Knightsbridge, a leading provider of institutional-grade cryptocurrency infrastructure and services, has announced its integration with Blockstream products. This integration will provide Knightsbridge clients with access to Bitcoin and Liquid assets, including L-BTC, USDt, L-CAD, and JPYS.

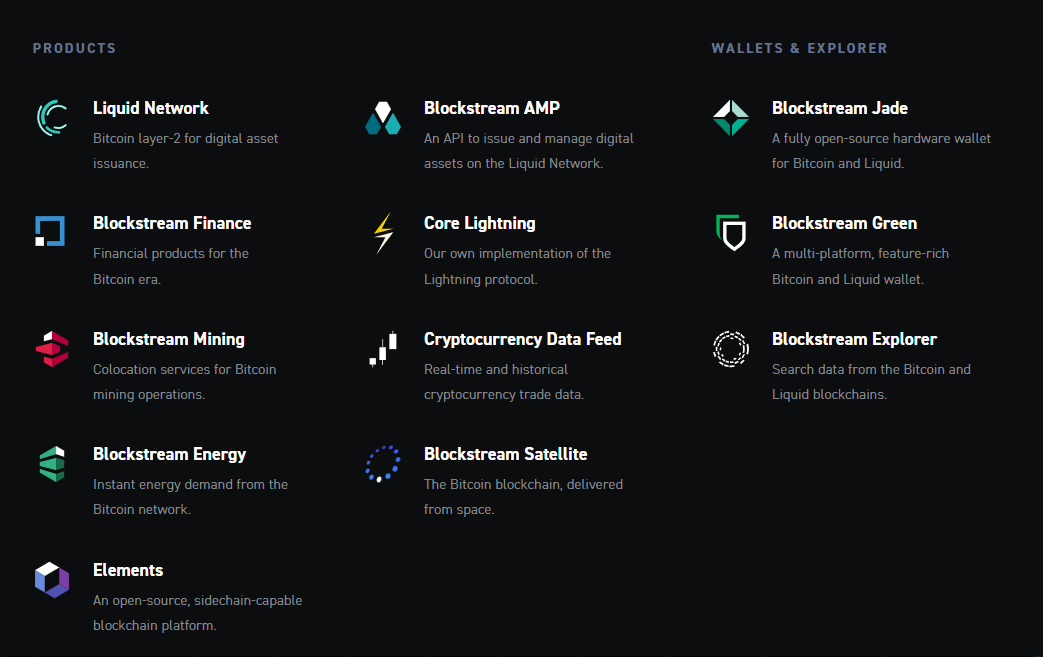

Blockstream is a leading Bitcoin technology company that offers a suite of products and services for individuals and businesses. Blockstream’s products include the Blockstream Green wallet, the Blockstream Satellite network, and the Liquid Network.

The Liquid Network is a sidechain to Bitcoin that offers faster and cheaper transactions than the Bitcoin mainchain. Liquid is also a good option for institutional investors who want to trade Bitcoin and other assets in a more private and confidential way.

Knightsbridge’s integration with Blockstream products will give institutional investors a one-stop shop for all of their Bitcoin and Liquid needs. Knightsbridge offers a variety of services, including custody, trading, and asset management.

The integration between Knightsbridge and Blockstream is a significant development for the institutional Bitcoin market. It will make it easier for institutional investors to access Bitcoin and Liquid assets, and it will help to legitimize Bitcoin as an asset class.

Benefits of the Knightsbridge and Blockstream Integration for Institutional Investors

The integration between Knightsbridge and Blockstream offers a number of benefits to institutional investors, including:

- Access to Bitcoin and Liquid assets: Knightsbridge clients will now have access to Bitcoin and Liquid assets, including L-BTC, USDt, L-CAD, and JPYS.

- One-stop shop: Knightsbridge offers a variety of services, including custody, trading, and asset management. This gives institutional investors a one-stop shop for all of their Bitcoin and Liquid needs.

- Security: Blockstream’s products are some of the most secure in the cryptocurrency industry. This gives institutional investors peace of mind knowing that their assets are safe.

- Compliance: Knightsbridge is a regulated company that offers compliance solutions for institutional investors. This helps institutional investors to meet their regulatory obligations.

Conclusion

The integration between Knightsbridge and Blockstream is a significant development for the institutional Bitcoin market. It will make it easier for institutional investors to access Bitcoin and Liquid assets, and it will help to legitimize Bitcoin as an asset class.

Shayne Heffernan