As global markets experience a turbulent period, investors are seeking alternative avenues to safeguard their wealth. Recent market fluctuations have raised questions about traditional investment instruments, leading some to consider cryptocurrencies as a potential store of value. In this article, we will explore the recent market volatility and examine why Bitcoin could be an attractive option for investors looking for stability and long-term growth.

Market Outlook

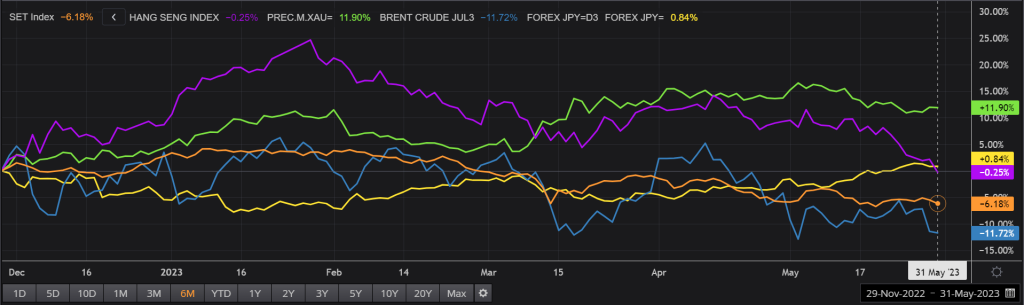

The yuan fell to a six-month low of 7.1090 per dollar, prompting concerns among investors. Simultaneously, a range of economic indicators, including output, industrial profits, retail sales, and loan growth, have failed to meet forecasts, with some experiencing significant declines. As a result, China-sensitive assets have taken a hit. The Australian dollar is on track for its fourth consecutive monthly loss, teetering just above seven-month lows at $0.6492. Meanwhile, Aussie stocks have dropped 2.4% and are facing their worst month since February.

Even the much-anticipated tourism-led rally for Thailand’s baht and stock index has failed to materialize. Hong Kong’s Hang Seng has seen an 8% decline in May, with a 1.6% drop on Friday alone. Even in Japan, Asia’s brightest market, stocks took a breather with the benchmark Nikkei falling 0.8%. However, it is worth noting that the Nikkei has experienced an impressive 7.7% monthly gain, propelling the index to its highest levels in over 30 years.

Global Market Volatility

The world’s financial markets have recently witnessed a period of volatility, with uncertainty stemming from various factors such as geopolitical tensions, inflation concerns, and fluctuations in major economies. These developments have left investors searching for ways to protect their portfolios from potential losses and preserve their purchasing power.

Amidst this backdrop, Bitcoin, the most prominent cryptocurrency, has emerged as an intriguing option for those seeking a reliable store of value. Unlike traditional fiat currencies, Bitcoin operates on a decentralized network called blockchain, providing security, transparency, and limited supply. These unique characteristics have attracted both institutional and retail investors, who view Bitcoin as a potential hedge against market volatility and inflation.

Bitcoin’s Appeal as a Store of Value:

The recent market volatility has brought Bitcoin into the spotlight as a potential store of value for several reasons.

- Decentralization: Bitcoin operates on a decentralized network, which means it is not controlled by any central authority or government. This attribute provides a level of independence from geopolitical uncertainties and central bank policies, making it an appealing option for those seeking to diversify their investments.

- Limited Supply: Bitcoin has a capped supply of 21 million coins, which creates scarcity and potential value appreciation over time. This finite supply differentiates Bitcoin from fiat currencies, which can be subject to inflationary pressures. As global economies grapple with rising inflation concerns, Bitcoin’s limited supply becomes increasingly attractive to investors.

- Technological Advancements: The blockchain technology underlying Bitcoin has gained recognition for its security and transparency, instilling investor confidence by recording transactions on an immutable ledger that minimizes the risk of fraud or manipulation.

Is Bitcoin the Next Store of Value?

As global markets experience volatility, investors are exploring alternative investment options to protect their wealth. Bitcoin, with its decentralized nature, limited supply, and technological advancements, presents a compelling case as a potential store of value. However, it is important to note that Bitcoin’s price volatility remains a concern for some investors, and regulatory developments could impact its future outlook.

The global markets’ unpredictable nature has prompted individuals and institutions to consider diversifying their portfolios beyond traditional assets. Whether Bitcoin will emerge as the next prominent store of value is a question that only time can answer. Nevertheless, as investors continue to seek stability and long-term growth, Bitcoin’s unique characteristics position it as a contender for those looking to navigate the evolving financial landscape.