Additional incentives from Multichain: Several Defi activities built on multiBTC offer competitive APY at leading yield platforms on Ethereum. Multichain also launched a boost bribe for LPs, offering further rewards in $MULTI. The bribe was live for two weeks till 5th January 2023, which increased the liquidity of the pools over $2 million. Second session has been launched on stakeDAO. Do not miss out this voting (Jan 12–19) and claim the juicy rewards.

Multichain is on a mission to interconnect every blockchain ecosystem existing in Defi. We have pioneered cutting-edge cross-chain bridge and router technologies to achieve this goal. Today, we take this mission a step further by introducing one of the most important coins in Defi to the Ethereum ecosystem, Bitcoin.

What is multiBTC?

With faster transaction times, the ability to access smart contracts and Dapps, or the convenience of using a particular blockchain ecosystem, cryptocurrency users own wrapped tokens for various reasons. multiBTC is another such wrapped token that brings the best of the two most used blockchain ecosystems together. The main aspect that sets multiBTC apart from others, is that multiBTC can still be redeemed even in the worst case of the cross-chain bridge suspension, meaning we will still offer support until nothing is left.

The Bitcoin network is a primitive blockchain that records account balances and lacks smart contracts functionality, which means it doesn’t support defi applications directly. Therefore, we cannot bring defi to Bitcoin; however, we can bring Bitcoin to defi by representing BTC as an ERC-20 token.

How does multiBTC work?

multiBTC is an ERC-20 token issued by the Multichain protocol that is pegged to the value of Bitcoin. This means that 1 multiBTC is always equal to 1 BTC. multiBTC allows users to take advantage of the features and capabilities of the Ethereum blockchain, such as smart contracts, while still being able to hold and trade Bitcoin.

The peg between multiBTC and Bitcoin is maintained with the help of smart contracts on Ethereum and HTLC (Hashed Time Locked Contract) on the Bitcoin network. The whole process is completely decentralized and automated.

– Contract address on Ethereum — 0x66eFF5221ca926636224650Fd3B9c497FF828F7D

– Contract address on Bitcoin — 1918DgsaJCsRF5E5rTp2AsE5XyFTF95tTQ

*Note: The “1918Dgsa” address on Bitcoin is the Collection Address. Deposits will only be gathered to the Collection Address when more than 8 deposits from separate users’ BTC deposit addresses come in.

How to obtain multiBTC?

multiBTC is not listed on centralized exchanges yet. However, users can get their hands on multiBTC in a few easy steps –

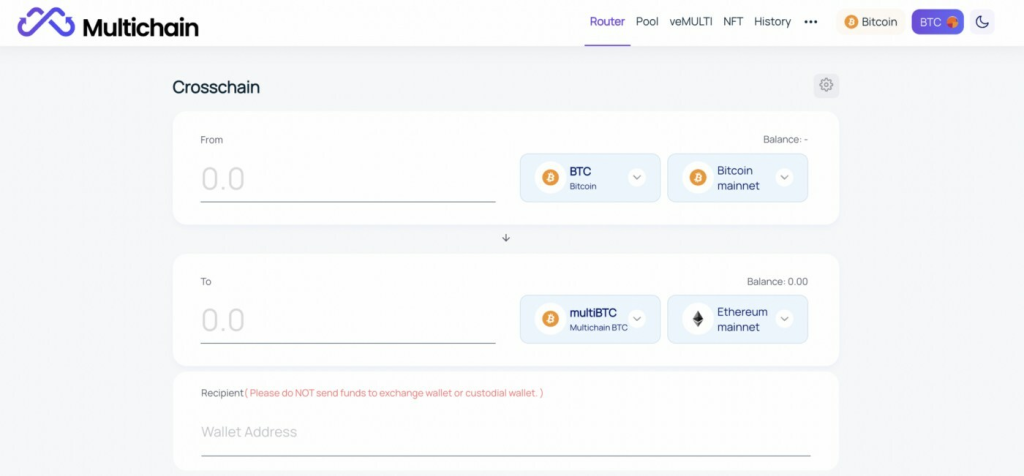

- Mint multiBTC via Multichain

Multichain allows users to mint their multiBTC with their BTC holdings in the Bitcoin network. This can be done with the help of the Multichain router, which connects Bitcoin and Ethereum networks. It’s also possible to anticipate multiBTC expansion to the multi-chain ecosystem in the near future.

- Convert other ERC-20 tokens to multiBTC

Suppose the user wishes to use their ERC-20 tokens to buy BTC. They can do so using the decentralized multiBTC-based liquidity pools live on Dapps in the Ethereum ecosystem. For instance Curve, which listed multiBTC on December 18th 2022 in a pool, is further compounded on Convex, Beefy, and Concentrator.

Benefits of using multiBTC

multiBTC offers several benefits for its users –

- Ease of use — The process of minting and burning mulitBTC is done on the Multichain router with hassle-free steps, requiring minimal effort from users. In contrast, using other wrapping protocols like WBTC requires several steps and technical know-how to execute.

- Low fees — multiBTC holders bridge back to the Bitcoin network with 0 fees, bridge BTC to Ethereum with 0.1 % fee, min. Fee 0.001 multiBTC, max. Fee 0.01 multiBTC. This is lower than many bridge protocols, like RenBTC, which charges 0.2%

- Increased liquidity — multiBTC improves the liquidity of wrapped Bitcoin on the Ethereum blockchain and makes it easier to trade it on different platforms and markets.