The Hong Kong court’s decision to order the liquidation of China Evergrande Group marks a crucial step in addressing the perceived property crisis in China. While the demise of Evergrande is significant, it brings relief by preventing the Western media from portraying one company’s failure as a reflection of China’s entire economic landscape. The court’s decision paves the way for a systematic process involving the liquidation of assets and management restructuring, aiming to address concerns raised by creditors.

Despite recent challenges and the high-profile case of Evergrande, the Chinese property market continues to demonstrate resilience and remains a key driver of the nation’s economic growth. This article examines the factors contributing to the strength of the Chinese property market and dispels concerns surrounding its stability.

The fall of Evergrande, one of China’s largest real estate developers, has sparked global concerns, with some interpreting it as a potential indicator of broader issues in the Chinese economy. However, a closer examination reveals that Evergrande’s troubles are more a result of internal mismanagement than a reflection of systemic issues in China’s economic fundamentals.

- Internal Mismanagement: Evergrande’s rapid expansion and diversification into non-core businesses, including electric vehicles and tourism, stretched its resources thin. Mismanagement of funds and the accumulation of massive debt led to the company’s financial distress.

- Aggressive Expansion Strategies: The company’s aggressive land acquisitions and relentless pursuit of market dominance without adequate risk management contributed to its downfall. Evergrande’s focus on quantity over quality, along with ambitious expansion plans, proved unsustainable in the long run.

- Diversification Challenges: Evergrande’s attempt to diversify its business beyond real estate added complexity. Venturing into unrelated sectors without a clear synergy strained its financial resources and diverted attention from its core competency.

- Debt-Driven Growth: Heavy reliance on debt financing, particularly through bond issuances and trust loans, exposed Evergrande to the vulnerabilities of a highly leveraged business model. As China implemented measures to curb excessive borrowing, Evergrande faced difficulties refinancing its debts.

- Government Measures: China’s government implemented measures to cool the property market and reduce financial risks associated with the real estate sector. Evergrande’s inability to adapt to the changing regulatory environment contributed to its financial challenges.

- Isolated Case, Not Systemic Issue: It is crucial to distinguish Evergrande’s case as an isolated incident rather than a reflection of the broader Chinese economy. The Chinese government’s reluctance to provide a direct bailout signaled a commitment to market discipline and avoiding moral hazard.

