KXCO, the Organization behind the FBX Cryptocurrency, announced plans to move FBX to the KXCO Armature in the 1st half of 2023 further advancing the capabilities of FBX the inflation-resistant store of value that can be used as peer-to-peer digital cash.

Designed to solve the systemic risk of the crypto industry’s odd reliance on centralized Fiat denominated stablecoins and other dollar substitutes in decentralized finance, KXCO developed FBX to be a freely tradeable currency that can maintain a base value under stress without interventional bailouts.

FBX will be built on KXCO Armature, a proprietary blockchain that was developed to handle complex financial transactions and is using a proof-of-Authority validation concept.

The KXCO Armature was built with KYC, AML, and Banking regulations in mind with a focus on the speed of transactions.

“This year’s events have started the unravel of poorly planned endeavors in the Crypto space: first, we need professionals running organizations in the space understanding auditable systems that protect users from the custodial risks of centralized systems. Accomplishing this on-chain, we need radically different Chains that don’t rely on continuous growth or bailouts,” John Heffernan, Economist at KXCO said.

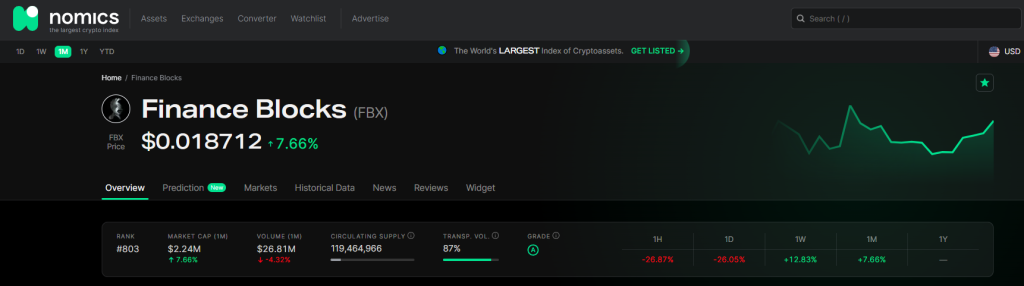

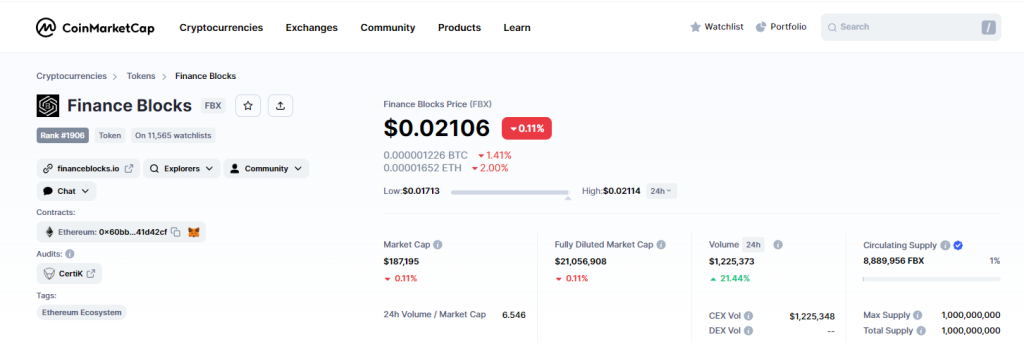

Trade FBX

https://www.mexc.com/exchange/FBX_USDT

https://www.probit.com/app/exchange/FBX-USDT

The inevitable failure of the nonsense crypto markets began with the collapse of the algorithmic stablecoin, TerraUSD (UST), and escalated with the downfall of Celsius, Voyager, BlockFi, FTX and hundreds more. “DeFi remains in many cases a disaster waiting to happen both from the continuing fallout from the collapse of industry players and poorly designed, impossible to deliver investment returns,” commented Joe Heffernan from the Trade Desk at KXCO.

The collapses highlighted the need for radically traditional ways of designing systems that can safely operate under all market conditions.

FBX is a freely tradable currency designed the way money was meant to be, Money was originally envisaged as a unit of exchange, a measure of value and a store of wealth, but in the modern world those original goals have been replaced as governments print money to cover their spending, they manipulate interest rates and FX rates for domestic and international trade purposes and the money that the individual has suffers as a consequence.

The price of FBX is determined by the market. Its value is the cumulative state of the use case and the FBX reserve balance sheet.

To learn more, access the FBX whitepaper here: https://financeblocks.io/whitepaper.docx

And the KXCO Whitepaper here: https://wp.kxco.io