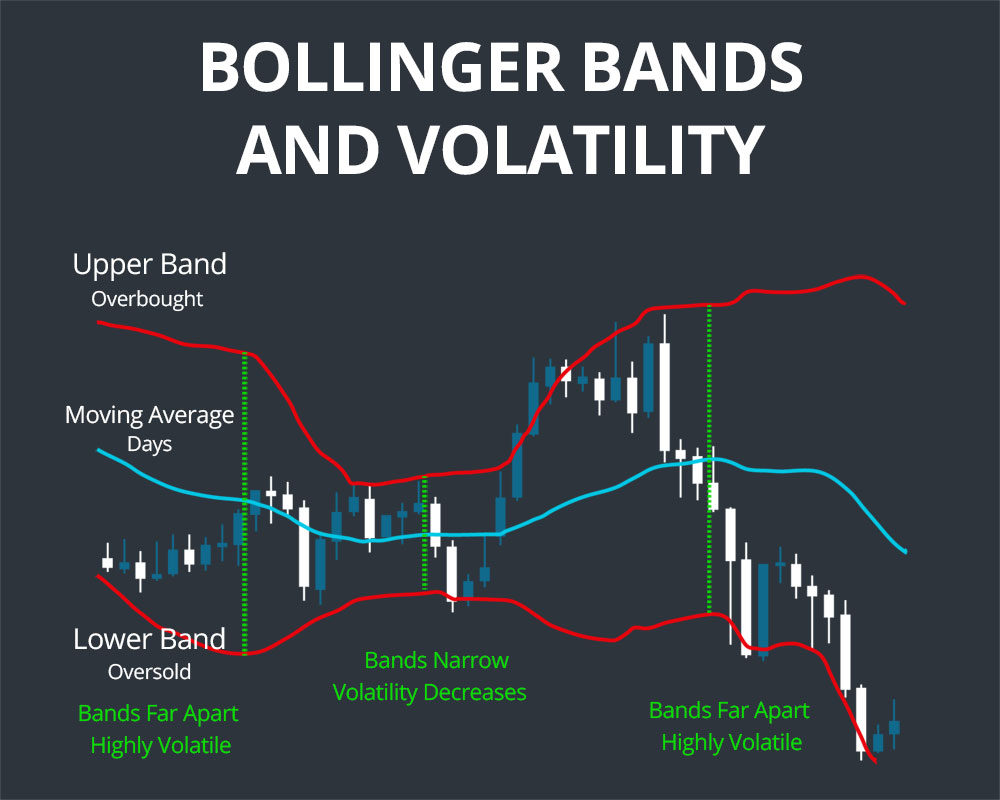

Bollinger Bands are a technical analysis tool that can be used to identify potential trading opportunities in Bitcoin. Bollinger Bands are made up of three lines:

- The Bollinger Band Middle Line is a simple moving average of the price of Bitcoin.

- The Bollinger Band Upper Band is the middle line plus two standard deviations of the price of Bitcoin.

- The Bollinger Band Lower Band is the middle line minus two standard deviations of the price of Bitcoin.

When the price of Bitcoin moves outside of the Bollinger Bands, it is considered to be overbought or oversold. This can be a signal that the price is about to reverse direction.

For example, if the price of Bitcoin is trading above the Bollinger Bands, it is considered to be overbought. This could be a signal that the price is about to fall. Conversely, if the price of Bitcoin is trading below the Bollinger Bands, it is considered to be oversold. This could be a signal that the price is about to rise.

Here are some of the ways that Bollinger Bands can be used to trade Bitcoin:

- Bollinger Band Squeeze: A Bollinger Band Squeeze occurs when the Bollinger Bands narrow. This can be a sign that the price of Bitcoin is about to break out in either direction.

- Bollinger Band Crossover: A Bollinger Band Crossover occurs when the Bollinger Band Middle Line crosses the Bollinger Band Upper Band or Lower Band. This can be a signal that the price of Bitcoin is about to reverse direction.

- Bollinger Band Width: The width of the Bollinger Bands can be used to measure volatility. When the Bollinger Bands are wide, it indicates that the market is volatile. Conversely, when the Bollinger Bands are narrow, it indicates that the market is less volatile.

It is important to note that Bollinger Bands are just one technical analysis tool that can be used to trade Bitcoin. They should not be used in isolation, and other factors should be considered before making any trading decisions.

Here are some additional thoughts on trading Bitcoin with Bollinger Bands:

- Bollinger Bands are a versatile tool: Bollinger Bands can be used to trade Bitcoin in a variety of ways. They can be used to identify overbought and oversold conditions, to trade breakouts and reversals, and to measure volatility.

- Bollinger Bands are not perfect: No technical analysis tool is perfect, and Bollinger Bands are no exception. They can generate false signals, and they should not be used in isolation.

- Bollinger Bands can be used with other tools: Bollinger Bands can be used in conjunction with other technical analysis tools, such as moving averages, trendlines, and Fibonacci retracements. This can help to improve the accuracy of trading signals.

Bollinger Bands are a powerful tool that can be used to trade Bitcoin. However, it is important to use them in conjunction with other technical analysis tools and to understand their limitations.

Shayne Heffernan