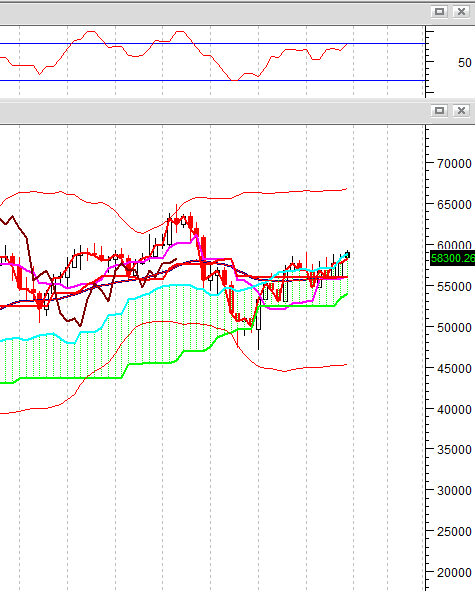

Bitcoin is looking a touch bearish in the short term after a recent rally out of the $56k range, Money Flow indicators are looking ready close to toppish.

Looks likely there will be an entry opportunity in the next few days, long term not much has changed we still see Bitcoin trading in the $100k plus range next year and eventually hitting $1m.

Technical Outlook

Short Term: Overbought

Intermediate Term: Bearish

Long Term: Bullish

Moving Averages: 10-period 50-period 200-period

Close: 56,959.95 56,764.53 38,004.59

Volatility: 55 57 82

Volume: 1,616,920 1,767,599 1,531,245

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

Bitcoin is currently 53.8% above its 200-period moving average and is in an downward trend. Volatility is extremely low when compared to the average volatility over the last 10 periods. There is a good possibility that there will be an increase in volatility along with sharp price fluctuations in the near future. Our volume indicators reflect volume flowing into and out of BTC at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bearish on BTC and have had this outlook for the last 1 periods.