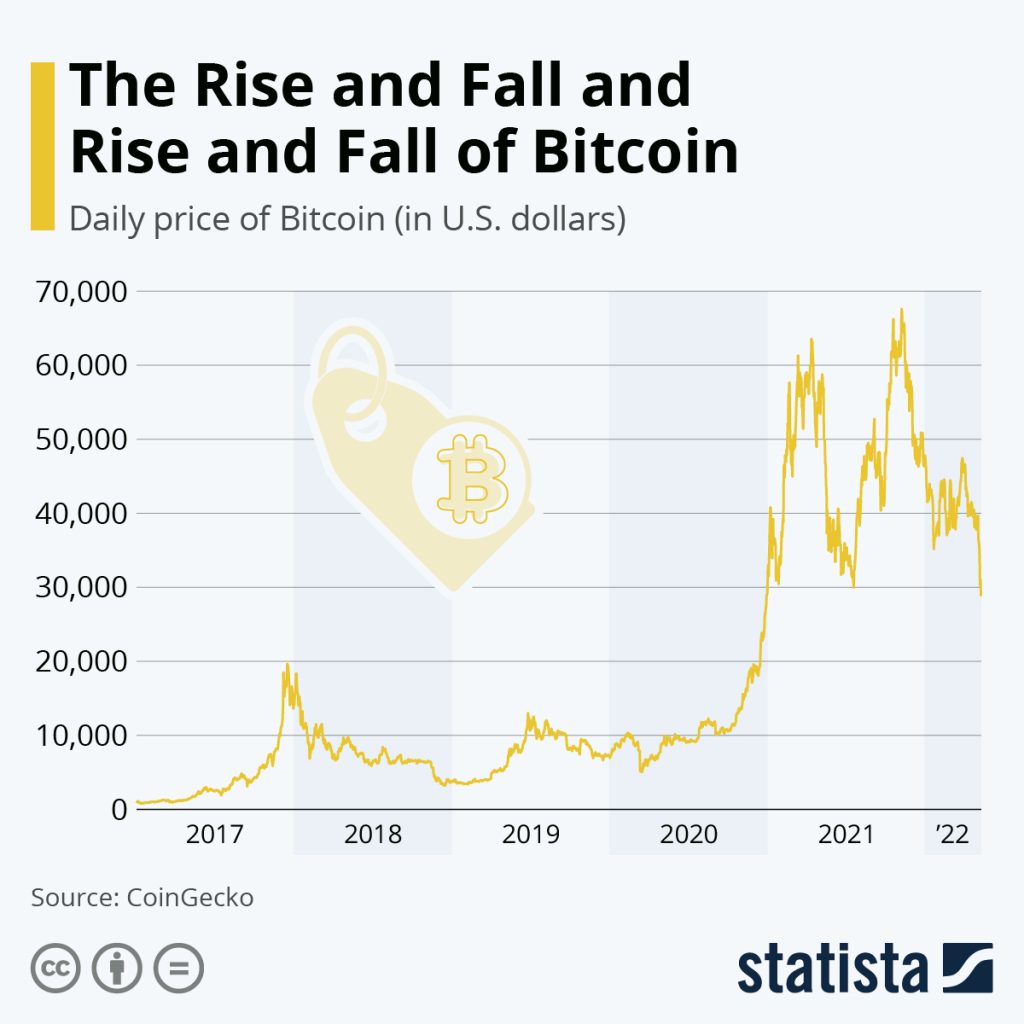

If you cannot stomach volatility then crypto is not for you. Some data to ponder upon provided by Statista about ups and downs of Bitcoin

Navigating the Evolving Regulatory Environment in Cryptocurrency

regulatory environment in cryptocurrency is a pivotal aspect of ensuring the stability and legitimacy of this burgeoning financial ecosystem. As governments worldwide grapple with integrating digital assets into existing frameworks, investors face the challenge of staying compliant with ever-changing regulations. The regulatory landscape varies significantly from country to country, ranging from embracing innovation to imposing stringent controls. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is becoming increasingly crucial, impacting both exchanges and individual investors. Clarity in tax regulations surrounding cryptocurrency transactions is also a focal point, influencing investment strategies and reporting requirements. Investors need to remain vigilant, stay informed about regulatory developments, engage with policymakers, and adapt their practices accordingly. Collaborative efforts between the cryptocurrency industry and regulatory bodies are essential to strike a balance that fosters innovation while ensuring investor protection and market integrity. Navigating this intricate regulatory maze is paramount for the long-term success and acceptance of cryptocurrency investments on a global scale.

