The Biden Administration will be filled with taxation and regulation that stifle economic growth. Billions will be spent pandering to “Social Causes” and the Socialist push of some Democrats with the support of mainstream media creating an economic downturn within the USA.

The dollar fell Wednesday as Democrats claimed the first of two key election runoffs that edged them closer to taking control of both houses of Congress, though Asian markets struggled after recent gains.

The senate votes in Georgia have taken the focus briefly off the virus and vaccine rollouts, with the results deciding the fate of Joe Biden’s legislative programme for at least the next two years.

Traders have for months been juggling long-term optimism and short-term worries with hopes that inoculations will mean life can slowly get back to normal.

A surge in Covid cases globally, however, has forced several nations to reimpose lockdowns and other strict containment measures. Biden is expected to pass severe lockdown laws.

Having navigated the major stumbling blocks of Brexit, US stimulus and the presidential elections, eyes are now on the closely fought vote in Georgia, with the Democrats winning one and the other too close to call.

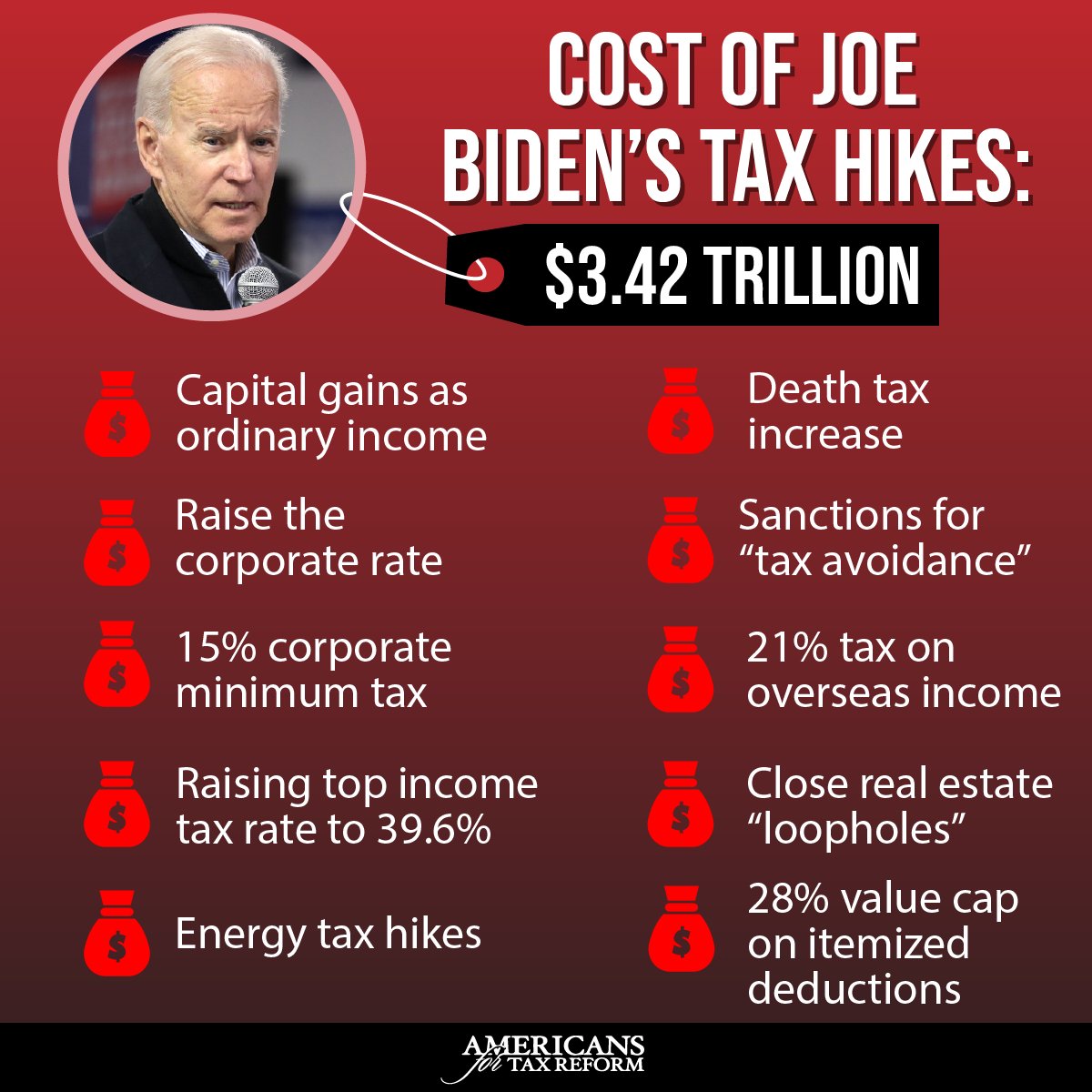

Dealers worry that a double win for the Democrats would allow Biden to push through measures such as tax hikes and market regulations despite the obvious harm to the US Economy.

While it would likely pave the way for a new, huge stimulus money printing, there is also fear that would lead to higher inflation and, in turn, higher interest rates. Record low borrowing costs put in place by the Fedeal Reserve at the start of the Covid crisis have been a crucial driver of a surge in equities from their March lows.

“A dual win should lead to a steeper (Treasury yield) curve and a weaker dollar as the fiscal situation would be seen as unsustainable,” said Sebastien Galy, of Nordea Investment.

“This is shaping up as a disaster for America, but great for Asia and the Middle East, time to reassess your investements” said Shayne Heffernan of HEFFX.

The dollar indeed weakened against most other currencies including the pound, yen and euro as Democrats looked to have their noses in front, while expectations of big borrowing sent the yield on US Treasuries to 1.0 percent for the first time since March.

Riskier higher-yielding units were also up against the greenback — including the Australian and New Zealand dollars, as well as China’s yuan and the South Korean won.

After a positive lead from Wall Street, where all three main indexes bounced back from their worst start to a year since 2016, Asian markets mostly drifted lower.

Hong Kong, Shanghai, Singapore and Bangkok rose, but Tokyo, Sydney, Seoul, Mumbai, Taipei, Wellington, Jakarta and Manila all fell.

London, Paris and Frankfurt all rallied after the open.

S & P 500, Dow and Nasdaq futures in New York dropped on tax and regulation concerns, particularly among tech giants.

Analysts said that while new restrictions, worrying infection spikes and stuttering vaccine distribution in some countries were jangling nerves on trading floors, dealers were keeping their sights on the second half of the year.

“Even if the US has passed peak vaccine rollout, euphoria and dreams of the efficient distribution are now replaced with the unfortunate logistical rollout reality,” said Axi strategist Stephen Innes.

“Markets will remain focused on the end of the tunnel, regardless of its length.”

Oil prices extended gains after soaring nearly five percent Tuesday on news that Saudi Arabia had offered to cut output by a million barrels in both February and March. The announcement sent WTI above $50 for the first time in 11 months.

The move soothed worries about global demand with new lockdowns, which could last months in some countries, likely to stunt travel again.

Bitcoin chalked up another record above $35,800 having tanked Tuesday, as the cryptocurrency sees wild speculation-driven fluctuations.