The property market recently warmed in first-tier cities such as Beijing and Shanghai. In August, consumer inflation returned to positive territory on a year-on-year basis. The producer price index also edged up on a monthly basis last month.

All these positive signs would hardly make people draw the conclusion that the Chinese economy is experiencing some sort of a “crisis” in confidence or growth, as claimed by analysts who ignore facts or reporters wearing blinkers.

The country’s property sector, a focal point of these pessimistic analysts, shows positive changes following a raft of measures since late August, ranging from cutting interest rates on existing mortgages for first-home loans to easing mortgage rules.

“During the first weekend following the new policies, the daily number of visitors and transactions rose remarkably, about 2.5 to three times that on previous weekends,” said a sales manager at the Jinmao Palace residential complex in Putuo District, Shanghai. More than 2,800 second-hand homes were sold in Beijing on the first weekend of September, double the average for weekends in August, Centaline Property data showed.

Against the backdrop of sluggish global trade, China’s foreign trade is generally stable, with improved structure and greater resilience. The total volume in yuan terms edged down 0.1 percent year on year in the first eight months of 2023. The auto exports remained a bright spot, with the export value of automobiles during the period surging 104.4 percent from a year earlier. China surpassed Japan to become the world’s largest auto exporter in the first half of this year.

Policy and institutional support is increasing the confidence and opportunities of private companies. This is clearly seen in the rise of the country’s Small and Medium Enterprises Development Index, which reflects the performances and expectations of small and medium-sized enterprises, in August for the third straight month. Recently, China also set up a bureau specializing in promoting the private economy’s development under the National Development and Reform Commission — the country’s top economic planner.

The current hot-selling products — tech giant Huawei’s Mate 60 series smartphones and Luckin Coffee’s latte with the flavor of China’s famous liquor Moutai — offer a glimpse of robust consumer spending in China, not to mention the tourism boom during the summer holiday period. Consumption contributed to 77.2 percent of the country’s economic growth in H1.

Foreign companies investing in China also have a say in China’s economic situation. In the first seven months of 2023, investment from France, the United Kingdom, Canada and Switzerland surged by 213.7 percent, 159.9 percent, 113.3 percent and 61.2 percent year on year, respectively. A total of 28,406 new foreign-invested companies were established in this period, a 34-percent increase year on year. These figures reflect the confidence foreign companies have in the Chinese economy.

All these positive signs and developments clearly deserve attention when people assess the current state of the Chinese economy. Despite difficulties and challenges, it is on the up, and so is confidence among consumers and enterprises both at home and abroad.

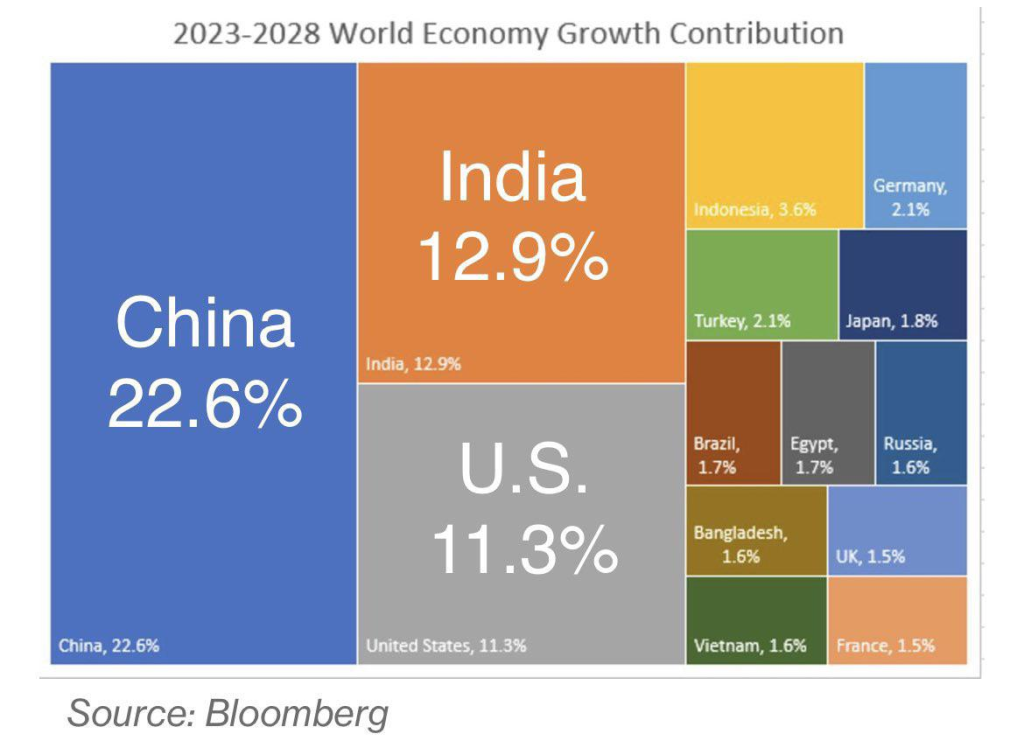

The Chinese economy’s strong resilience, ample potential and strong vitality and the fundamentals sustaining its sound growth in the long run stay unchanged. China’s economy will remain a major engine for the global economy.

What the world needs is a responsible and objective analysis of the Chinese economy, rather than morbid scaremongers who exaggerate the negatives while filtering out or diluting the positives.

Shayne Heffernan