#Ferrari #Enzo #Dream

$RACE

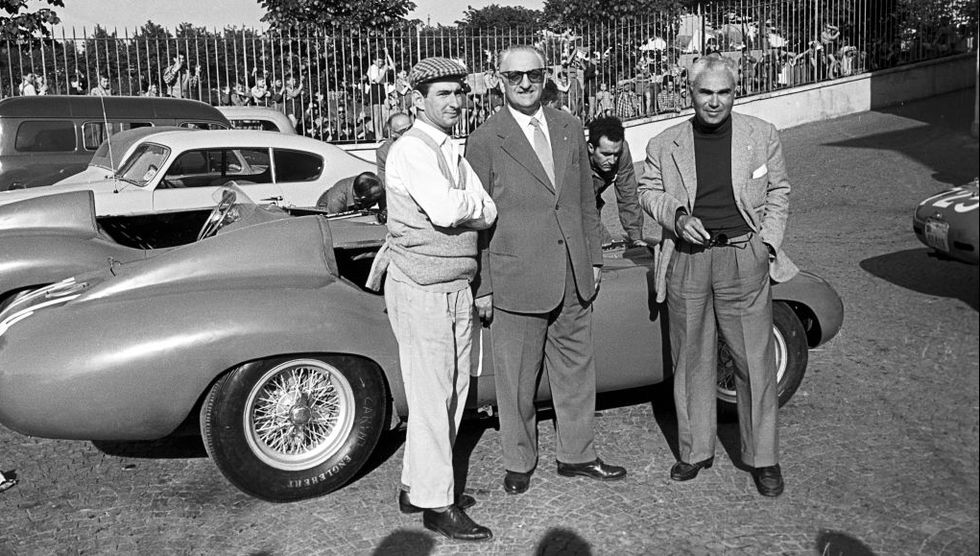

“Adam Driver will play Enzo circa 1957, Penelope Cruz will play wife Laura, Shailene Woods the Mistress, Michael Mann’s biopic of the 1st Ferrari Dreamer start, filming in Modena in May, I expect it to be super” — Paul Ebeling

The long waited biopic Ferrari, based on automotive journalist Brock Yates’ Y 1991 book Ferrari – The Man, The Cars, The Races, The Machine, will finally make it to the silver screen.

Director Michael Mann has been working on the project for 20 yrs. Thanks to his passion for the project, along with the involvement of major entertainment and media company STX, which will handle distribution.

The film is set in the Summer of Y 1957, as bankruptcy stalks the relatively carmaker Ferrari SpA. Enzo and Laura’s beloved son Dino had passed away the yr before from muscular dystrophy at 24 anni. And Enzo has acknowledged Piero as his own.

A bold move happens, Enzo decides to counter his losses by rolling the dice on 1 race, 1,000 miles across Italy, the iconic Mille Miglia.

“Ferrari is so much more than a story about a man and his machine,” said the Chairman of STX Films’ Motion Picture Group. “It is an extraordinary and emotional story that Michael (Mann) has been developing for years and the entire team at STX is looking forward to the start of production with this dream cast and filmmaker. Adam Driver is one of the most talented and fascinating actors working today, and we could not be more thrilled to pair him with Penélope, whose legendary career builds with every role she takes.”

The script was written by Mr. Mann and Troy Kennedy Martin, who penned The Italian Job. The movie will be shot in Modena starting in May. No word on when it will be in theaters. But with the recent success of the racing film Ford v Ferrari, hopes are high.

Ferrari is The Aristocrat of the automotive sector.

Ferrari is 1 of the most recognizable brands in the world, even becoming the world’s strongest luxury brand in Y 2021, according to Brand Finance. Its Brand Strength Index scored 93.9 pts out of 100 and has a brand strength of AAA+.

Ferrari finished Friday at 218.17 within its 52 wk range of 127.73 – 275.30 in NY, down from its all time closing high at 275.30 on 22nd November.

Key technical indicators are Neutral with a Bullish bias in here. The candlestick pattern indicated the confirmation of the break out at 196.01 on 3 November and confirmed.

The Key resistance is at , the Key support is at , our Key technical indicator is Neutral.

Societe Generale places a Street high price target of $290 on RACE as compared to the average sell-side price target at 195.93. Most Street analysts still do not know how to view Ferrari.

Morgan Stanley called out $RACE a “sleeper” EV play as the firm can justify more than 100% of the company’s value with its ICE business. MS’s new price target of $350 reps more than 35% Northside potential for shares and is above the average analyst 1 yr target is at 214.43.

MS automotive analyst says, “Longer term, we see scope for Ferrari to offer a range of EV products at potentially higher prices than the average selling price of today’s Ferrari, while leveraging economies of scale on higher volumes.“

Note: At the beginning of Y 2020 I called RACE at 230 by year’s end, the stock was trading at 165.22 on 1 January 2020, on 29 December 2020 it marked 233.66 intraday, an all time high

The Maranello Outfit’s shares were raised to Buy from Hold at HSBC, and Buys at Morgan Stanley and Bank of America.

UBS is now calling the stock at 365. I have not seen any other Street downgrades.

Ferrari will continue to create value in the long term as it becomes the world’s 1st Super Luxury brand.

Ferrari is a quality 1st long term luxury products investment, BAML raised its call to 270 long term.

I have raised my long term target to 375, a Strong Bull call, the strongest on the Street and am holding the mark during this recent profit taking, and seeing RACE as a buying opportunity.

Ferrari has an average rating of Buy and a consensus target price at 214.43.

Ferrari will continue to create value in the long term. Ferrari is a quality 1st long term luxury products investment, and I am calling it 375 long term, the Top call on the Street, and adjusting it to 250/share short term.

A number of large investors have recently bought shares of RACE, and Ferrari continues to buy back its stock in here.

The stock is considered defensive in the sector.

Have a prosperous week, Keep the Faith!