* China’s gross domestic product (GDP) grew 5.5 percent year on year in the first half (H1) of 2023, data from the National Bureau of Statistics (NBS) showed Monday.

* In the first half of this year, in the face of a grave and complex international environment and arduous tasks of reform, development and stability at home, all regions and departments made great efforts to stabilize growth, employment and prices, said NBS spokesperson Fu Linghui at a press conference.

* Experts agreed that the Chinese economy has strong resilience, great potential and enough vitality, and hence they have confidence in the prospects of China’s economy in the second half of the year.

China’s gross domestic product (GDP) grew 5.5 percent year on year in the first half (H1) of 2023, data from the National Bureau of Statistics (NBS) showed Monday.

The country’s GDP reached 59.3 trillion yuan (about 8.3 trillion U.S. dollars) in the first half, according to the NBS data.

In the second quarter, the country’s GDP expanded 6.3 percent year on year, according to the NBS.

In the first half of this year, in the face of a grave and complex international environment and arduous tasks of reform, development and stability at home, all regions and departments made great efforts to stabilize growth, employment and prices, said NBS spokesperson Fu Linghui at a press conference.

Market demand has gradually recovered, production and supply continued to increase, and economic performance, on the whole, picked up, Fu added.

Fu spoke highly of the 5.5 percent growth rate in the first half of this year, saying that this growth rate is relatively high worldwide.

In the first quarter of this year, the GDP of the United States, the Eurozone, Japan and Brazil increased by 1.8 percent, 1 percent, 1.9 percent and 4 percent, respectively. Even considering the situation in the second quarter, the overall economic growth rate of China in the first half of the year was still the fastest among major economies.

China’s 5.5-percent growth in H1 can be attributed to an enhanced structure and optimized driving force, as consumption and service are playing an even bigger role in economic growth, according to Fu.

“From the perspective of demand, major driving forces of economic growth have changed from investment and export last year to consumption and investment this year,” Fu said.

China’s retail sales of consumer goods went up 8.2 percent year on year in the first half of this year, 2.4 percentage points faster than that of the first quarter, the NBS spokesperson pointed out. Retail sales of consumer goods totaled around 22.76 trillion yuan in H1. In June alone, retail sales edged up 3.1 percent year on year.

The country’s value-added service output went up 6.4 percent year on year in H1. The growth rate accelerated by 1 percentage point from the pace recorded in the first quarter.

From the perspective of production, the economic growth was mainly driven by the secondary industry last year, but there has been a significant shift this year as the growth is jointly driven by the service industry and the secondary industry, and the contribution of the service industry increased greatly, Fu said.

The country’s value-added industrial output, an important economic indicator, went up 3.8 percent year on year in H1, according to the NBS. In June alone, industrial output rose 4.4 percent year on year.

China’s fixed-asset investment went up 3.8 percent year on year in H1, NBS data showed.

The 5.5-percent growth in H1 was also characterized by employment expansion and improvement of people’s livelihood, Fu said.

The surveyed urban unemployment rate in China stood at 5.3 percent in H1 of 2023, 0.2 percentage points lower than that in the first quarter, official data showed. In June, the rate stayed unchanged from that in May, at 5.2 percent.

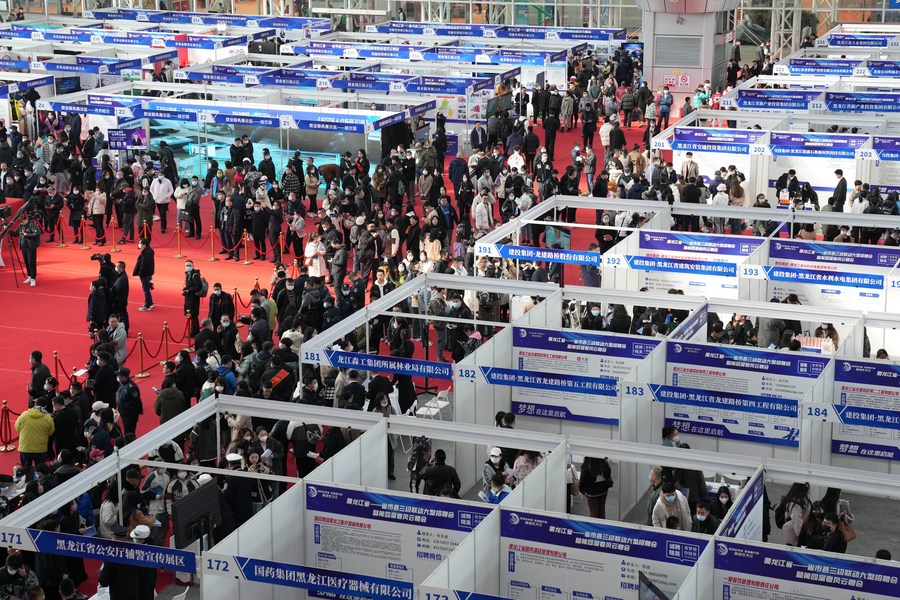

This photo taken on March 18, 2023 shows a view of a job fair in Harbin, northeast China’s Heilongjiang Province. (Xinhua/Wang Jianwei)

China’s per capita disposable income stood at 19,672 yuan in H1, up 6.5 percent year on year in nominal terms, data showed on Monday. After deducting price factors, per capita disposable income rose 5.8 percent from the previous year.

“The innovation-driven strategy has been implemented in an in-depth way, and new growth drivers have continued to grow, strongly boosting high-quality development,” said Fu. “At the same time, the pursuit of green transformation has achieved remarkable results, and its synergy with economic growth has been enhanced.”

In particular, new energy vehicles (NEVs) have become a highlight in China’s economic development in the past two years. The production and sales of NEVs in China exceeded 3 million units in the first half of this year, with a growth rate of over 30 percent.

This photo taken on July 3, 2023 shows robotic arms working in the welding workshop of GAC Aion New Energy Automobile Co., Ltd. in Guangzhou, south China’s Guangdong Province. (Xinhua/Deng Hua)

The outstanding performance of China’s NEV industry proves the effectiveness of key industrial policies implemented in recent years, said Li Hui, a senior official with the National Development and Reform Commission, at China Economic Roundtable, an all-media talk launched by Xinhua News Agency on Monday.

Speaking at the roundtable, Liu Yuanchun, president of the Shanghai University of Finance and Economics, said that China’s H1 economic performance undoubtedly represents an example of high-speed growth around the globe.

According to Liu, it is essential to understand this round of recovery from a global and historical perspective, particularly taking the pandemic, disasters and major changes into consideration.

“Although the Chinese economy faces some difficulties and challenges, the economic performance will gradually improve in the second half of the year. The development momentum will remain positive,” said Fu at the roundtable.

The experts agreed that the Chinese economy has strong resilience, great potential and enough vitality, and hence they have confidence in the prospects of China’s economy in the second half of the year.

“With the further implementation of the policies and arrangements made by the central authorities, we have the confidence, conditions and capability to constantly optimize the economic structure, strengthen the driving forces of growth and maintain a positive development trend,” Li Hui added.

Shayne Heffernan