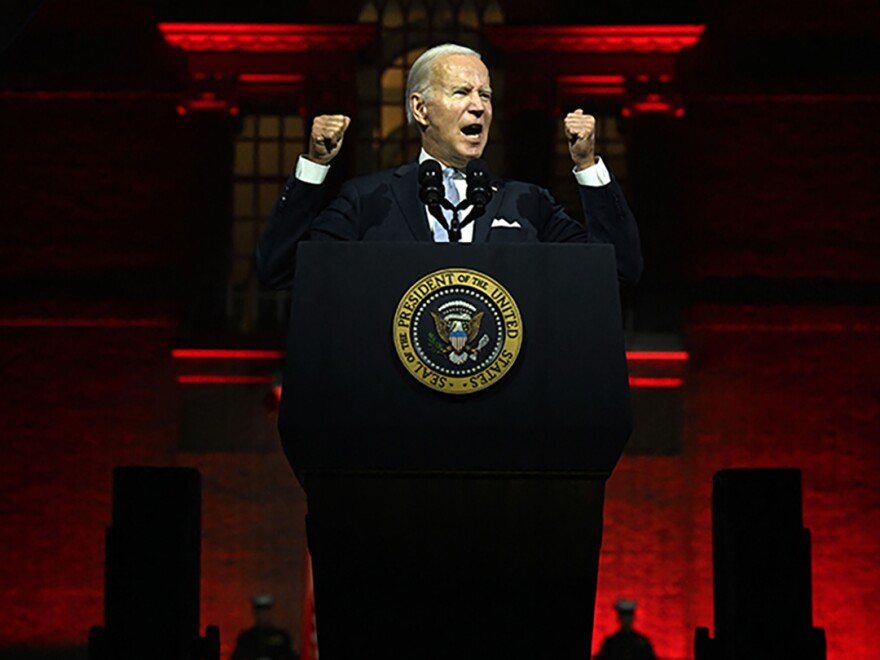

It seems that U.S. President Joe Biden intends to take smearing China as part of his “grand strategy” to shoot America’s economic troubles.

At a fund-raising event on Thursday, the top U.S. leader characterized the Chinese economy as a “ticking time bomb.” Quite an interesting description. If taking a closer look at the devastating impact America’s economic failures have unleashed upon the world in recent years, one might come up with a very different conclusion.

In Fact, the United States itself is presently grappling with severe economic challenges, exemplified by Fitch Ratings’ recent downgrade of its credit rating. Fitch attributed this downgrade to an “erosion of governance” relative to other leading economies over the past two decades.

Echoing Fitch’s point, the Wall Street Journal noted that one of the reasons for Fitch’s downgrade was the absence of any political will in the United States to deal with its domestic problems.

Photo taken on March 13, 2023 shows the New York Stock Exchange (NYSE) in New York, the United States. (Photo by Michael Nagle/Xinhua)

Whenever confronted with criticism from both domestic and international spheres, it is a recurring pattern for the U.S. government to assuage pressure and divert public attention by hyping up all kinds of negative theories on China.

And Washington’s track record of handling its economic problems would only instigate more global concerns. From the 2008 financial crisis to the recent wave of bank failures in the United States, history indicates that Uncle Sam has consistently been the spark that ignites global economic turmoil.

Undeniably, the Chinese economy is currently facing downward pressures, including such challenges as declining exports and investment. However, despite all these obstacles, China has stayed rather focused on solving problems, instead of blaming others. Already, Beijing has rolled out a range of measures to unleash its market potential, and has managed to maintain its growth trajectory.

Throughout this year, China’s economy has consistently displayed signs of a relatively robust recovery. In the first half of the year, the nation’s GDP expanded by 5.5 percent compared to the corresponding period last year. Domestic demand has gradually rebounded, with consumption expenditure contributing a remarkable 77.2 percent to economic growth in the first half of the year, marking a notable increase of 44.4 percentage points from the previous year.

When juxtaposed with most major developed economies, including the United States, China demonstrates not only faster economic growth but also a significant lead in its contribution to the global economy. International institutions such as the World Bank and the International Monetary Fund recognize China as a vital driving force behind global economic growth.

A woman buys food at a food truck in New York, the United States, May 11, 2022. (Xinhua/Wang Ying)

Indeed, the world economy is currently mired in an unprecedented predicament. In the aftermath of the COVID-19 pandemic, the global economic climate is marked by a looming downturn. Many countries are experiencing a slowdown in growth momentum, and the expansion of global trade has been lackluster.

As the world’s two largest economies, the United States and China bear a collective responsibility to join hands in boosting global recovery efforts.

Regrettably, what China has received from across the Pacific is not a cooperative hand, but an onslaught of stringent sanctions and measures intended to coerce other nations into cutting ties with China under the guise of “de-risking.”

Driven by its pursuit of maintaining hegemony and prioritizing its own interests, the U.S. obsession with containing China has gravely undermined the stability of global supply chains and industrial networks, posing a significant threat to the overall well-being of the global economy.

The Economist said in a recent report that Washington is “putting the risk into de-risking,” and the so-called “de-risking” measures are making “the world not safer, but more dangerous.”

The world economy is like an expansive and interconnected ocean, not an isolated river, where no nation can thrive in isolation. Indulging in a blame game and solely fixating on hindering China’s progress will only exacerbate the troubles faced by the already tottering global economy.

Shayne Heffernan