Silvergate the largest on-ramps and off-ramps for the Crypto market delayed filing their 10-K report to the SEC. Controlling 80%+ of all crypto ramps the Crypto community has a lot of exposure should the Bank fail. Silvergate is a holding company for Silvergate Bank (the Bank). The Bank is a provider of financial infrastructure solutions and services for the digital currency industry. The Company’s platform, known as the Silvergate Exchange Network, provides payments, lending, and funding solutions for an expanding class of digital currency companies and investors.

With Stock collapsing, market cap dropping, AUM leaving, and income non-existent, the upcoming 10-K is no looking good for Silvergate. With Stock prices at their lowest point and RSI down and Volume 585% higher than average, a full recovery is unlikely.

@DataaRocks posted a thread on Twitter about the situation.

MicroStrategy is one of the largest public Corporate owners of Bitcoin, and mine bitcoin with its extensive infrastructure. MicroStrategy also has a loan from Silvergate, though MicroStrategy says that Silvergates issues won’t affect them. Although the market of Bitcoin and other Cryptos are in question, as the industries biggest bank is about to go under. This will have an affect on MicroStrategy as they continue to attempt to distance themselves from Silvergate.

MiscroStrategy (MSTR.O) chart

Several more Crypto Corporations have exposure to Silvergate. Read more about that here. Binance in particular, with their issues with the SEC labeling BUSD as an unregistered security beginning a downward trend, now Silvergate on the way down, Binance may have more trouble in future.

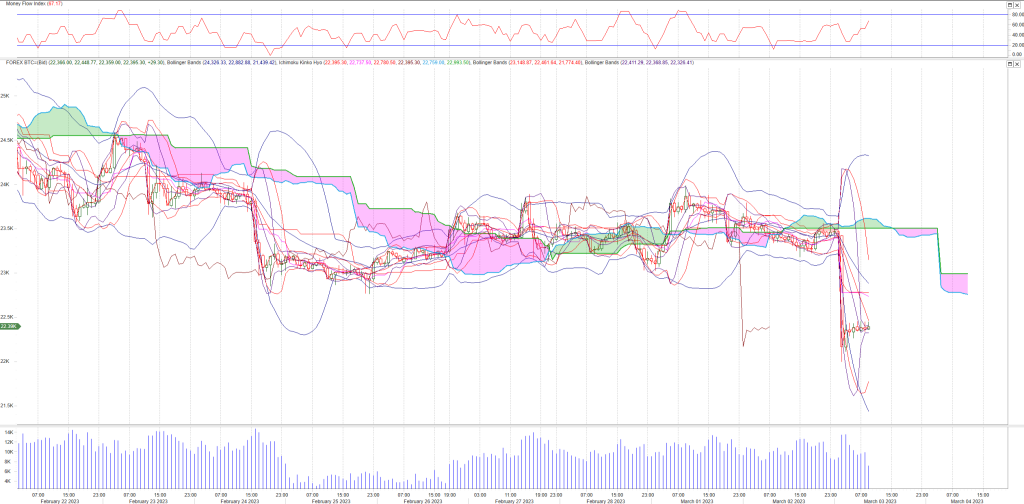

News of this already impacted the price of BTC= as the price dropped near 5% within an hour. BTC, ETH, BNB, and around 50 other Crypto dropped in a similar manner. Although unusual in the traditional market, such price fluctuations are not unusual for the Crypto market. Though the speed and news surrounding the drop does indicate a dump.

Gemini, another large exchange in the Crypto community made a statement surrounding Silvergate Bank. Stating that they have no customer funds with Silvergate and that they’ve stopped accepting deposits via ACH and Wire transfers. Adding to an already long list of firms distancing themselves from Silvergate.

The full scale of this situation would require a research paper to properly explain, along with the other news of 1. SEC says crypto exchanges not “safe”, 2. Crypto․com suspends Silvergate payments, 3. FTX confirms $8.9 billion in missing funds, and 4. Crypto loses $200+ million in hours.

Charts are from MetaStock, click here for a promotion on the chart.