The Metaverse is hot, NFTs are hot BUT a lot of the market does not have a clear path to success, MetaRace DOG$ does, and that is what makes it a winner.

The metaverse, a concept referring to a shared, immersive virtual environment, has become one of the hottest business trends: tech giants including Facebook, Google and Microsoft have all jumped on the bandwagon, and investors are helping fuel the momentum, having poured more than US$10 billion into related startups in 2021 alone, data from Crunchbase show.

Research firm Emergen Research estimates that the market for metaverse technologies, which includes gaming and virtual reality (VR) headsets, reached US$48 billion in 2020 and will grow by more than 40% each year between 2020 and 2027.

The frenzy surrounding the metaverse has led to a thriving ecosystem of young players looking to tap into the opportunity and provide the building blocks for immersive virtual environments. Here we’ve compiled a list of five must-follow startups from Asia that have witnessed strong traction and made notable strides over the past year, and which are worth keeping a close eye on in 2022.

MetaRace is a play-to-earn NFT greyhound racing blockchain game in the Metaverse that will allow investors the ability to own dogs, participate in races, breed unique NFT dogs, grow a kennel or training business, buy land, build racecourses, and co-own community racecourses.

Combining a multi-billion dollar business, a fully verifiable blockchain and unlimited earning potential due to NFT and decentralised community participation – there are no limits to growth potential!

If we use a comparable entity the easiest in my opinion is ZED RUN.

Zed Run Started in 2019 and our last real idea of a valuation was in July 2021 Zed Run raised $20m at the time with more than $30 million in sales of digital racehorses in the books, Zed Run parent company Virtually Human Studio raised $20 million (at a rumored $200m valuation) to continue sprinting into the NFT future.TCG Capital Management, Andreessen Horowitz and Red Beard Ventures all playing a part.

Since that raise in 2021 there has been little seen of the valuation but it is good to keep in mind that Opensea over the same period went from a $1.5b to $16b in valuations. so if we say Zed Run grew at a conservative 50% of that rate then they are worth up to $2b now, lets cut that in half again and say the comparison is at $1b.

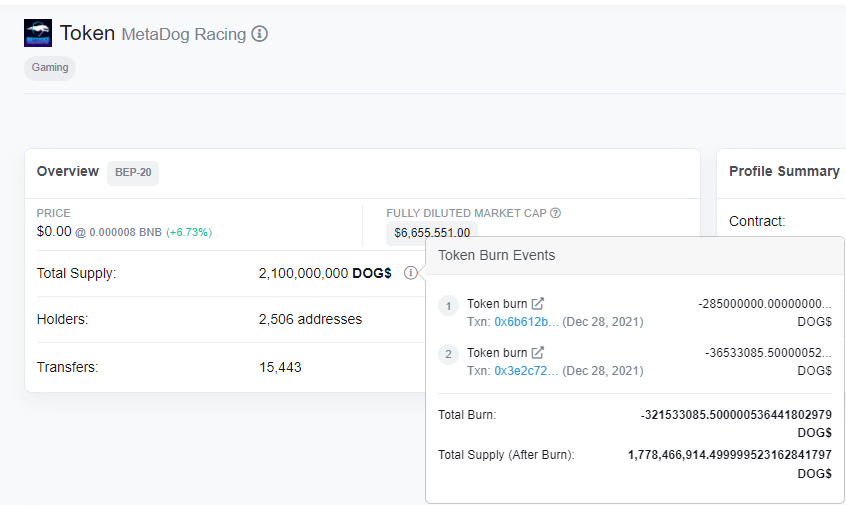

Bringing us back to the subject Upgrade on DOG$

Just on the comparison the $1 range is about the number we arrive at 1st, but that is not the end of the Metarace story, Ricky Jackson is a Sports Industry legend, his idea to not only create the Dog racing but include a broad reaching Metaverse platform where people can own Virtual racetracks etc etc take DOG$ to whole other level, if he cracks the Gambling angle, and I reckon he will, then forget it, the valuation explodes from the $1 point.

Right now our 2022 target is $0.33c 2023 Target $1.20, but lets revisit this as the developments progress, it is on our coverage list now so updates will be regular. On the side of that is an even bigger picture with how SGO SGOX and DOG$ grow and interact with each other that I am still getting to understand, but that is what is really exciting here, stay tuned for more updates.