Impact of Technological Advances on Cryptocurrency Investments

Today the effect of technological advances is profound and is shaping the landscape of digital assets and influencing investment strategies. At the forefront is the ongoing evolution of blockchain technology, which serves as the backbone of cryptocurrencies. Innovations such as smart contracts and decentralized applications (DApps) contribute to increased functionality, efficiency, and automation within blockchain networks. Scalability solutions address long-standing challenges, enhancing transaction throughput and reducing costs. The integration of artificial intelligence (AI) and machine learning (ML) further refines trading algorithms and risk management strategies. As the industry embraces interoperability standards, cross-chain compatibility becomes a reality, unlocking new possibilities for asset transfers and decentralized finance (DeFi) ecosystems. These technological advances not only improve the infrastructure of cryptocurrencies but also foster the development of novel use cases, expanding the potential for innovation and investment. However, investors must remain vigilant, understanding the implications of these advances, as rapid technological evolution may introduce both opportunities and risks to the dynamic world of cryptocurrency investments.

Crafting Effective Investment Strategies in the Cryptocurrency Market

Diversification stands out as a cornerstone strategy, spreading risk across various cryptocurrencies to mitigate the inherent volatility associated with individual assets. A thorough understanding of market trends, technological developments, and regulatory shifts is essential for making informed investment decisions. Tactical asset allocation, balancing high-risk, high-reward investments with more stable assets, helps create resilient portfolios. Regularly reassessing and rebalancing portfolios in response to market changes ensures adaptability. Additionally, staying abreast of macroeconomic factors, global events, and sentiment analysis aids in anticipating market movements. Long-term investors may consider strategies like dollar-cost averaging to mitigate the impact of short-term price fluctuations. Continuous education, risk management, and a disciplined approach form the pillars of crafting effective investment strategies in the cryptocurrency market, allowing investors to navigate the complexities and capitalize on the vast opportunities presented by this evolving asset class.

Learning from Successful and Notable Cryptocurrency Investment Cases

El Salvador made headlines by becoming the first country to recognize Bitcoin as legal tender, a move aimed at fostering financial inclusion and reducing remittance costs for its citizens. The success of this investment hinges on various factors, including the government’s commitment to promoting cryptocurrency usage, educating the public on digital financial literacy, and establishing a regulatory framework to address potential risks. Observing how El Salvador manages issues such as price volatility, technological infrastructure, and international relations offers lessons for other nations contemplating a similar path. While the move has sparked global debates and faced criticism, it represents an unprecedented experiment that may influence future governmental approaches to cryptocurrency adoption. Learning from El Salvador’s journey provides a case study for both the opportunities and challenges inherent in integrating cryptocurrencies into a national economic system.

Since the beginning below is their El Salvador’s BTC Investment Journey.

Summing Up the Future Outlook for Cryptocurrency Investments

This requires a nuanced understanding of the evolving landscape, acknowledging both the potential advancements and persistent challenges. The trajectory suggests continued growth and maturation of the cryptocurrency market, fueled by ongoing technological innovations, increased institutional interest, and a growing acceptance of digital assets. As blockchain technology evolves, it is likely to expand beyond the realm of financial transactions, impacting various industries and offering new use cases. The potential for decentralized finance (DeFi) to reshape traditional financial services and the emergence of non-fungible tokens (NFTs) as a digital asset class further underscore the diverse opportunities in the space.

However, challenges persist. Regulatory uncertainties, security concerns, and market volatility continue to pose hurdles that demand attention. Striking a delicate balance between innovation and regulation will be crucial for the sustained growth of the cryptocurrency ecosystem. Investors, both individual and institutional, must remain vigilant, staying informed about market dynamics, regulatory developments, and technological advancements.

The future outlook for cryptocurrency investments is marked by a blend of optimism and caution. While the transformative potential of digital assets is undeniable, navigating the complexities of this evolving landscape requires a strategic and informed approach. As the industry matures, the successful integration of cryptocurrencies into mainstream finance hinges on addressing challenges collaboratively, fostering innovation, and ensuring a robust regulatory framework that safeguards both investors and the integrity of the market. The journey ahead is dynamic and uncertain, but the opportunities for those who navigate it with prudence and adaptability remain vast.