Bitcoin Ordinals are a new technology that allows for the creation of unique, non-fungible tokens (NFTs) on the Bitcoin blockchain. NFTs are digital assets that represent real-world objects such as art, music, and collectibles. They are stored on a blockchain, which is a secure and decentralized ledger that records transactions.

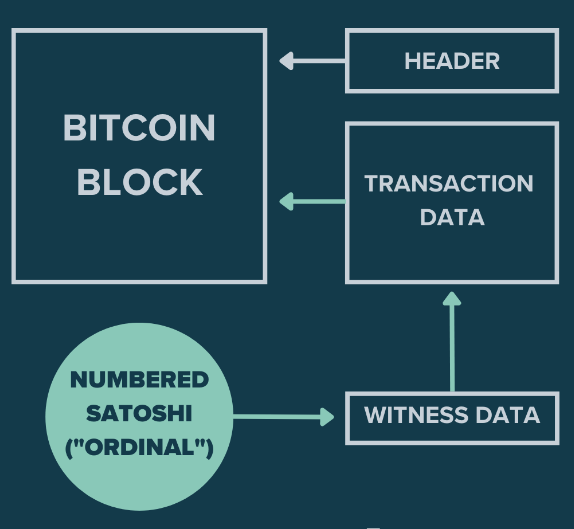

Bitcoin Ordinals are created by inscribing data into Bitcoin transactions. This data can be anything from a simple text message to a complex piece of digital art. Once an ordinal is created, it is permanently stored on the Bitcoin blockchain and cannot be changed or deleted.

Bitcoin Ordinals have the potential to revolutionize the way we interact with digital assets. They can be used to create unique, verifiable ownership records for digital goods, which could make it easier to buy, sell, and trade them. Ordinals could also be used to create new forms of digital content, such as interactive games and experiences.

The future of Bitcoin Ordinals is still uncertain, but the potential benefits are clear. Ordinals have the potential to make Bitcoin a more powerful and versatile platform for digital asset ownership and creation. As the technology continues to develop, we can expect to see even more innovative and exciting applications for Bitcoin Ordinals.

Here are some of the potential impacts of Bitcoin Ordinals on the future:

- Increased adoption of Bitcoin: Ordinals could help to increase the adoption of Bitcoin by making it easier to create and use digital assets on the blockchain. This could lead to more people using Bitcoin for everyday transactions, such as buying goods and services.

- New forms of digital content: Ordinals could be used to create new forms of digital content, such as interactive games and experiences. This could lead to a more immersive and engaging digital experience for users.

- Improved security: Ordinals could help to improve the security of digital assets by providing a verifiable way to track ownership. This could make it more difficult for criminals to steal digital assets.

- Increased transparency: Ordinals could help to increase transparency in the digital asset market by providing a way to track the provenance of digital assets. This could make it easier for buyers to know where their digital assets come from.

Overall, Bitcoin Ordinals have the potential to make Bitcoin a more powerful and versatile platform for digital asset ownership and creation. As the technology continues to develop, we can expect to see even more innovative and exciting applications for Bitcoin Ordinals.

Shayne Heffernan