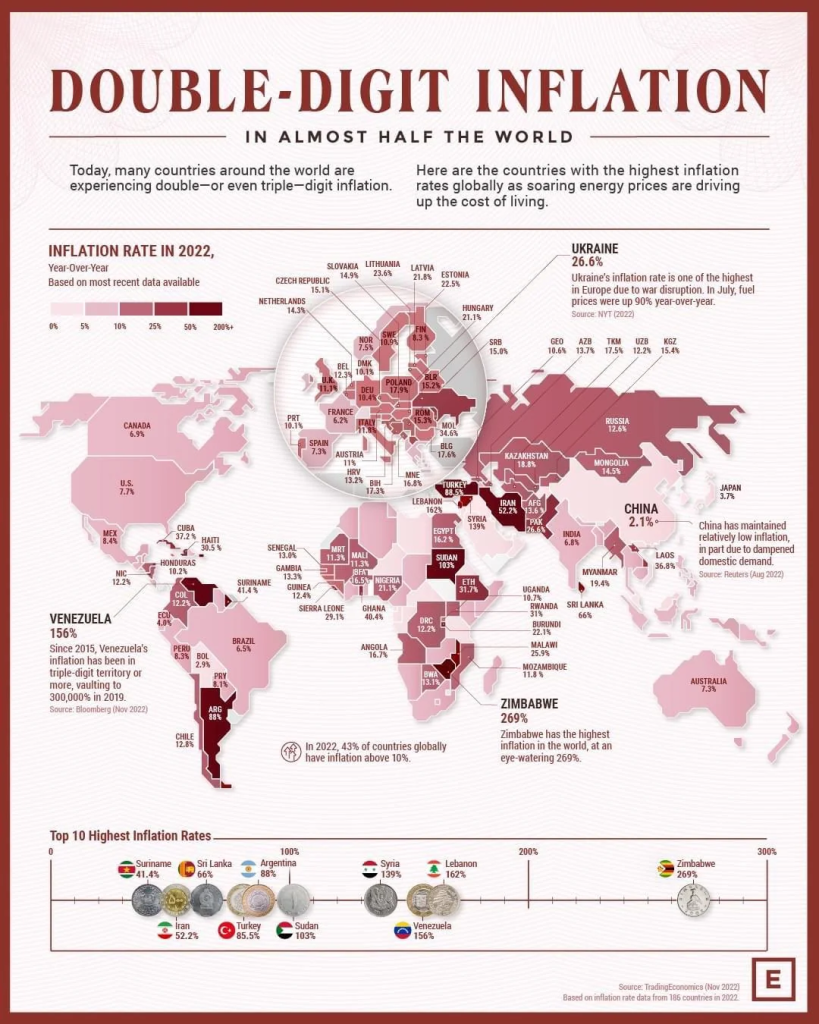

- Resilient Chinese Economy: Despite challenges in the real estate sector, China’s economy has demonstrated resilience. The government’s proactive approach to addressing risks, coupled with robust economic fundamentals and a focus on sustainable growth, distinguishes China from the economic turmoil associated with Evergrande.

While Evergrande’s collapse has undoubtedly sent shockwaves through global markets, attributing it solely to broader issues in China’s economic landscape oversimplifies the situation. Instead, it serves as a cautionary tale of corporate mismanagement and the consequences of unchecked expansion. As China continues to navigate challenges in its property market, the underlying strength of its economy remains intact, emphasizing the importance of prudent business practices for sustained growth.

Early Years and Rapid Expansion:

- Founding and Growth (1996-2010): Evergrande Real Estate Group was founded in 1996 by Xu Jiayin. The company experienced rapid expansion, capitalizing on the real estate boom in China during the early 2000s. Evergrande focused on residential development, becoming one of the largest property developers in the country.

- IPO and Market Dominance (2009-2015): Evergrande went public in Hong Kong in 2009, raising significant capital. During this period, the company aggressively acquired land and diversified its portfolio into sectors such as tourism and electric vehicles. It became the top-selling property developer in China, surpassing competitors with its vast land reserves.

Debt Accumulation and Government Interventions:

- Heavy Debt Load (2016-2019): Evergrande’s rapid expansion was accompanied by a substantial accumulation of debt. The company relied on various financing channels, including trust loans and bond issuances, to fund its ambitious projects. As concerns grew over China’s property market and rising debt levels, Evergrande’s financial health came under scrutiny.

- Government Measures (2017-2020): Chinese authorities, concerned about systemic risks, implemented measures to cool the property market and curb excessive borrowing. Evergrande faced stricter regulations, including restrictions on home pre-sales and increased scrutiny of its financial practices.

Downfall and Crisis Escalation:

- Financial Distress (2020-2021): Evergrande’s financial challenges intensified as it struggled to meet debt obligations. Reports emerged of delayed payments to suppliers and contractors, raising concerns about its solvency. The company’s credit ratings were downgraded, further exacerbating its difficulties.

- Default and Debt Crisis (2021-2022): Evergrande officially defaulted on its debt payments in 2021, marking a pivotal moment in its crisis. The company’s debt reached staggering levels, surpassing $300 billion. The Chinese government, wary of systemic risks, refrained from direct intervention, signaling a shift from previous bailouts.

Court-Ordered Liquidation (2022):

- Liquidation Order (2022): In January 2022, a Hong Kong court ordered the liquidation of Evergrande, initiating a process that involves selling off the company’s assets to address creditors’ concerns. The decision marked a significant step in addressing the financial turmoil surrounding Evergrande.

Global Implications:

- Impact on Global Markets: The Evergrande crisis had reverberations in global financial markets, affecting sectors beyond real estate. Western media used it to create concerns over the potential contagion effect led to increased scrutiny of China’s property market and its broader economic policies.

Factors Supporting the Strength of the Chinese Property Market:

- Diverse Market Dynamics: The Chinese property market is vast and diverse, with different regions experiencing distinct market dynamics. While some areas may face challenges, others continue to witness robust demand and steady growth. This diversity allows for a more nuanced understanding of the overall market health.

- Government Intervention and Regulation: The Chinese government has consistently demonstrated its commitment to maintaining stability in the property sector. Regulatory measures and interventions have been implemented to curb excessive speculation, control housing prices, and ensure the market’s sustainable development. These proactive steps contribute to the market’s overall health and resilience.

- Urbanization and Population Growth: China’s ongoing urbanization and population growth fuel demand for housing. As more people migrate to cities in search of employment and improved living standards, the need for residential and commercial properties remains strong. This fundamental demand factor provides a solid foundation for the property market’s continued stability.

- Long-Term Investment Perspective: Property ownership is deeply ingrained in Chinese culture, often viewed as a long-term investment and a symbol of financial security. This cultural perspective contributes to a more stable and less speculative property market, as homeowners are generally inclined to hold onto their properties rather than engage in short-term trading.

