$BTCUSD

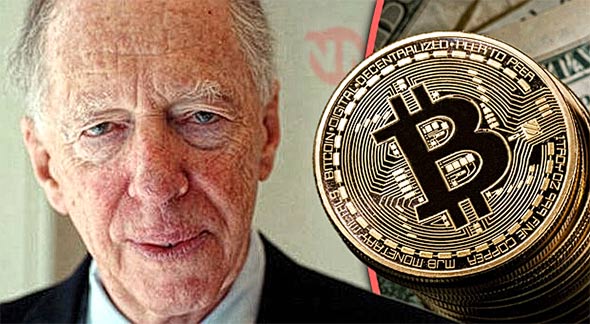

“Lord Rothchild said that he will make a new cryptocurrency which will be on the governments side and will kill the enemy: Bitcoin. Sorry not likely!” — Paul Ebeling

Role of Central Banks in an Economy: it is important to understand the role that central banks play in an economy. Central bank policymaking underpins the global financial system. Between countries, the mandates for central banks varies.

Central banks use monetary policy, to achieve their mandates. In the main they manipulate money supply and interest rates.

For example, a central bank might increase or decrease the quantity of money circulating in an economy. More money in an economy equals more spending by consumers and, consequently, economic growth. The opposite situation i.e., less money in an economy translates to 1 in which consumers spend less and a recession ensues.

A central bank’s actions also have an effect on imports, exports, and overseas investment. For example, high interest rates can deter investment by foreign entities in real estate, while low interest rates can promote investment.

The case for Bitcoin as an alternative to central banks is based both on economics and technology. Satoshi Nakamoto, Bitcoin’s inventor, defined the cryptocurrency as a “peer-to-peer version of electronic cash” that allows “online payments to be sent directly from one party to another without going through a financial institution.”

Within the context of a financial infrastructure system dominated by central banks, Bitcoin solves 3 problems.

1st, it eliminates the problem of double-spending. Each Bitcoin is unique and cryptographically secured, meaning it cannot be hacked or replicated. Therefore, you cannot spend Bitcoin twice or counterfeit it.

2nd, even though it is decentralized, Bitcoin’s network is still a trustworthy system. In this case, trust is an algorithmic construct. Transactions on Bitcoin’s network have to be approved by nodes spread out across the world to be included in its ledger. Even a single disagreement by a node can make the transaction ineligible for inclusion in Bitcoin’s ledger.

3rd, Bitcoin’s network eliminates the need for a centralized infrastructure by streamlining the process to produce and distribute the currency. Anyone with a full node can generate Bitcoin at home. Intermediaries are not required for peer-to-peer transfer between 2 addresses on Bitcoin’s blockchain.

So, a network of banks chartered by a central authority is not necessary to distribute the cryptocurrency.

Central banks are at the helm of the modern global financial infrastructure in the current economic system. An about 122 countries around the world use central banks to manage their economies. While it offers several advantages, this form of centralized structure vests far too much power on a single authority and has resulted in severe economic recessions.

Bitcoin’s technology relies on algorithmic trust, and its decentralized system offers an alternative to the current system. Meanwhile, central banks have co-opted elements of Bitcoin’s design and tech to explore the case of a digital currency issued by central banks.

The Big Q: Did you know BTC beat the 2020 returns of gold and the S&P 500?

The Big A: Coins and altcoins are investments too!

Have a prosperous day, Keep the Faith!