Over the years, Wall Street has consistently emerged as a beacon of wealth creation. When juxtaposed with the returns from housing, gold, oil, and bonds, the stock market outshines these asset classes over extended periods.

However, the narrative shifts when the magnifying glass zooms in on shorter time frames. In recent times, indices like the Dow Jones Industrial Average (DJINDICES: ^DJI), the S&P 500 (SNPINDEX: ^GSPC), and the Nasdaq Composite (NASDAQINDEX: ^IXIC) have oscillated between bullish and bearish territories, leaving investors on tenterhooks.

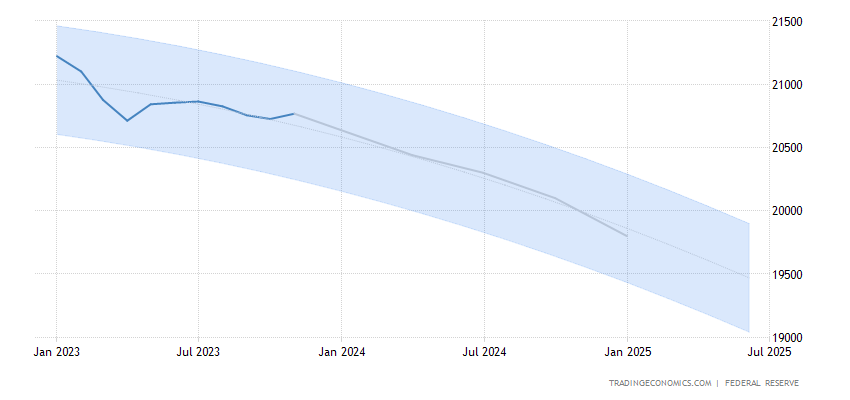

Predicting the future of the Dow Jones, S&P 500, or Nasdaq Composite remains elusive. Yet, specific data points have historically signaled significant market shifts, capturing the attention of both Wall Street and discerning investors. A prime example currently is the U.S. money supply.

A Deep Dive into U.S. Money Supply Dynamics

Economists primarily monitor M1 and M2, two critical money supply metrics. While M1 represents immediately spendable assets like cash and checking accounts, M2 encompasses M1 and includes savings, money markets, and certain CDs below $100,000. The recent contraction in M2, a phenomenon last witnessed during the Great Depression, is causing concern. With M2’s decline amidst rampant inflation, potential economic implications could be dire.

Historically, significant drops in M2 have often foreshadowed economic downturns. While today’s economic landscape is vastly different from past centuries, historical patterns suggest caution.

Commercial Bank Credit: Another Warning Sign?

Commercial bank credit, mirroring the trajectory of M2, has shown consistent growth over the decades. However, sporadic declines, especially significant ones, have historically heralded economic challenges. The recent contraction in commercial bank credit might indicate tightening lending standards, potentially affecting corporate earnings and market trajectories.

Historical Perspective: The Optimist’s Guide

Despite looming challenges, history underscores the resilience of the market and the rewards for patient, long-term investors. Recessions, while unsettling, are cyclical and often brief. Notably, bullish market trends typically outlast bearish ones, reinforcing the age-old investment adage: time in the market beats timing the market.

| Related | Last | Previous | Unit | Reference |

|---|---|---|---|---|

| GDP Growth Rate | 4.90 | 2.10 | percent | Sep 2023 |

| GDP Annual Growth Rate | 2.90 | 2.40 | percent | Sep 2023 |

| Government Spending | 3843.36 | 3789.80 | USD Billion | Sep 2023 |

| GDP Constant Prices | 22490.69 | 22225.40 | USD Billion | Sep 2023 |

| Gross National Product | 22641.82 | 22384.60 | USD Billion | Sep 2023 |

| Gross Fixed Capital Formation | 3981.30 | 3955.90 | USD Billion | Sep 2023 |

| Changes in Inventories | 77.76 | 14.90 | USD Billion | Sep 2023 |

| Real Consumer Spending | 3.10 | 0.80 | percent | Sep 2023 |

| GDP Sales QoQ | 3.60 | 2.10 | percent | Sep 2023 |

| Full Year GDP Growth | 1.90 | 5.80 | percent | Dec 2022 |

| GDP from Utilities | 336.30 | 364.00 | USD Billion | Sep 2023 |

| GDP from Transport | 736.10 | 729.00 | USD Billion | Sep 2023 |

| GDP from Services | 16258.90 | 16096.70 | USD Billion | Sep 2023 |

| GDP from Public Administration | 2563.40 | 2550.50 | USD Billion | Sep 2023 |

| GDP from Mining | 301.30 | 292.80 | USD Billion | Sep 2023 |

| GDP from Manufacturing | 2312.90 | 2262.30 | USD Billion | Sep 2023 |

| GDP from Construction | 850.90 | 820.30 | USD Billion | Sep 2023 |

| GDP from Agriculture | 179.30 | 182.10 | USD Billion | Sep 2023 |

Research from Knightsbridge highlights the long-term benefits of staying invested. Regardless of short-term market fluctuations, historical data underscores the importance of a long-term, optimistic investment strategy.

In conclusion, while 2024 might present challenges, armed with historical insights and a patient approach, investors can navigate the markets with confidence.