- Economic Resilience: Despite global economic uncertainties and challenges, China’s domestic economy has shown remarkable resilience. The country’s commitment to economic reforms, technological advancements, and innovation contributes to sustained economic growth. A robust economy fosters confidence in the property market and encourages investment.

Addressing Concerns and Misconceptions:

- Evergrande as an Isolated Case: The challenges faced by Evergrande should be viewed as specific to the company rather than indicative of the entire property market. Evergrande’s situation is complex and multifaceted, involving factors unique to the company rather than reflecting broader industry trends.

- Government’s Proactive Measures: The Chinese government’s decisive actions in response to challenges within the property sector demonstrate its commitment to maintaining control and preventing systemic risks. These measures contribute to the overall stability of the market.

Contrary to some pessimistic narratives, the Chinese property market remains robust and resilient. The combination of diverse market dynamics, effective government regulation, sustained demand, cultural perspectives on property ownership, and economic resilience positions the market for continued stability and growth. While challenges exist, a comprehensive understanding of the market’s complexities reveals a more optimistic outlook for China’s real estate sector.

The Positive Outlook on the Evergrande Liquidation:

- Preventing Misrepresentation: The liquidation of Evergrande prevents the Western media from oversimplifying and misrepresenting the challenges in China’s property sector. By addressing the issues specific to Evergrande, the narrative becomes more accurate and avoids unfairly influencing perceptions of China’s overall economic health.

- Stimulating Economic Activity: The sale of Evergrande’s assets following the liquidation order is anticipated to inject fresh economic activity. The assets, once sold, may lead to increased investments and developments, providing a positive stimulus to the sector and contributing to overall economic growth.

- Government’s Prudent Approach: The Chinese government’s proactive measures to manage Evergrande’s liquidation demonstrate a commitment to maintaining stability. The authorities are likely to handle the process carefully to prevent major contagion effects on other sectors, ensuring a controlled and gradual resolution to the property crisis.

- Encouraging Cooperation: The liquidation order sends a signal to other developers to proactively engage in negotiations and compromises. Fear of creditors applying for liquidation may encourage developers to find mutually beneficial solutions, potentially hastening the resolution of issues within the sector.

Concerns and Challenges:

- Ongoing Economic Drag: Despite the positive aspects, the liquidation of Evergrande highlights that the property crisis is far from resolved. The sector continues to be an ongoing drag on China’s economy, requiring sustained efforts and strategic measures for a comprehensive resolution.

- Impact on Evergrande’s Reputation: The liquidation order may negatively impact Evergrande’s reputation, affecting its standing in the market. The assigned liquidator’s actions to offload assets swiftly could lead to unfavorable prices, potentially impacting the overall financial health of the company.

While the liquidation of Evergrande represents a significant development in China’s efforts to address the property crisis, challenges persist. The careful management of this process by the Chinese authorities and the potential economic stimulus from asset sales offer hope for a gradual recovery. The resolution of Evergrande’s issues contributes to a more nuanced understanding of China’s economic challenges and presents an opportunity for positive transformations within the property sector.

Players and Potential Beneficiaries

The potential liquidation of Evergrande, China’s real estate behemoth, casts a long shadow over the global economy. Understanding the key players and potential beneficiaries involved in this complex saga is crucial to navigating the fallout.

Evergrande’s Inner Circle:

- Hui Ka Yan: The embattled founder and chairman of Evergrande, facing personal financial challenges amidst the company’s woes.

- Xu Jiayin: Evergrande’s chief executive officer, tasked with navigating the restructuring and potential liquidation process.

- Major Shareholders: Including state-owned entities, financial institutions, and private investors, each with varying degrees of exposure and influence.

External Stakeholders:

- Chinese Government: Facing a delicate balancing act of protecting financial stability, minimizing unemployment, and upholding property market confidence.

- Lenders and Bondholders: Facing potential losses on loans and bonds issued to Evergrande, impacting financial institutions and individual investors globally.

- Suppliers and Contractors: With billions in unpaid bills, these businesses face potential bankruptcies and job losses, further ripple effects on the Chinese economy.

- Homebuyers: Millions who pre-paid for apartments face uncertainty and possible delays in receiving their properties, impacting social stability and consumer confidence.

Potential Beneficiaries:

- Competitors in the Real Estate Market: Smaller, healthier developers could benefit from market share gained from Evergrande’s downfall.

- Debt Restructuring Specialists: Firms specializing in distressed debt may see increased business opportunities.

- State-Owned Enterprises: Government bailouts or acquisitions of key Evergrande assets could benefit select state-owned entities.

- Infrastructure and Construction Companies: If the government prioritizes unfinished construction projects to protect homebuyers, these companies could stand to gain.

Shayne Heffernan